International Bancshares Corporation (IBOC): Price and Financial Metrics

IBOC Price/Volume Stats

| Current price | $69.25 | 52-week high | $69.79 |

| Prev. close | $68.45 | 52-week low | $41.96 |

| Day low | $68.34 | Volume | 260,300 |

| Day high | $69.79 | Avg. volume | 229,038 |

| 50-day MA | $58.70 | Dividend yield | 1.95% |

| 200-day MA | $53.18 | Market Cap | 4.31B |

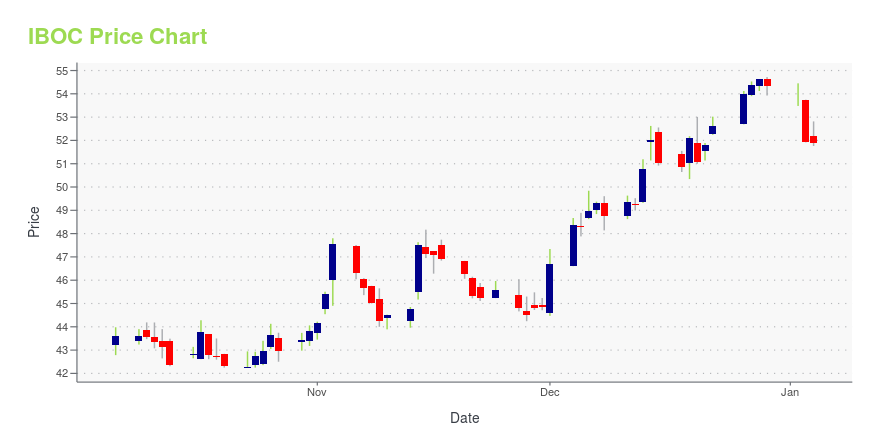

IBOC Stock Price Chart Interactive Chart >

International Bancshares Corporation (IBOC) Company Bio

International Bancshares Corporation provides commercial and retail banking services in South, Central, and Southeast Texas, as well as in the State of Oklahoma. The company was founded in 1966 and is based in Laredo, Texas.

Latest IBOC News From Around the Web

Below are the latest news stories about INTERNATIONAL BANCSHARES CORP that investors may wish to consider to help them evaluate IBOC as an investment opportunity.

Great week for International Bancshares Corporation (NASDAQ:IBOC) institutional investors after losing 9.2% over the previous yearKey Insights Significantly high institutional ownership implies International Bancshares' stock price is sensitive to... |

International Bancshares Corp (IBOC) Reports a 56.8% Increase in Net Income for Q3 2023IBOC's Diluted Earnings Per Share Rise by 58.9% Year-Over-Year |

IBC Continues to Deliver Exceptional EarningsLAREDO, Texas, November 02, 2023--International Bancshares Corporation (NASDAQ:IBOC), one of the largest independent bank holding companies in Texas, today reported net income for the nine months ended Sept. 30, 2023 of $305.4 million, or $4.91 diluted earnings per common share ($4.92 per share basic), compared to $194.8 million, or $3.09 diluted earnings per common share ($3.10 per share basic), for the same period of 2022, which represents an increase of 56.8% in net income and an increase of |

Here's Why We Think International Bancshares (NASDAQ:IBOC) Might Deserve Your Attention TodayThe excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even... |

Top 3 Small Bank Stocks to Buy for Rapid Growth in 2023Here is a trio of small, lesser-known banks quietly gearing up for explosive growth in 2023. |

IBOC Price Returns

| 1-mo | 25.07% |

| 3-mo | 23.33% |

| 6-mo | 29.13% |

| 1-year | 45.27% |

| 3-year | 93.87% |

| 5-year | 112.27% |

| YTD | 29.13% |

| 2023 | 21.97% |

| 2022 | 10.94% |

| 2021 | 16.51% |

| 2020 | -9.51% |

| 2019 | 28.67% |

IBOC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IBOC

Want to do more research on International Bancshares Corp's stock and its price? Try the links below:International Bancshares Corp (IBOC) Stock Price | Nasdaq

International Bancshares Corp (IBOC) Stock Quote, History and News - Yahoo Finance

International Bancshares Corp (IBOC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...