Intercept Pharmaceuticals, Inc. (ICPT): Price and Financial Metrics

ICPT Price/Volume Stats

| Current price | $19.00 | 52-week high | $21.86 |

| Prev. close | $18.96 | 52-week low | $8.82 |

| Day low | $18.98 | Volume | 3,963,400 |

| Day high | $19.01 | Avg. volume | 1,362,029 |

| 50-day MA | $15.82 | Dividend yield | N/A |

| 200-day MA | $14.74 | Market Cap | 793.88M |

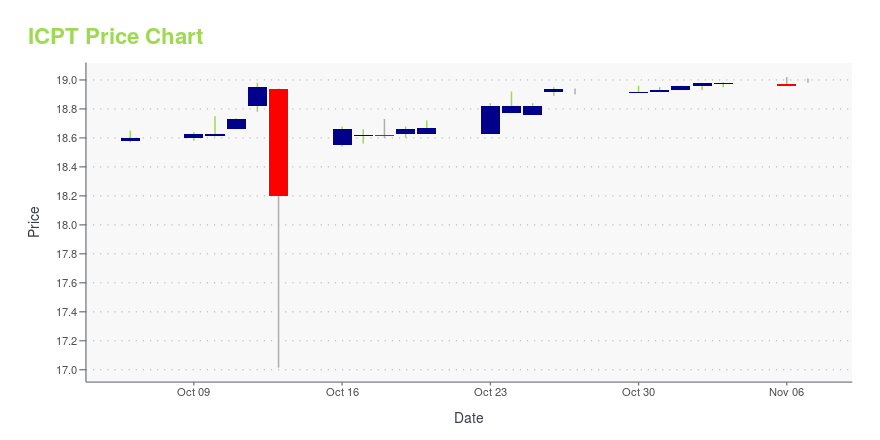

ICPT Stock Price Chart Interactive Chart >

Intercept Pharmaceuticals, Inc. (ICPT) Company Bio

Intercept Pharmaceuticals is a biopharmaceutical company focused on the development and commercialization of novel therapeutics to treat chronic underserved liver diseases. The company was founded in 2002 and is based in New York, New York.

Latest ICPT News From Around the Web

Below are the latest news stories about INTERCEPT PHARMACEUTICALS INC that investors may wish to consider to help them evaluate ICPT as an investment opportunity.

Will Intercept Pharmaceuticals (ICPT) Report Negative Q3 Earnings? What You Should KnowIntercept (ICPT) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations. |

Stocks to Sell: 7 Overbought Companies You Ought to Dump Right NowOverbought stocks are an early indication of a potential correction on a stock; act now if you hold these stocks. |

Intercept Pharmaceuticals (NASDAQ:ICPT) shareholders have endured a 83% loss from investing in the stock five years agoIt is a pleasure to report that the Intercept Pharmaceuticals, Inc. ( NASDAQ:ICPT ) is up 67% in the last quarter. But... |

Madrigal (MDGL) to Raise Capital Via Public Offering of $500MMadrigal (MDGL) is raising funds through a public offering of 1.25 million shares of its common stock to use in commercial activities in the preparation of a potential launch of resmetirom in the United States. |

Biotech Stock Roundup: ICPT Up on Buyout Deal, IMVT & PLRX Gain on Study DataAcquisition news from Intercept (ICPT) and study updates from Immunovant (IMVT) are in focus in the biotech sector. |

ICPT Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 83.22% |

| 3-year | 15.64% |

| 5-year | -70.31% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -24.06% |

| 2021 | -34.05% |

| 2020 | -80.07% |

| 2019 | 22.95% |

Continue Researching ICPT

Want to do more research on Intercept Pharmaceuticals Inc's stock and its price? Try the links below:Intercept Pharmaceuticals Inc (ICPT) Stock Price | Nasdaq

Intercept Pharmaceuticals Inc (ICPT) Stock Quote, History and News - Yahoo Finance

Intercept Pharmaceuticals Inc (ICPT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...