ICL Group Ltd. (ICL): Price and Financial Metrics

ICL Price/Volume Stats

| Current price | $4.62 | 52-week high | $6.72 |

| Prev. close | $4.61 | 52-week low | $4.13 |

| Day low | $4.59 | Volume | 525,377 |

| Day high | $4.66 | Avg. volume | 717,736 |

| 50-day MA | $4.54 | Dividend yield | 3.97% |

| 200-day MA | $4.84 | Market Cap | 6.07B |

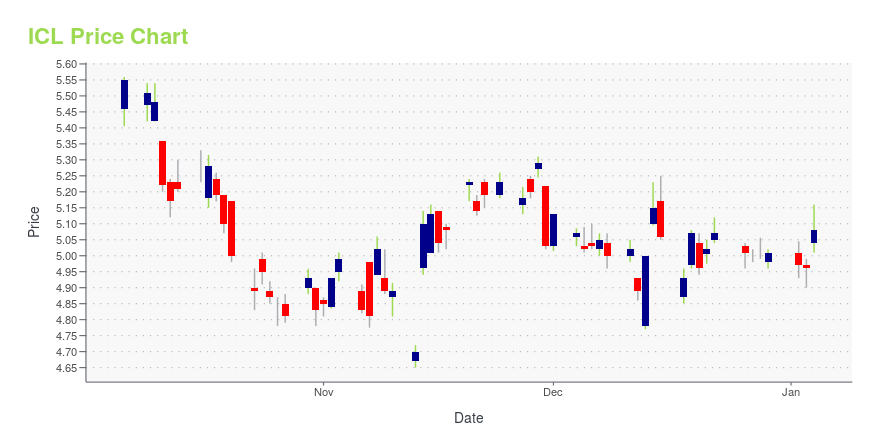

ICL Stock Price Chart Interactive Chart >

ICL Group Ltd. (ICL) Company Bio

ICL Group Ltd. engages in the manufacture of mineral-based products for the agriculture, food, and engineered materials markets. Its products include potash and phosphate fertilizers, specialty fertilizers, functional ingredients, flame retardants and magnesia products. The company was founded in 1968 and is headquartered in Tel Aviv, Israel.

Latest ICL News From Around the Web

Below are the latest news stories about ICL GROUP LTD that investors may wish to consider to help them evaluate ICL as an investment opportunity.

15 Most Productive Agricultural Regions in the WorldIn this article we will list the world’s most productive agricultural regions and the staples they produce. You can skip the details and read 5 Most Productive Agricultural Regions in the World. Worldwide, agriculture is influenced by a complex network of interconnected processes, primarily reliant on staple crops. For instance, wheat serves as a primary […] |

ICL Announces Plans to Develop Customer Innovation and Qualification CenterTEL AVIV, Israel, December 19, 2023--ICL (NYSE: ICL) (TASE: ICL), a leading global specialty minerals company, today announced plans to invest $30 million to develop a customer innovation and qualification center (CIQC) in North America, as the company continues to execute on its long-term plan to provide commercial solutions for the energy storage systems (ESS) market in the United States. The CIQC is expected to become a hub for ICL, its partners and its customers, as the company looks to make |

ICL Reports Third Quarter 2023 ResultsTEL AVIV, Israel, November 08, 2023--ICL (NYSE: ICL) (TASE: ICL), a leading global specialty minerals company, today reported its financial results for the third quarter ended September 30, 2023. Consolidated sales were $1.9 billion versus $2.5 billion, while operating income was $227 million versus $935 million in the third quarter of last year. Operating cash flow was $407 million vs. $606 million, and adjusted EBITDA was $346 million versus $1,049 million. |

Analysts Estimate ICL Group (ICL) to Report a Decline in Earnings: What to Look Out forICL Group (ICL) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations. |

ICL Announces Third Quarter 2023 Earnings CallTEL AVIV, Israel, October 19, 2023--ICL (NYSE: ICL) (TASE: ICL), a leading global specialty minerals company, today announced it plans to release third quarter 2023 results prior to the opening of the TASE market on Wednesday, November 8, 2023. |

ICL Price Returns

| 1-mo | 5.24% |

| 3-mo | 0.79% |

| 6-mo | 1.77% |

| 1-year | -27.57% |

| 3-year | -24.15% |

| 5-year | 5.08% |

| YTD | -5.95% |

| 2023 | -28.27% |

| 2022 | -18.50% |

| 2021 | 94.35% |

| 2020 | 6.55% |

| 2019 | -15.37% |

ICL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ICL

Want to see what other sources are saying about Israel Chemicals Ltd's financials and stock price? Try the links below:Israel Chemicals Ltd (ICL) Stock Price | Nasdaq

Israel Chemicals Ltd (ICL) Stock Quote, History and News - Yahoo Finance

Israel Chemicals Ltd (ICL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...