HTG Molecular Diagnostics, Inc. (HTGM): Price and Financial Metrics

HTGM Price/Volume Stats

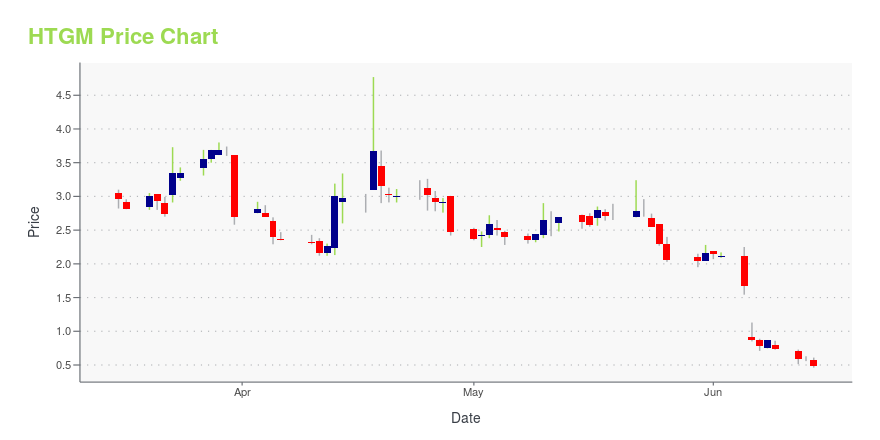

| Current price | $0.48 | 52-week high | $24.96 |

| Prev. close | $0.60 | 52-week low | $0.46 |

| Day low | $0.46 | Volume | 773,000 |

| Day high | $0.61 | Avg. volume | 457,696 |

| 50-day MA | $2.33 | Dividend yield | N/A |

| 200-day MA | $4.75 | Market Cap | 1.06M |

HTGM Stock Price Chart Interactive Chart >

HTG Molecular Diagnostics, Inc. (HTGM) Company Bio

HTG Molecular Diagnostics, Inc. develops and markets technology platforms that facilitate the routine use of complex molecular profiling. The companys HTG Edge and HTG EdgeSeq platforms consist of instrumentation, consumables, and software analytics that are used in molecular profiling applications, including tumor profiling, biomarker development and prospectively, and molecular diagnostic testing. The company was founded in 1997 and is based in Tucson, Arizona.

Latest HTGM News From Around the Web

Below are the latest news stories about HTG MOLECULAR DIAGNOSTICS INC that investors may wish to consider to help them evaluate HTGM as an investment opportunity.

Why Is Coinbase (COIN) Stock Down 16% Today?Coinbase (COIN) stock is falling on Tuesday with heavy trading following news that the SEC is suing the crypto exchange. |

Why Is HTG Molecular Diagnostics (HTGM) Stock Down 42% Today?HTG Molecular Diagnostics (HTGM) stock is falling on Tuesday after the company announced a Chapter 11 bankruptcy filing. |

Why Is Zura Bio (ZURA) Stock Up 9% Today?Zura Bio (ZURA) stock is on the rise Tuesday alongside a couple of positive pieces of news from the clinical-stage biotechnology company. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time for another dive into the latest pre-market stock movers as we check out all of the news moving shares on Tuesday morning! |

Why Are HTG Molecular Diagnostics Shares Plunging TodayHTG Molecular Diagnostics (NASDAQ: HTGM) stock is down on Tuesday after the company announced a Chapter 11 bankruptcy filing. According to the filing, HTG Molecular Diagnostics will operate as a "debtor-in-possession" business during the bankruptcy. It's also seeking a variety of first-day motions that will allow it to continue normal operations. The filing also accelerates the obligations of the company's debts, including a $2.68 million loan held by Silicon Valley Bank, now a division of First |

HTGM Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -99.25% |

| 5-year | -99.81% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -93.87% |

| 2021 | 13.15% |

| 2020 | -54.50% |

| 2019 | -72.37% |

Continue Researching HTGM

Here are a few links from around the web to help you further your research on Htg Molecular Diagnostics Inc's stock as an investment opportunity:Htg Molecular Diagnostics Inc (HTGM) Stock Price | Nasdaq

Htg Molecular Diagnostics Inc (HTGM) Stock Quote, History and News - Yahoo Finance

Htg Molecular Diagnostics Inc (HTGM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...