Hanover Bancorp, Inc. (HNVR): Price and Financial Metrics

HNVR Price/Volume Stats

| Current price | $16.59 | 52-week high | $18.86 |

| Prev. close | $16.56 | 52-week low | $13.62 |

| Day low | $16.57 | Volume | 1,800 |

| Day high | $16.98 | Avg. volume | 5,710 |

| 50-day MA | $16.57 | Dividend yield | 2.29% |

| 200-day MA | $16.88 | Market Cap | 120.26M |

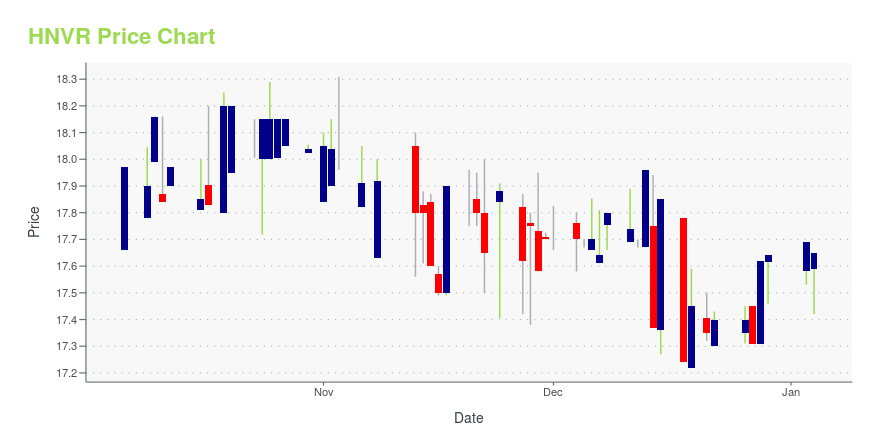

HNVR Stock Price Chart Interactive Chart >

Hanover Bancorp, Inc. (HNVR) Company Bio

Hanover Bancorp, Inc. operates as the bank holding company for Hanover Community Bank that provides banking products and services for small and medium-sized businesses, municipalities, and individuals in the New York metro area. The company offers checking, savings, money market, NOW, and individual retirement accounts, as well as certificates of deposits and time deposits; cards; and residential and commercial real estate mortgages, commercial and industrial loans, lines of credit, and small business administration loans, as well as home equity, multi-family, business, bridge, and other personal purpose loans. It operates branch offices located in Manhattan, Brooklyn, Queens, and Nassau County, New York; and administrative office in Suffolk County, New York. The company was founded in 2008 and is headquartered in Mineola, New York.

Latest HNVR News From Around the Web

Below are the latest news stories about HANOVER BANCORP INC that investors may wish to consider to help them evaluate HNVR as an investment opportunity.

ACRES Commercial (ACR) Expands Share Buyback Program by $10MACRES Commercial's (ACR) additional $10 million authorization for common and preferred stock under its existing share repurchase program will boost investor confidence. |

Hanover Bancorp Announces Joseph Burns as its New Executive Vice President, Chief Lending OfficerMINEOLA, N.Y., Nov. 16, 2023 (GLOBE NEWSWIRE) -- Hanover Bancorp, (NASDAQ: HNVR) (the “Bank”) the bank holding company for Hanover Community Bank, today announced the appointment of Mr. Joseph Burns to the position of Executive Vice President, Chief Lending Officer, effective immediately. In his new role Mr. Burns will lead the Bank’s commercial banking expansion with an emphasis on relationship-based business deposit and loan growth on Long Island and across the New York metro market. Among oth |

Should You Buy Hanover Bancorp, Inc. (NASDAQ:HNVR) For Its Upcoming Dividend?Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be... |

Hanover Bancorp (NASDAQ:HNVR) Has Announced A Dividend Of $0.10The board of Hanover Bancorp, Inc. ( NASDAQ:HNVR ) has announced that it will pay a dividend on the 15th of November... |

Hanover Bancorp Inc (HNVR) Reports Earnings for Q3 and Fiscal Year 2023Declares $0.10 Quarterly Cash Dividend |

HNVR Price Returns

| 1-mo | 0.67% |

| 3-mo | 1.47% |

| 6-mo | -6.23% |

| 1-year | -6.34% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -4.85% |

| 2023 | -11.58% |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

HNVR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...