HomeStreet, Inc. (HMST): Price and Financial Metrics

HMST Price/Volume Stats

| Current price | $13.99 | 52-week high | $15.82 |

| Prev. close | $13.33 | 52-week low | $4.20 |

| Day low | $13.43 | Volume | 151,398 |

| Day high | $13.99 | Avg. volume | 236,755 |

| 50-day MA | $10.80 | Dividend yield | N/A |

| 200-day MA | $10.81 | Market Cap | 263.82M |

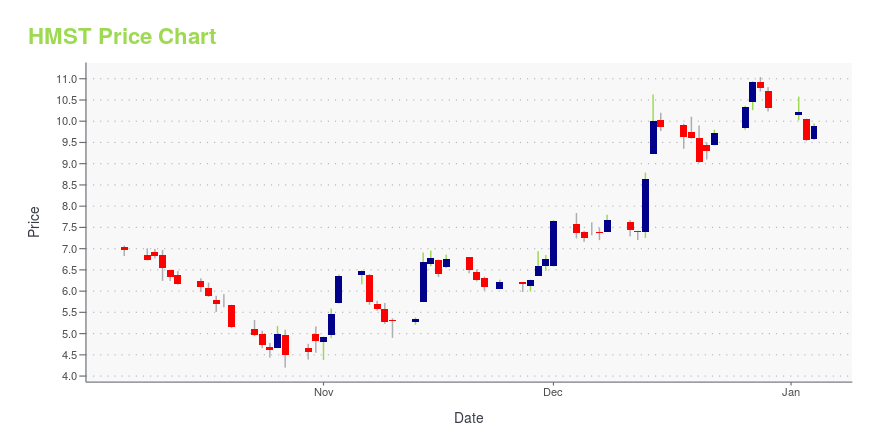

HMST Stock Price Chart Interactive Chart >

HomeStreet, Inc. (HMST) Company Bio

HomeStreet Inc. provides various financial services primarily in the Pacific Northwest, California, and Hawaii. The company was founded in 1921 and is based in Seattle, Washington.

Latest HMST News From Around the Web

Below are the latest news stories about HOMESTREET INC that investors may wish to consider to help them evaluate HMST as an investment opportunity.

With 70% ownership, HomeStreet, Inc. (NASDAQ:HMST) boasts of strong institutional backingKey Insights Significantly high institutional ownership implies HomeStreet's stock price is sensitive to their trading... |

Investors in HomeStreet (NASDAQ:HMST) have unfortunately lost 78% over the last three yearsHomeStreet, Inc. ( NASDAQ:HMST ) shareholders will doubtless be very grateful to see the share price up 44% in the last... |

Just Three Days Till HomeStreet, Inc. (NASDAQ:HMST) Will Be Trading Ex-DividendSome investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be... |

HomeStreet, Inc. (NASDAQ:HMST) Q3 2023 Earnings Call TranscriptHomeStreet, Inc. (NASDAQ:HMST) Q3 2023 Earnings Call Transcript October 31, 2023 Operator: Good afternoon, and thank you for attending today’s Third Quarter 2023 Analyst Earnings Call for HomeStreet Bank. Joining us on this call is Mark Mason, CEO, President, and Chairman of the Board. I would now like to pass the conference over to our […] |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time for another busy day of trading as we go over the biggest pre-market stock movers worth watching on Tuesday morning! |

HMST Price Returns

| 1-mo | 29.06% |

| 3-mo | 16.10% |

| 6-mo | -6.86% |

| 1-year | 42.39% |

| 3-year | -57.89% |

| 5-year | -44.53% |

| YTD | 35.83% |

| 2023 | -60.62% |

| 2022 | -44.81% |

| 2021 | 57.69% |

| 2020 | 1.35% |

| 2019 | 60.15% |

Continue Researching HMST

Here are a few links from around the web to help you further your research on HomeStreet Inc's stock as an investment opportunity:HomeStreet Inc (HMST) Stock Price | Nasdaq

HomeStreet Inc (HMST) Stock Quote, History and News - Yahoo Finance

HomeStreet Inc (HMST) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...