Hawthorn Bancshares, Inc. (HWBK): Price and Financial Metrics

HWBK Price/Volume Stats

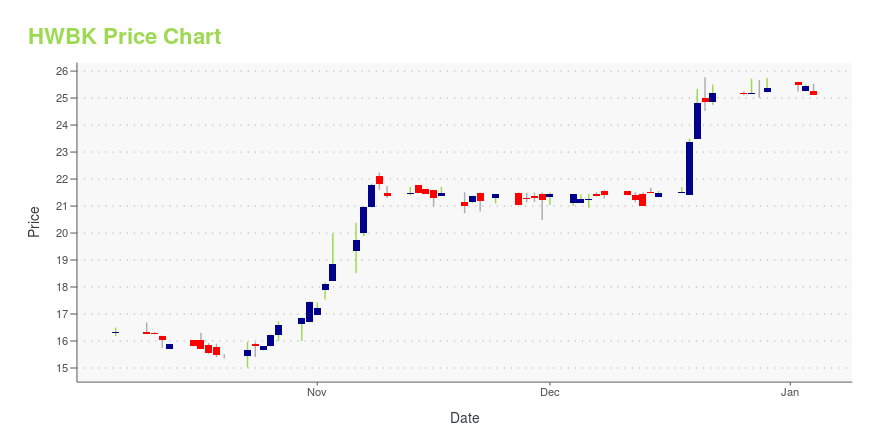

| Current price | $21.50 | 52-week high | $26.00 |

| Prev. close | $21.08 | 52-week low | $15.02 |

| Day low | $20.75 | Volume | 2,435 |

| Day high | $21.50 | Avg. volume | 12,278 |

| 50-day MA | $19.98 | Dividend yield | 3.65% |

| 200-day MA | $20.87 | Market Cap | 150.54M |

HWBK Stock Price Chart Interactive Chart >

Hawthorn Bancshares, Inc. (HWBK) Company Bio

Hawthorn Bancshares, Inc. operates as the bank holding company for Hawthorn Bank that provides various banking services in Missouri. It offers checking and savings accounts, and certificates of deposit; and a range of lending services, including commercial and industrial, single payment personal, installment, and commercial and residential real estate loans. The company also provides trust, Internet banking, and brokerage services; safety deposit boxes; and debit cards. It operates 23 banking offices. The company was founded in 1865 and is headquartered in Jefferson City, Missouri.

Latest HWBK News From Around the Web

Below are the latest news stories about HAWTHORN BANCSHARES INC that investors may wish to consider to help them evaluate HWBK as an investment opportunity.

Hawthorn Bancshares, Inc. Repositions Balance SheetJEFFERSON CITY, Mo., Dec. 19, 2023 (GLOBE NEWSWIRE) -- Hawthorn Bancshares, Inc. (NASDAQ: HWBK) (the "Company"), the parent company of Hawthorn Bank (the "Bank"), implemented a balance sheet repositioning strategy of its portfolio of available-for-sale investment securities. The Bank sold $83.7 million in book value of investment securities, with an average yield of 1.57%, for an after-tax realized loss of $9.1 million. Investment securities sold included $1.0 million of U.S. Treasury securities |

Hawthorn Bancshares' (NASDAQ:HWBK) Dividend Will Be $0.17The board of Hawthorn Bancshares, Inc. ( NASDAQ:HWBK ) has announced that it will pay a dividend of $0.17 per share on... |

Is It Smart To Buy Hawthorn Bancshares, Inc. (NASDAQ:HWBK) Before It Goes Ex-Dividend?It looks like Hawthorn Bancshares, Inc. ( NASDAQ:HWBK ) is about to go ex-dividend in the next four days. The... |

Hawthorn Bancshares, Inc. Announces Directorate AppointmentJEFFERSON CITY, Mo., Oct. 27, 2023 (GLOBE NEWSWIRE) -- Hawthorn Bancshares, Inc. (NASDAQ: HWBK), the parent company of Hawthorn Bank, announced today that Douglas T. Eden has been appointed independent, non-executive director to both Hawthorn Bancshares and Hawthorn Bank’s board of directors effective October 25, 2023. “We are pleased to welcome Mr. Eden to the board of directors and are confident that his experience and knowledge will expand the diversification of perspectives across our Board, |

Hawthorn Bancshares Inc (HWBK) Reports Q3 2023 EarningsNet income of $2.6 million and EPS of $0.36 |

HWBK Price Returns

| 1-mo | 8.59% |

| 3-mo | 14.93% |

| 6-mo | -13.77% |

| 1-year | 25.49% |

| 3-year | 2.30% |

| 5-year | -1.64% |

| YTD | -13.67% |

| 2023 | 20.74% |

| 2022 | -13.79% |

| 2021 | 21.43% |

| 2020 | -8.45% |

| 2019 | 23.57% |

HWBK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HWBK

Here are a few links from around the web to help you further your research on Hawthorn Bancshares Inc's stock as an investment opportunity:Hawthorn Bancshares Inc (HWBK) Stock Price | Nasdaq

Hawthorn Bancshares Inc (HWBK) Stock Quote, History and News - Yahoo Finance

Hawthorn Bancshares Inc (HWBK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...