Hyzon Motors Inc. (HYZN): Price and Financial Metrics

HYZN Price/Volume Stats

| Current price | $0.16 | 52-week high | $2.17 |

| Prev. close | $0.15 | 52-week low | $0.12 |

| Day low | $0.15 | Volume | 6,120,317 |

| Day high | $0.16 | Avg. volume | 874,329 |

| 50-day MA | $0.39 | Dividend yield | N/A |

| 200-day MA | $0.69 | Market Cap | 39.68M |

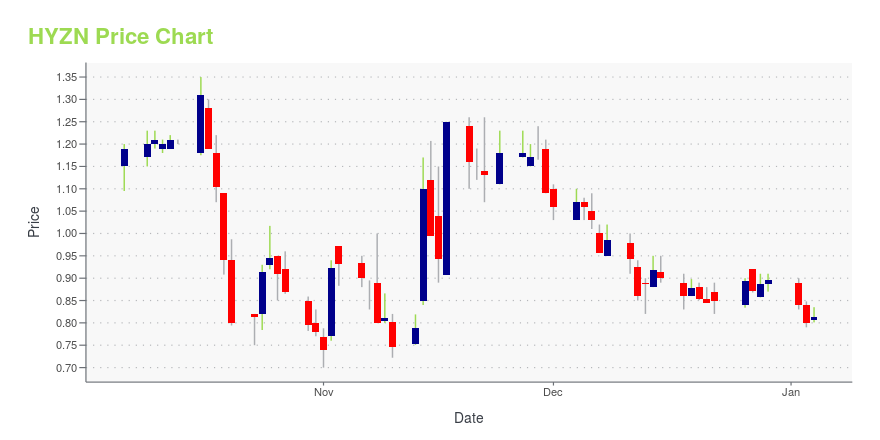

HYZN Stock Price Chart Interactive Chart >

Hyzon Motors Inc. (HYZN) Company Bio

HYZON Motors Inc, a hydrogen mobility company, manufactures hydrogen-powered commercial vehicles and fuel cell systems. It focuses on developing medium and heavy-duty trucks, as well as city and coach buses. The company was incorporated in 2020 and is headquartered in Honeoye Falls, New York.

Latest HYZN News From Around the Web

Below are the latest news stories about HYZON MOTORS INC that investors may wish to consider to help them evaluate HYZN as an investment opportunity.

3 Doomed Penny Stocks to Dump in DecemberAvoid these high-risk, low-value, doomed penny stocks that can compromise your long-term investment health and financial stability |

HYZON ANNOUNCES DR. CHRISTIAN MOHRDIECK AS CHIEF TECHNOLOGY OFFICERHyzon Motors Inc. (NASDAQ: HYZN) (Hyzon or the company), a high-power hydrogen fuel cell technology developer and global supplier of zero-emission heavy-duty fuel cell electric vehicles (FCEVs), today announced the appointment of Dr. Christian Mohrdieck as Chief Technology Officer (CTO) and the retirement of current CTO Shinichi Hirano. |

HYZON MOTORS INC. ANNOUNCES THIRD QUARTER 2023 FINANCIAL AND OPERATING RESULTSHyzon Motors Inc. (NASDAQ: HYZN) (Hyzon or the Company), a leading hydrogen fuel cell technology developer and global supplier of zero-emission heavy-duty fuel cell electric vehicles (FCEVs), today announced its third quarter 2023 financial and operational results. |

HYZON MOTORS ANNOUNCES DATE FOR THIRD QUARTER 2023 FINANCIAL RESULTS AND CONFERENCE CALLHyzon Motors Inc. (Hyzon) (NASDAQ: HYZN), a leading hydrogen fuel cell technology developer and global supplier of zero-emission heavy-duty fuel cell electric vehicles (FCEVs), today announced that Management will host a conference call to discuss its third quarter 2023 earnings results at 8:30AM EST on Tuesday, November 14, 2023. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayIt's time to start off the final trading day this week with a breakdown of the biggest pre-market stock movers on Friday! |

HYZN Price Returns

| 1-mo | -55.69% |

| 3-mo | -72.45% |

| 6-mo | -78.93% |

| 1-year | -91.06% |

| 3-year | -97.80% |

| 5-year | N/A |

| YTD | -82.12% |

| 2023 | -42.26% |

| 2022 | -76.12% |

| 2021 | -38.77% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...