HighPeak Energy, Inc. (HPK): Price and Financial Metrics

HPK Price/Volume Stats

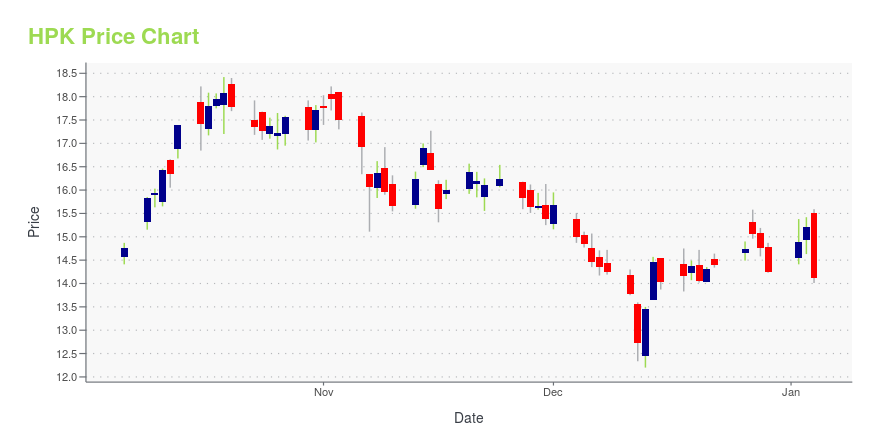

| Current price | $9.19 | 52-week high | $17.48 |

| Prev. close | $9.71 | 52-week low | $7.82 |

| Day low | $9.16 | Volume | 117,807 |

| Day high | $9.83 | Avg. volume | 308,681 |

| 50-day MA | $10.07 | Dividend yield | 1.59% |

| 200-day MA | $12.47 | Market Cap | 1.16B |

HPK Stock Price Chart Interactive Chart >

HighPeak Energy, Inc. (HPK) Company Bio

HighPeak Energy, Inc. operates as an exploration company. The Company offers petroleum engineering, geology, geophysics, drilling, and land financing services. HighPeak Energy serves customers in the United States.

HPK Price Returns

| 1-mo | -22.77% |

| 3-mo | 2.75% |

| 6-mo | -37.38% |

| 1-year | -43.10% |

| 3-year | -58.41% |

| 5-year | -10.27% |

| YTD | -37.03% |

| 2024 | 4.28% |

| 2023 | -37.40% |

| 2022 | 56.90% |

| 2021 | -7.30% |

| 2020 | 54.00% |

HPK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...