Harmony Biosciences Holdings Inc. (HRMY): Price and Financial Metrics

HRMY Price/Volume Stats

| Current price | $33.92 | 52-week high | $39.26 |

| Prev. close | $33.30 | 52-week low | $18.61 |

| Day low | $33.03 | Volume | 272,737 |

| Day high | $33.95 | Avg. volume | 386,242 |

| 50-day MA | $30.94 | Dividend yield | N/A |

| 200-day MA | $30.21 | Market Cap | 1.93B |

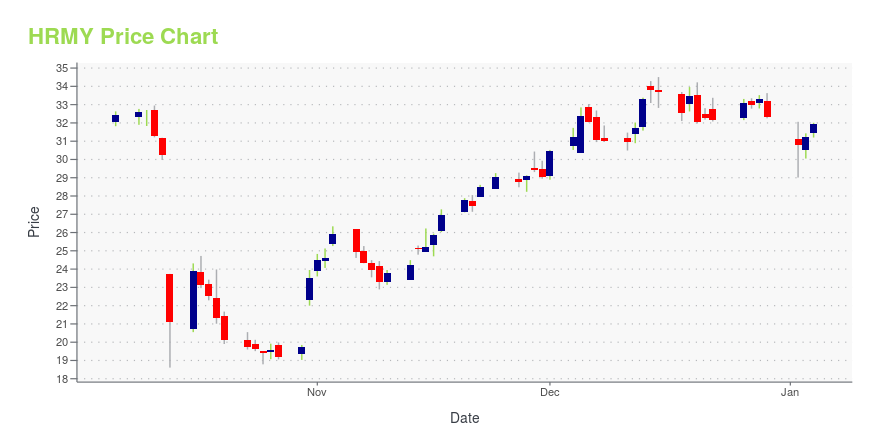

HRMY Stock Price Chart Interactive Chart >

Harmony Biosciences Holdings Inc. (HRMY) Company Bio

Harmony Biosciences Holdings, Inc. is a commercial-stage pharmaceutical company, which engages in the development and commercialization of therapies for the treatment of neurological disorders. Its product WAKIX is a molecule with a novel mechanism of action designed to increase histamine signaling in the brain by binding to H3 receptors. The company was founded on July 25, 2017 and is headquartered in Plymouth Meeting, PA.

Latest HRMY News From Around the Web

Below are the latest news stories about HARMONY BIOSCIENCES HOLDINGS INC that investors may wish to consider to help them evaluate HRMY as an investment opportunity.

7 Undervalued Biotech Stocks That are Flying Under the Clinical RadarWith so many innovative firms skyrocketing this year, astute investors seeking compelling discounts may want to turn their attention to undervalued biotech picks. |

Russell 2000 Front-Runners: 3 Stocks to Keep an Eye OnWhile all eyes may be on the usual suspects of market hype and influence, astute investors with a contrarian streak may want to consider Russell 2000 stocks. |

HRMY or GMAB: Which Is the Better Value Stock Right Now?HRMY vs. GMAB: Which Stock Is the Better Value Option? |

HARMONY BIOSCIENCES ANNOUNCES POSITIVE TOPLINE DATA FROM PHASE 2 SIGNAL DETECTION STUDY EVALUATING PITOLISANT IN ADULT PATIENTS WITH MYOTONIC DYSTROPHY TYPE 1Harmony Biosciences Holdings, Inc. ("Harmony" or the "Company") (Nasdaq: HRMY) today announced positive topline results from its Phase 2 signal detection study evaluating the safety and efficacy of pitolisant in adult patients with myotonic dystrophy type 1 (DM1). |

16 Most Undervalued Small-Cap Stocks To Buy According To Hedge FundsIn this article, we will take a look at the 16 most undervalued small-cap stocks to buy according to hedge funds. To see more such companies, go directly to 5 Most Undervalued Small-Cap Stocks To Buy According To Hedge Funds. Despite strong signs that the central bank would be ready to hit brakes on its […] |

HRMY Price Returns

| 1-mo | 9.14% |

| 3-mo | 15.69% |

| 6-mo | 9.14% |

| 1-year | -3.25% |

| 3-year | 32.09% |

| 5-year | N/A |

| YTD | 5.02% |

| 2023 | -41.38% |

| 2022 | 29.22% |

| 2021 | 17.95% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...