HSBC Holdings PLC ADR (HSBC): Price and Financial Metrics

HSBC Price/Volume Stats

| Current price | $43.28 | 52-week high | $45.46 |

| Prev. close | $42.84 | 52-week low | $35.30 |

| Day low | $42.73 | Volume | 2,185,558 |

| Day high | $43.37 | Avg. volume | 1,859,173 |

| 50-day MA | $43.80 | Dividend yield | 4.58% |

| 200-day MA | $40.59 | Market Cap | 162.34B |

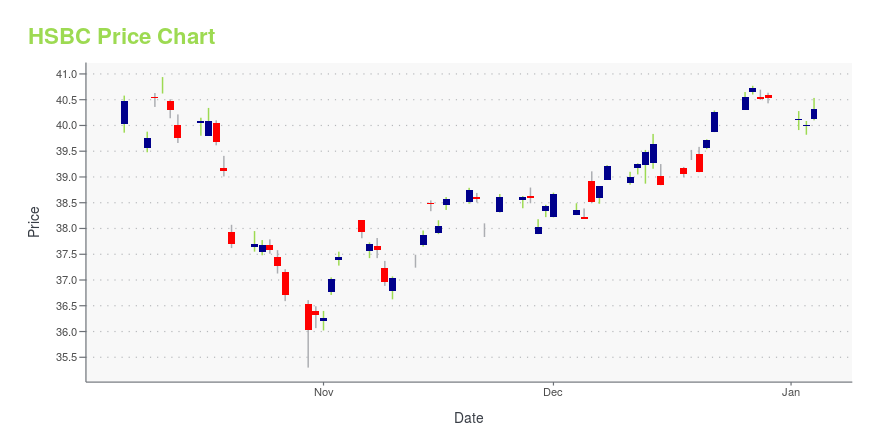

HSBC Stock Price Chart Interactive Chart >

HSBC Holdings PLC ADR (HSBC) Company Bio

HSBC Holdings plc is a British multinational universal bank and financial services holding company. It is the largest bank in Europe by total assets ahead of BNP Paribas, with US$2.953 trillion as of December 2021. In 2021, HSBC had $10.8 trillion in assets under custody (AUC) and $4.9 trillion in assets under administration (AUA), respectively. HSBC traces its origin to a hong in British Hong Kong, and its present form was established in London by the Hongkong and Shanghai Banking Corporation to act as a new group holding company in 1991; its name derives from that company's initials. The Hongkong and Shanghai Banking Corporation opened branches in Shanghai in 1865 and was first formally incorporated in 1866. (Source:Wikipedia)

Latest HSBC News From Around the Web

Below are the latest news stories about HSBC HOLDINGS PLC that investors may wish to consider to help them evaluate HSBC as an investment opportunity.

Wall Street Says These 3 Magnificent 7 Stocks Will Crash in 2024Only a handful of stocks drove the market higher and these are the Magnificent 7 stocks to avoid in 2024 according to analysts. |

Investors in HSBC Holdings (LON:HSBA) have seen notable returns of 91% over the past three yearsOne simple way to benefit from the stock market is to buy an index fund. But if you pick the right individual stocks... |

Is 2024 When QuantumScape Stock Becomes Investment Worthy?The EV battery maker needs to get up to commercial scale production before it runs out of cash making QS stock a risky bet. |

Stock Analysis: HSBC Holdings PLCEstablished in 1865 in Hong Kong, London-based HSBC is one of the largest banks in the world, with assets of USD 3 trillion and 40 million customers worldwide. |

Naked Short-Selling Crackdown: HSBC and BNP Paribas Hit With Fines In South KoreaHSBC Holdings PLC (NYSE: HSBC) and BNP Paribas (OTCQX: BNPQY) were hit with a fine of 26.5 billion won ($20.4 million) by South Korea for naked short-selling. In particular, South Korea ordered BNP Paribas to pay 11 billion won and its local brokerage unit to pay 8 billion won for naked short-selling, which is illegal in the country, as per Bloomberg. Apart from this, the South Korean authorities fined HSBC with 7.5 billion won for naked short-selling. “The violations were a grave matter that hu |

HSBC Price Returns

| 1-mo | -0.98% |

| 3-mo | 6.93% |

| 6-mo | 17.63% |

| 1-year | 16.07% |

| 3-year | 88.74% |

| 5-year | 39.42% |

| YTD | 15.05% |

| 2023 | 39.38% |

| 2022 | 7.76% |

| 2021 | 20.72% |

| 2020 | -31.72% |

| 2019 | 1.43% |

HSBC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HSBC

Want to do more research on Hsbc Holdings Plc's stock and its price? Try the links below:Hsbc Holdings Plc (HSBC) Stock Price | Nasdaq

Hsbc Holdings Plc (HSBC) Stock Quote, History and News - Yahoo Finance

Hsbc Holdings Plc (HSBC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...