ICON PLC (ICLR): Price and Financial Metrics

ICLR Price/Volume Stats

| Current price | $323.46 | 52-week high | $347.72 |

| Prev. close | $313.10 | 52-week low | $221.20 |

| Day low | $312.85 | Volume | 908,602 |

| Day high | $325.10 | Avg. volume | 583,136 |

| 50-day MA | $322.07 | Dividend yield | N/A |

| 200-day MA | $294.11 | Market Cap | 26.68B |

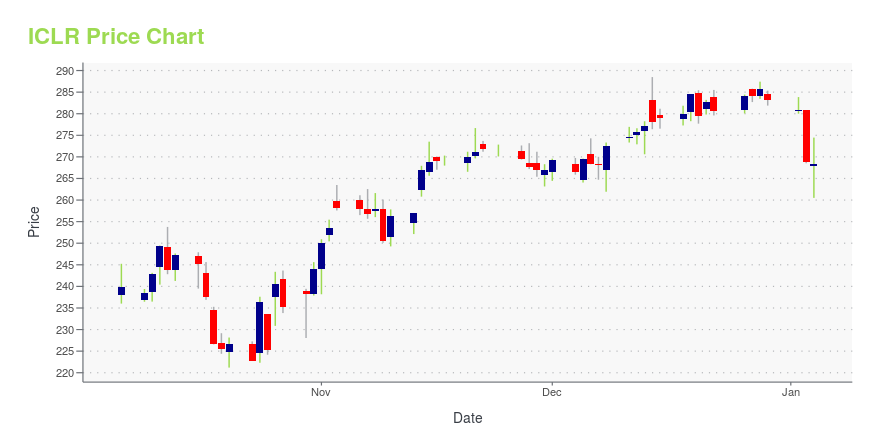

ICLR Stock Price Chart Interactive Chart >

ICON PLC (ICLR) Company Bio

ICON Public Limited Company provides outsourced development services to the pharmaceutical, biotechnology, and medical device industries in Ireland, rest of Europe, the United States, and internationally. The company was founded in 1990 and is based in Dublin, Ireland.

Latest ICLR News From Around the Web

Below are the latest news stories about ICON PLC that investors may wish to consider to help them evaluate ICLR as an investment opportunity.

ICON Wins Industry Accolades from TIME Magazine, Forbes and Financial Times in Second Half of 2023DUBLIN, December 18, 2023--ICON earns recognition as employer of choice and leading innovator in the clinical trial industry in second half of 2023. |

Is It Too Late To Consider Buying ICON Public Limited Company (NASDAQ:ICLR)?Today we're going to take a look at the well-established ICON Public Limited Company ( NASDAQ:ICLR ). The company's... |

Reasons to Invest in ICON (ICLR)ClearBridge Investments, an investment management company, released its “ClearBridge Select Strategy” third quarter 2023 investor letter. A copy of the same can be downloaded here. Rising bond rates and the Federal Reserve’s shift to a more hawkish stance put pressure on stocks in the third quarter. The strategy underperformed its Russell 3000 Index in the third […] |

ICON Secures Upgraded Credit Rating from Moody’s Investors ServiceDUBLIN, December 07, 2023--ICON Secures Upgraded Credit Rating from Moody’s Investors Service |

3 Reasons Growth Investors Will Love Icon PLC (ICLR)Icon PLC (ICLR) could produce exceptional returns because of its solid growth attributes. |

ICLR Price Returns

| 1-mo | 3.35% |

| 3-mo | 4.91% |

| 6-mo | 21.37% |

| 1-year | 33.86% |

| 3-year | 44.61% |

| 5-year | 100.78% |

| YTD | 14.27% |

| 2023 | 45.72% |

| 2022 | -37.28% |

| 2021 | 58.84% |

| 2020 | 13.21% |

| 2019 | 33.29% |

Loading social stream, please wait...