HMN Financial, Inc. (HMNF): Price and Financial Metrics

HMNF Price/Volume Stats

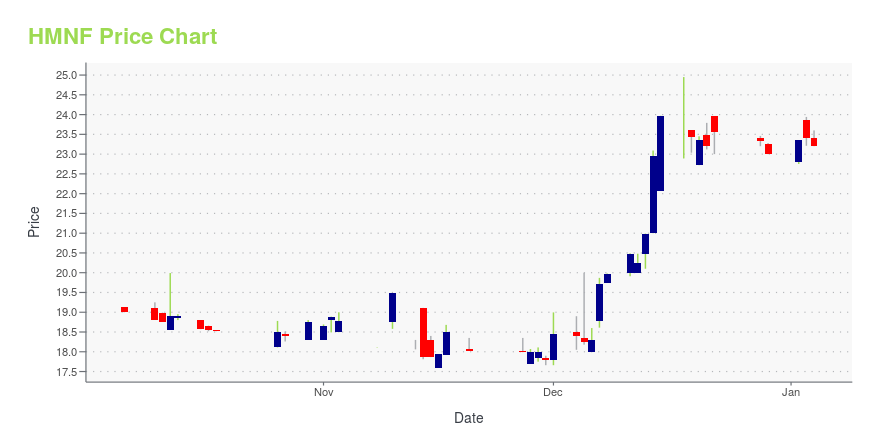

| Current price | $26.40 | 52-week high | $26.72 |

| Prev. close | $26.45 | 52-week low | $17.60 |

| Day low | $26.01 | Volume | 1,159 |

| Day high | $26.60 | Avg. volume | 7,327 |

| 50-day MA | $22.84 | Dividend yield | 1.51% |

| 200-day MA | $20.91 | Market Cap | 117.88M |

HMNF Stock Price Chart Interactive Chart >

HMN Financial, Inc. (HMNF) Company Bio

HMN Financial, Inc. operates as a bank holding company for Home Federal Savings Bank that provides various retail banking products and services. The company offers various deposit accounts, such as savings, interest bearing checking, non-interest bearing checking, money market, and certificate accounts. Its loan products include single family residential loans; commercial real estate and multi-family mortgage loans; construction loans; consumer loans, such as home equity, automobile, recreational vehicle, mobile home, and lot loans, as well as loans secured by deposit accounts, and other loans for household and personal purposes; and commercial business loans. The company offers financial planning products and services; and invests in mortgage-backed and related securities, the United States government agency obligations, and other permissible investments. As of April 20, 2020, it operated twelve full service offices in Minnesota located in Albert Lea, Austin, Eagan, Kasson, La Crescent, Owatonna, Rocheste, Spring Valley, and Winona, Minnesota; one full service office in Marshalltown, Iowa; one full service office in Pewaukee, Wisconsin; and a loan origination office in Sartell, Minnesota. HMN Financial, Inc. was founded in 1934 and is headquartered in Rochester, Minnesota.

Latest HMNF News From Around the Web

Below are the latest news stories about HMN FINANCIAL INC that investors may wish to consider to help them evaluate HMNF as an investment opportunity.

Should You Buy HMN Financial, Inc. (NASDAQ:HMNF) For Its Upcoming Dividend?HMN Financial, Inc. ( NASDAQ:HMNF ) is about to trade ex-dividend in the next four days. The ex-dividend date is... |

HMN Financial, Inc. Announces DividendROCHESTER, Minn., Oct. 25, 2023 (GLOBE NEWSWIRE) -- HMN Financial, Inc. (HMN or the Company) (Nasdaq:HMNF) today announced that its Board of Directors has declared a quarterly dividend of $0.08 per share of common stock, payable on December 7, 2023 to stockholders of record at the close of business on November 16, 2023. The declaration and amount of any future cash dividends remains subject to the sole discretion of the Board of Directors and will depend upon many factors, including the Company’ |

HMN Financial Inc (HMNF) Reports Decrease in Q3 EarningsNet income and diluted earnings per share down from Q3 2022, despite growth in net loans receivable |

HMN Financial, Inc. Announces Third Quarter ResultsThird Quarter Summary Net income of $1.5 million, down $0.3 million, from $1.8 million for third quarter of 2022Diluted earnings per share of $0.34, down $0.08, from $0.42 for third quarter of 2022Net interest income of $7.8 million, down $0.5 million, from $8.3 million for third quarter of 2022Net interest margin of 2.81%, down 32 basis points, from 3.13% for third quarter of 2022Net loans receivable of $851 million, up $24 million, from $827 million at June 30, 2023 Year to Date Summary Net in |

Why You Might Be Interested In HMN Financial, Inc. (NASDAQ:HMNF) For Its Upcoming DividendSome investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be... |

HMNF Price Returns

| 1-mo | 22.79% |

| 3-mo | 34.59% |

| 6-mo | 19.08% |

| 1-year | 28.94% |

| 3-year | 22.27% |

| 5-year | 28.48% |

| YTD | 15.72% |

| 2023 | 9.49% |

| 2022 | -12.61% |

| 2021 | 43.43% |

| 2020 | -18.13% |

| 2019 | 7.08% |

HMNF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HMNF

Want to do more research on Hmn Financial Inc's stock and its price? Try the links below:Hmn Financial Inc (HMNF) Stock Price | Nasdaq

Hmn Financial Inc (HMNF) Stock Quote, History and News - Yahoo Finance

Hmn Financial Inc (HMNF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...