Hywin Holdings Ltd. (HYW): Price and Financial Metrics

HYW Price/Volume Stats

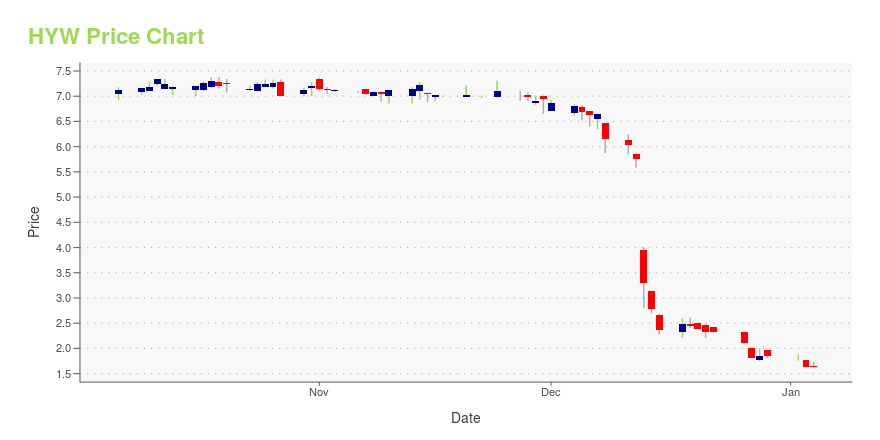

| Current price | $0.37 | 52-week high | $7.48 |

| Prev. close | $0.37 | 52-week low | $0.30 |

| Day low | $0.35 | Volume | 12,500 |

| Day high | $0.37 | Avg. volume | 145,872 |

| 50-day MA | $0.49 | Dividend yield | N/A |

| 200-day MA | $2.59 | Market Cap | 10.33M |

HYW Stock Price Chart Interactive Chart >

Hywin Holdings Ltd. (HYW) Company Bio

Hywin Holdings Ltd., through its subsidiaries, provides wealth management, insurance brokerage, and asset management service in China. It offers privately raised products, including private securities investment funds; private equity and venture capital; privately raised funds of other assets; and real estate products, including traditional real estate fixed-income products, real estate securitization products, and real estate equity investments. The company also offers publicly raised fund products, such as money market fund comprising fixed income mutual fund products that are invested in low risk, highly liquid, and short-term financial instruments, including government bonds, central bank bills, term deposits, certificates of deposits, and corporate commercial papers; bond fund; equity securities fund, which are invested in publicly traded stocks; and hybrid fund, which are invested in mixed products in the combination of publicly traded stocks, bonds, or money market fund. In addition, it provides insurance products, such as life insurance products comprising individual whole life, individual term life, universal life, and individual health insurance; and annuity insurance products and critical illness insurance products, including personal accident insurance products. Further, the company provides overseas property investment consulting; and information technology services, including transaction process management, data analysis, and system maintenance services, as well as engages in microfinance and finance leasing businesses. The company was founded in 2006 and is headquartered in Shanghai, China.

Latest HYW News From Around the Web

Below are the latest news stories about HYWIN HOLDINGS LTD that investors may wish to consider to help them evaluate HYW as an investment opportunity.

Hywin's debacle underscores close links between China's property and wealth management sectorsHywin Wealth, a Shanghai-based wealth management company with ties to embattled property developer China Evergrande Group, said it would look into missed payments on its investment products, after talk of repayment difficulties sent shares of its Nasdaq-listed parent plunging to a third of its value over the past week. Hywin Wealth, controlled by Nasdaq-listed Hywin Holdings, said in a statement on Sunday that its "projects were delayed due to a declining economy", and that it had established a |

Chinese wealth manager Hywin to offer resolution plans after missed paymentsChina's Hywin Wealth Management said it is reviewing its outstanding business and will provide resolution plans to investors by month-end, following missed payments on some investment products amid Chinese property-sector woe. That shareholder is controlled by Han Xiao, son of Hywin controller Han Hongwei, local media reported. |

UPDATE 3-China's Hywin hits record low over missed payments amid property woesShares of Chinese wealth manager Hywin Holdings Ltd. fell by nearly 18% to a record low on Friday after it said that it has been unable to promptly fulfill client redemption requests. While Hywin is a small player with total assets of 2.37 billion yuan ($328 million) as of the end of June, company documents showed, its troubles show how China's faltering property sector is causing strain throughout the financial system. Hywin, whose products are primarily invested into real estate, announced on Thursday that asset managers for some products the company distributes were unable to reach an agreement with "relevant clients" to defer their redemption requests. |

China's Hywin seeks payment delay on some products amid property woesChinese wealth manager Hywin Holdings Ltd., whose products are primarily invested into real estate, said it has been unable to meet some repayments on time, a sign of spreading stress in a financial market dragged down by a property crisis. The announcement comes after market chatter on social media that the firm missed payments on some investment products. Hywin derives most of its revenues from distributing real estate products, including those investing in projects from troubled China Evergrande Group and Sunac China Holdings Ltd. |

Hywin Holdings Reports Redemption Issues Relating to Certain Asset-Backed ProductsSHANGHAI, China, Dec. 14, 2023 (GLOBE NEWSWIRE) -- Hywin Holdings Ltd. (“Hywin”, or the “Company”) (NASDAQ: HYW), a leading independent wealth management service provider in China, today announced that redemption issues have been reported on certain asset-backed products previously distributed by the Company. The asset managers of these products were unable to reach an agreement with the relevant clients to defer redemption. While the Company acted only as distributor of these asset-backed produ |

HYW Price Returns

| 1-mo | -5.27% |

| 3-mo | -56.34% |

| 6-mo | -70.63% |

| 1-year | -95.02% |

| 3-year | -94.64% |

| 5-year | N/A |

| YTD | -80.00% |

| 2023 | -67.43% |

| 2022 | 1.25% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...