Houston American Energy Corporation (HUSA): Price and Financial Metrics

HUSA Price/Volume Stats

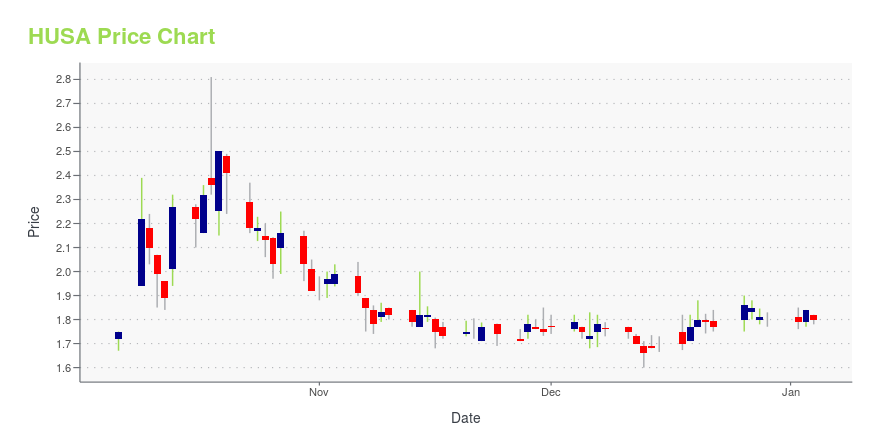

| Current price | $1.24 | 52-week high | $2.81 |

| Prev. close | $1.22 | 52-week low | $1.14 |

| Day low | $1.21 | Volume | 50,579 |

| Day high | $1.24 | Avg. volume | 378,248 |

| 50-day MA | $1.26 | Dividend yield | N/A |

| 200-day MA | $1.57 | Market Cap | 13.52M |

HUSA Stock Price Chart Interactive Chart >

Houston American Energy Corporation (HUSA) Company Bio

Houston American Energy Corp., an independent energy company, acquires, explores for, develops, and produces natural gas, crude oil, and condensate. Its oil and gas properties are located primarily in the Texas Permian Basin, the onshore Texas and Louisiana Gulf Coast region, and in the South American country of Colombia. As of December 31, 2019, the company owned interests in 4 gross wells. Houston American Energy Corp. was incorporated in 2001 and is based in Houston, Texas.

Latest HUSA News From Around the Web

Below are the latest news stories about HOUSTON AMERICAN ENERGY CORP that investors may wish to consider to help them evaluate HUSA as an investment opportunity.

Houston American Energy Increases Interest in Colombian CPO-11 ProjectHouston, TX, Dec. 09, 2022 (GLOBE NEWSWIRE) -- Houston American Energy Corp. (NYSE American: HUSA) today announced the acquisition of an additional interest in Hupecol Meta, LLC. Hupecol Meta owns the 639,405 gross acre CPO-11 block in the Llanos Basin in Colombia, comprised of the 69,128 acre Venus Exploration area, operated by Hupecol, and 570,277 acres which was 50% farmed out to Parex Resources by Hupecol. In total, the CPO-11 block covers almost 1000 square miles with multiple identified le |

HUSA Price Returns

| 1-mo | 0.81% |

| 3-mo | -25.75% |

| 6-mo | -22.98% |

| 1-year | -43.51% |

| 3-year | -24.39% |

| 5-year | -55.66% |

| YTD | -30.73% |

| 2023 | -47.97% |

| 2022 | 140.56% |

| 2021 | -18.29% |

| 2020 | -4.11% |

| 2019 | -23.16% |

Continue Researching HUSA

Want to see what other sources are saying about Houston American Energy Corp's financials and stock price? Try the links below:Houston American Energy Corp (HUSA) Stock Price | Nasdaq

Houston American Energy Corp (HUSA) Stock Quote, History and News - Yahoo Finance

Houston American Energy Corp (HUSA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...