iClick Interactive Asia Group Limited (ICLK): Price and Financial Metrics

ICLK Price/Volume Stats

| Current price | $2.43 | 52-week high | $4.01 |

| Prev. close | $2.31 | 52-week low | $1.03 |

| Day low | $2.36 | Volume | 49,894 |

| Day high | $2.57 | Avg. volume | 32,524 |

| 50-day MA | $1.40 | Dividend yield | N/A |

| 200-day MA | $2.77 | Market Cap | 24.64M |

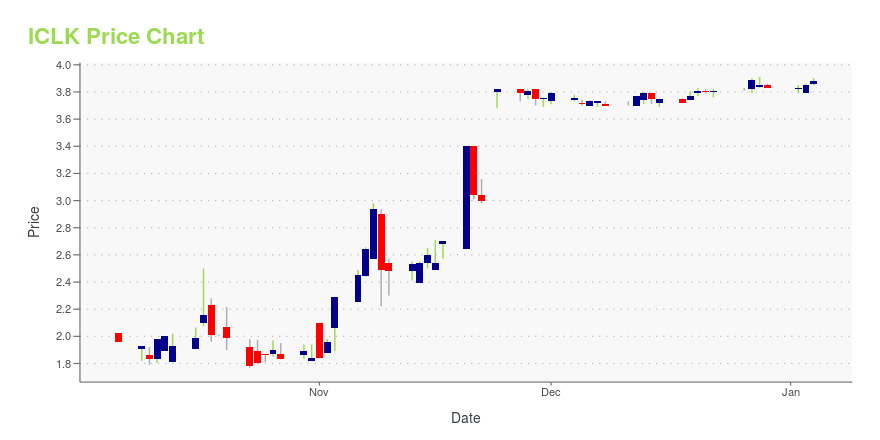

ICLK Stock Price Chart Interactive Chart >

iClick Interactive Asia Group Limited (ICLK) Company Bio

iClick Interactive Asia Limited, a digital marketing company, provides search, display, mobile, and video advertising solutions to reach online audience in China. It serves Fortune 500 companies and medium enterprises, as well as brands and multinational corporations worldwide. iClick Interactive Asia Limited was incorporated in 2008 and is based in Quarry Bay, Hong Kong.

Latest ICLK News From Around the Web

Below are the latest news stories about ICLICK INTERACTIVE ASIA GROUP LTD that investors may wish to consider to help them evaluate ICLK as an investment opportunity.

iClick Interactive Asia Group First Half 2023 Earnings: US$2.92 loss per share (vs US$5.37 loss in 1H 2022)iClick Interactive Asia Group ( NASDAQ:ICLK ) First Half 2023 Results Key Financial Results Revenue: US$67.1m (down 21... |

ICLK Stock Earnings: iClick Interactive Asia Reported Results for H1 2023iClick Interactive Asia just reported results for the first half of 2023. |

iClick Interactive Asia Group Limited Reports 2023 Half-Year Unaudited Financial ResultsiClick Interactive Asia Group Limited ("iClick" or the "Company") (Nasdaq: ICLK), a leading enterprise and marketing cloud platform in China that empowers worldwide brands with full-stack consumer lifecycle solutions, today announced unaudited financial results for the six months ended June 30, 2023. |

iClick Interactive Asia Group Limited Schedules 2023 Annual General Meeting for December 29, 2023iClick Interactive Asia Group Limited ("iClick" or the "Company") (NASDAQ: ICLK), a leading enterprise and marketing cloud platform in China that empowers worldwide brands with full-stack consumer lifecycle solutions, today announced that it will hold its 2023 annual general meeting on December 29, 2023 at 9:00 a.m. (Hong Kong time) or on December 28, 2023 at 8:00 p.m. (New York time) in Hong Kong, People's Republic of China. |

iClick Interactive Asia Group Limited Enters into a Definitive Merger Agreement for Going-Private TransactioniClick Interactive Asia Group Limited ("iClick" or the "Company") (NASDAQ: ICLK), a leading enterprise and marketing cloud platform in China that empowers worldwide brands with full-stack consumer lifecycle solutions, today announced that it has entered into a definitive Agreement and Plan of Merger (the "Merger Agreement") with TSH Investment Holding Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands ("Parent") and TSH Merger Sub Limited, an ex |

ICLK Price Returns

| 1-mo | 82.71% |

| 3-mo | 95.97% |

| 6-mo | -36.72% |

| 1-year | 29.95% |

| 3-year | -95.42% |

| 5-year | -93.25% |

| YTD | -36.55% |

| 2023 | -0.52% |

| 2022 | -91.65% |

| 2021 | -46.02% |

| 2020 | 165.22% |

| 2019 | -4.45% |

Continue Researching ICLK

Here are a few links from around the web to help you further your research on iClick Interactive Asia Group Ltd's stock as an investment opportunity:iClick Interactive Asia Group Ltd (ICLK) Stock Price | Nasdaq

iClick Interactive Asia Group Ltd (ICLK) Stock Quote, History and News - Yahoo Finance

iClick Interactive Asia Group Ltd (ICLK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...