Intellicheck, Inc. (IDN): Price and Financial Metrics

IDN Price/Volume Stats

| Current price | $3.10 | 52-week high | $4.46 |

| Prev. close | $2.95 | 52-week low | $1.56 |

| Day low | $2.97 | Volume | 24,200 |

| Day high | $3.10 | Avg. volume | 261,301 |

| 50-day MA | $3.31 | Dividend yield | N/A |

| 200-day MA | $2.46 | Market Cap | 60.35M |

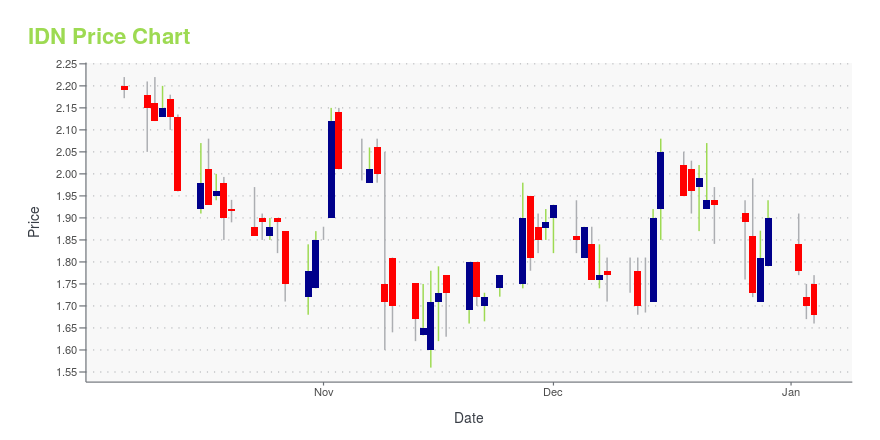

IDN Stock Price Chart Interactive Chart >

Latest IDN News From Around the Web

Below are the latest news stories about INTELLICHECK INC that investors may wish to consider to help them evaluate IDN as an investment opportunity.

7 Nano-Cap Stocks That Pack a Serious Punch for Their WeightPlaying in the field of nano-cap stocks is similar to the concept of stealing bases. |

Versatile Credit Integrates Intellicheck to Enrich Customer Experience with Advanced Identity ValidationMELVILLE, N.Y., December 12, 2023--Intellicheck, Inc. (Nasdaq: IDN), an industry-leading identity company delivering on-demand digital and physical identity validation, today announced Versatile Credit has integrated Intellicheck (Nasdaq: IDN) into their preeminent omnichannel lending platform. Versatile Credit is the premier credit aggregation and customer acquisition tool for merchants and lenders. |

Presenting on the Emerging Growth Conference 65 Day 2 on December 7th Register NowMIAMI, Dec. 06, 2023 (GLOBE NEWSWIRE) -- EmergingGrowth.com a leading independent small cap media portal announces the schedule of the 65th Emerging Growth Conference on December 6th and 7th, 2023. The Emerging Growth Conference identifies companies in a wide range of growth sectors, with strong management teams, innovative products & services, focused strategy, execution, and the overall potential for long-term growth. Register for the Conference here. Submit Questions for any of the presenting |

Companies Like Intellicheck (NASDAQ:IDN) Can Afford To Invest In GrowthJust because a business does not make any money, does not mean that the stock will go down. For example, biotech and... |

Intellicheck CEO Bryan Lewis to Present at the Emerging Growth Conference 65 on December 7, 2023MELVILLE, N.Y., November 28, 2023--Intellicheck, Inc. (Nasdaq: IDN), an industry-leading identity company delivering on-demand digital and physical identification validation solutions, today announced that it has been invited to present at the virtual Emerging Growth Conference 65 on December 7, 2023. |

IDN Price Returns

| 1-mo | -3.13% |

| 3-mo | -2.82% |

| 6-mo | 76.14% |

| 1-year | 20.62% |

| 3-year | -62.20% |

| 5-year | -45.80% |

| YTD | 63.16% |

| 2023 | -5.00% |

| 2022 | -56.71% |

| 2021 | -59.49% |

| 2020 | 52.27% |

| 2019 | 250.00% |

Continue Researching IDN

Want to see what other sources are saying about Intellicheck Inc's financials and stock price? Try the links below:Intellicheck Inc (IDN) Stock Price | Nasdaq

Intellicheck Inc (IDN) Stock Quote, History and News - Yahoo Finance

Intellicheck Inc (IDN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...