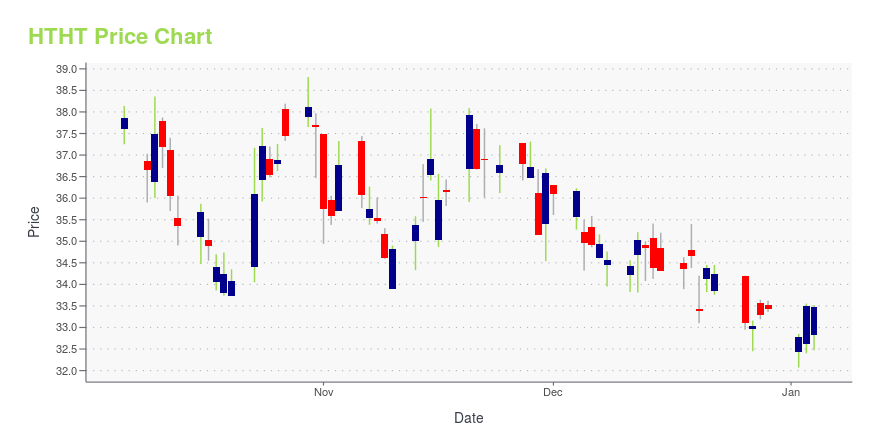

H World Group Ltd. ADR (HTHT): Price and Financial Metrics

HTHT Price/Volume Stats

| Current price | $31.10 | 52-week high | $48.84 |

| Prev. close | $31.10 | 52-week low | $29.87 |

| Day low | $30.93 | Volume | 810,300 |

| Day high | $31.31 | Avg. volume | 1,815,920 |

| 50-day MA | $34.36 | Dividend yield | 1.95% |

| 200-day MA | $35.64 | Market Cap | 10.16B |

HTHT Stock Price Chart Interactive Chart >

H World Group Ltd. ADR (HTHT) Company Bio

Huazhu Hotels Group Ltd (NASDAQ: HTHT;01179.HK )(simplified Chinese: 华住酒店集团; traditional Chinese: 華住酒店集團; pinyin: Huázhù Jiǔdiàn Jítuán) is a hotel management company in China. In 2021, it was ranked the 7th largest hotel group in the world. As of June 2020, Huazhu Hotels Group operates 6,187 properties in 16 countries around the world. It was previously known as China Lodging Group Limited. The company's head office is located in Minhang District, Shanghai. The first Hotel of Huazhu Hotels Group opened at Kunshan Railway Station for trial operation in August 2005. (Source:Wikipedia)

Latest HTHT News From Around the Web

Below are the latest news stories about H WORLD GROUP LTD that investors may wish to consider to help them evaluate HTHT as an investment opportunity.

H World Group Limited Announces Cash DividendSHANGHAI, China, Nov. 29, 2023 (GLOBE NEWSWIRE) -- H World Group Limited (NASDAQ: HTHT and HKEX: 1179) (“H World” or the “Company”), a leading and fast-growing hotel group, today announced that its board of directors (the “Board”) has approved the declaration and payment of a cash dividend (the “Cash Dividend”) of US$0.093 per ordinary share, or US$0.93 per American Depositary Share (the “ADS”). The Cash Dividend is comprised of two tranches, including (i) an ordinary dividend of US$0.062 per or |

H World Group Limited (NASDAQ:HTHT) Q3 2023 Earnings Call TranscriptH World Group Limited (NASDAQ:HTHT) Q3 2023 Earnings Call Transcript November 27, 2023 Operator: Thank you for standing by and welcome to the H World Q3 2023 Earnings Conference Call. All participants are in a listen-only mode. There will be a presentation followed by a question-and-answer session. [Operator Instructions] I would now like to hand […] |

H World Announces Q3 Financial Results, Continuous Revenue Growth Exceeds Guidance Legacy-Huazhu's RevPAR Hits a New HighH World Group Limited ("H World" or "the Group", NASDAQ: HTHT and HKEX: 1179) announced its unaudited financial results in the third quarter ended September 30, 2023. |

H World Group Limited Reports Third Quarter of 2023 Unaudited Financial ResultsA total of 9,157 hotels or 885,756 hotel rooms in operation as of September 30, 2023.Hotel turnover1 increased 55.1% year-over-year to RMB23.5 billion in the third quarter of 2023. Excluding Steigenberger Hotels GmbH and its subsidiaries (“DH”, or “Legacy-DH”), hotel turnover increased 59.2% year-over-year in the third quarter of 2023.Revenue increased 53.6% year-over-year to RMB6.3 billion (US$861 million)2 in the third quarter of 2023, surpassing the revenue guidance previously announced of a |

Is It Time To Consider Buying H World Group Limited (NASDAQ:HTHT)?H World Group Limited ( NASDAQ:HTHT ) received a lot of attention from a substantial price movement on the NASDAQGS... |

HTHT Price Returns

| 1-mo | -7.41% |

| 3-mo | -22.37% |

| 6-mo | -8.34% |

| 1-year | -26.90% |

| 3-year | -21.13% |

| 5-year | -4.21% |

| YTD | -7.00% |

| 2023 | -19.04% |

| 2022 | 14.31% |

| 2021 | -17.08% |

| 2020 | 13.28% |

| 2019 | 39.96% |

HTHT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HTHT

Want to do more research on Huazhu Group Ltd's stock and its price? Try the links below:Huazhu Group Ltd (HTHT) Stock Price | Nasdaq

Huazhu Group Ltd (HTHT) Stock Quote, History and News - Yahoo Finance

Huazhu Group Ltd (HTHT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...