Healthcare Realty Trust Incorporated (HR): Price and Financial Metrics

HR Price/Volume Stats

| Current price | $17.96 | 52-week high | $20.17 |

| Prev. close | $17.51 | 52-week low | $12.77 |

| Day low | $17.54 | Volume | 2,994,308 |

| Day high | $17.99 | Avg. volume | 3,476,006 |

| 50-day MA | $16.64 | Dividend yield | 6.96% |

| 200-day MA | $15.44 | Market Cap | 6.80B |

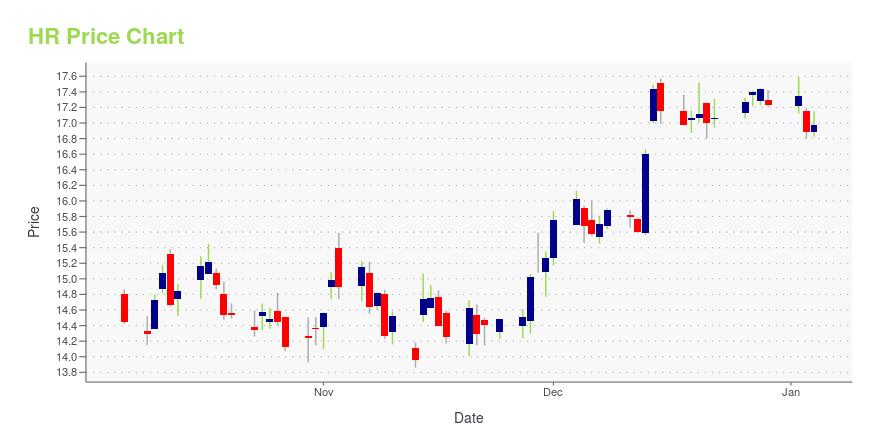

HR Stock Price Chart Interactive Chart >

Healthcare Realty Trust Incorporated (HR) Company Bio

Healthcare Realty Trust is a real estate investment trust that integrates owning, managing, financing and developing income-producing real estate properties associated primarily with the delivery of outpatient healthcare services throughout the United States. The company was founded in 1992 and is based Nashville, Tennessee.

Latest HR News From Around the Web

Below are the latest news stories about HEALTHCARE REALTY TRUST INC that investors may wish to consider to help them evaluate HR as an investment opportunity.

Healthcare Realty Trust Incorporated (NYSE:HR) Q3 2023 Earnings Call TranscriptHealthcare Realty Trust Incorporated (NYSE:HR) Q3 2023 Earnings Call Transcript November 3, 2023 Healthcare Realty Trust Incorporated misses on earnings expectations. Reported EPS is $-0.18 EPS, expectations were $0.39. Operator: Hello and welcome to the Healthcare Realty Trust Third Quarter Earnings Conference Call. My name is Harry, and I’ll be your operator today. [Operator Instructions] […] |

Q3 2023 Healthcare Realty Trust Inc Earnings CallQ3 2023 Healthcare Realty Trust Inc Earnings Call |

Healthcare Realty Trust (HR) Q3 Earnings: Taking a Look at Key Metrics Versus EstimatesThe headline numbers for Healthcare Realty Trust (HR) give insight into how the company performed in the quarter ended September 2023, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals. |

Healthcare Realty Trust (HR) Q3 FFO Match EstimatesHealthcare Realty Trust (HR) delivered FFO and revenue surprises of 0% and 0.38%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

Diversified Healthcare Trust (NASDAQ:DHC) Q3 2023 Earnings Call TranscriptDiversified Healthcare Trust (NASDAQ:DHC) Q3 2023 Earnings Call Transcript November 2, 2023 Operator: Good morning, everyone, and welcome to the Diversified Healthcare Trust Third Quarter 2023 Earnings Conference Call. [Operator Instructions] Please also note today’s event is being recorded. At this time, I’d like to turn the floor over to Melissa McCarthy, Manager of Investor […] |

HR Price Returns

| 1-mo | 9.45% |

| 3-mo | 29.63% |

| 6-mo | 12.79% |

| 1-year | -0.96% |

| 3-year | -6.20% |

| 5-year | 20.27% |

| YTD | 8.86% |

| 2023 | -4.08% |

| 2022 | -25.15% |

| 2021 | 32.31% |

| 2020 | -1.29% |

| 2019 | 30.43% |

HR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HR

Want to see what other sources are saying about Healthcare Realty Trust Inc's financials and stock price? Try the links below:Healthcare Realty Trust Inc (HR) Stock Price | Nasdaq

Healthcare Realty Trust Inc (HR) Stock Quote, History and News - Yahoo Finance

Healthcare Realty Trust Inc (HR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...