Integra LifeSciences Holdings Corporation (IART): Price and Financial Metrics

IART Price/Volume Stats

| Current price | $31.43 | 52-week high | $46.75 |

| Prev. close | $31.53 | 52-week low | $22.36 |

| Day low | $30.82 | Volume | 1,562,800 |

| Day high | $32.19 | Avg. volume | 1,088,769 |

| 50-day MA | $29.66 | Dividend yield | N/A |

| 200-day MA | $35.68 | Market Cap | 2.48B |

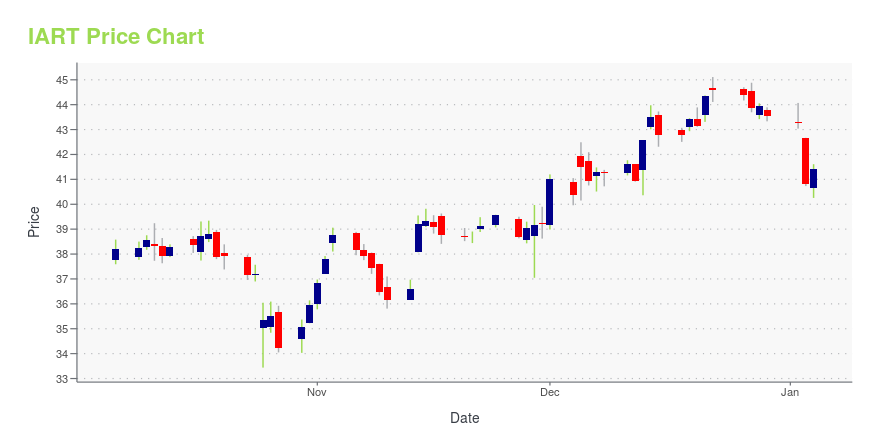

IART Stock Price Chart Interactive Chart >

Integra LifeSciences Holdings Corporation (IART) Company Bio

Integra LifeSciences develops, manufactures, and markets surgical implants and medical instruments for use in neurosurgery, extremity reconstruction, orthopedics, and general surgery. The company operates in five segments: U.S. Neuro-surgery; U.S. Extremities; U.S. Instruments; U.S. Spine and Other; and International. The company was founded in 1989 and is based in Plainsboro, New Jersey.

Latest IART News From Around the Web

Below are the latest news stories about INTEGRA LIFESCIENCES HOLDINGS CORP that investors may wish to consider to help them evaluate IART as an investment opportunity.

Integra (IART) to Advance ENT Division With New Buyout DealIntegra (IART) will be among the top suppliers of ENT products and technologies following the Acclarent acquisition. |

Integra LifeSciences Announces Definitive Agreement to Acquire Acclarent®The acquisition will become part of Integra’s Codman Specialty Surgical (CSS) division. The ear, nose and throat (ENT) category is a key area of strategic interest and highly complementary to the neurosurgery segment.Provides a unique opportunity to build scale and capture a leadership position in the attractive ENT device segment with Acclarent’s established commercial scale, strong brand recognition, differentiated portfolio, and robust innovation pipeline. Generates shareholder value; transac |

Integra to buy J&J’s Acclarent for $275MIntegra said the purchase, which includes a portfolio of balloon dilation products for the sinuses and eustachian tube, would make it a market leader in ENT procedures. |

Integra LifeSciences Appoints Jeff Graves, Ph.D., to Board of DirectorsJeff Graves Integra LifeSciences Appoints Jeff Graves, Ph.D., to Board of Directors PRINCETON, N.J., Dec. 12, 2023 (GLOBE NEWSWIRE) -- Integra LifeSciences Holdings Corporation (Nasdaq: IART), a leading global medical technology company, today announced that Jeff Graves, Ph.D., president and chief executive officer of 3D Systems Corporation, was appointed to the company’s board of directors, effective immediately. With the appointment of Dr. Graves, Integra has added four new directors since 202 |

Integra Gains From New Product Launches, Mounting Costs AilIntegra expands the international reach of the CUSA platform and registers DuraGen, DuraSeal, Mayfield and Duo LED lighting in the EMEA and Latin America. |

IART Price Returns

| 1-mo | 9.32% |

| 3-mo | 10.90% |

| 6-mo | -24.95% |

| 1-year | -30.92% |

| 3-year | -55.61% |

| 5-year | -50.51% |

| YTD | -27.83% |

| 2023 | -22.33% |

| 2022 | -16.30% |

| 2021 | 3.19% |

| 2020 | 11.39% |

| 2019 | 29.22% |

Continue Researching IART

Want to do more research on Integra Lifesciences Holdings Corp's stock and its price? Try the links below:Integra Lifesciences Holdings Corp (IART) Stock Price | Nasdaq

Integra Lifesciences Holdings Corp (IART) Stock Quote, History and News - Yahoo Finance

Integra Lifesciences Holdings Corp (IART) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...