Heritage Commerce Corp (HTBK): Price and Financial Metrics

HTBK Price/Volume Stats

| Current price | $10.66 | 52-week high | $10.99 |

| Prev. close | $10.71 | 52-week low | $7.66 |

| Day low | $10.25 | Volume | 1,513,400 |

| Day high | $10.99 | Avg. volume | 390,729 |

| 50-day MA | $8.62 | Dividend yield | 4.97% |

| 200-day MA | $8.64 | Market Cap | 652.99M |

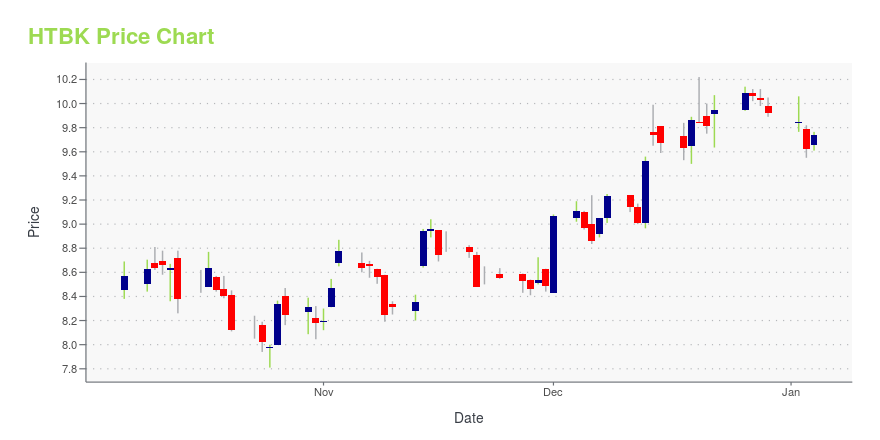

HTBK Stock Price Chart Interactive Chart >

Heritage Commerce Corp (HTBK) Company Bio

Heritage Commerce Corp provides commercial and personal banking services to customers in California. The company was founded in 1993 and is based in San Jose, California.

Latest HTBK News From Around the Web

Below are the latest news stories about HERITAGE COMMERCE CORP that investors may wish to consider to help them evaluate HTBK as an investment opportunity.

With 73% institutional ownership, Heritage Commerce Corp (NASDAQ:HTBK) is a favorite amongst the big gunsKey Insights Institutions' substantial holdings in Heritage Commerce implies that they have significant influence over... |

Heritage Commerce (HTBK) Surges 6.8%: Is This an Indication of Further Gains?Heritage Commerce (HTBK) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

Heritage Commerce (NASDAQ:HTBK) Could Be A Buy For Its Upcoming DividendSome investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be... |

Heritage Commerce's (NASDAQ:HTBK) Dividend Will Be $0.13The board of Heritage Commerce Corp ( NASDAQ:HTBK ) has announced that it will pay a dividend on the 21st of November... |

Heritage Commerce Corp (HTBK) Reports Q3 2023 Earnings of $15.8 MillionA Detailed Look at the Company's Financial Performance and Position |

HTBK Price Returns

| 1-mo | 29.84% |

| 3-mo | 35.37% |

| 6-mo | 19.58% |

| 1-year | 17.08% |

| 3-year | 14.50% |

| 5-year | 12.44% |

| YTD | 10.90% |

| 2023 | -19.19% |

| 2022 | 13.59% |

| 2021 | 41.02% |

| 2020 | -26.22% |

| 2019 | 17.61% |

HTBK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HTBK

Here are a few links from around the web to help you further your research on Heritage Commerce Corp's stock as an investment opportunity:Heritage Commerce Corp (HTBK) Stock Price | Nasdaq

Heritage Commerce Corp (HTBK) Stock Quote, History and News - Yahoo Finance

Heritage Commerce Corp (HTBK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...