Idera Pharmaceuticals, Inc. (IDRA): Price and Financial Metrics

IDRA Price/Volume Stats

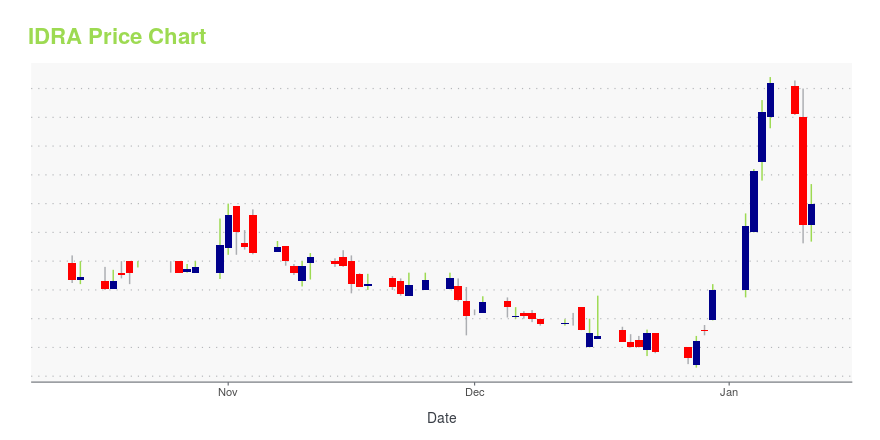

| Current price | $7.23 | 52-week high | $8.67 |

| Prev. close | $0.54 | 52-week low | $0.22 |

| Day low | $7.14 | Volume | 21,870 |

| Day high | $8.67 | Avg. volume | 464,030 |

| 50-day MA | $0.37 | Dividend yield | N/A |

| 200-day MA | $0.44 | Market Cap | 450.51M |

IDRA Stock Price Chart Interactive Chart >

Idera Pharmaceuticals, Inc. (IDRA) Company Bio

Idera Pharmaceuticals, Inc. focuses on the discovery, development, and commercialization of novel therapeutics for oncology and rare diseases in the United States. The company was founded in 1989 and is based in Cambridge, Massachusetts.

Latest IDRA News From Around the Web

Below are the latest news stories about IDERA PHARMACEUTICALS INC that investors may wish to consider to help them evaluate IDRA as an investment opportunity.

Idera Pharmaceuticals GAAP EPS of -$0.06, revenue of $0.05MIdera Pharmaceuticals press release (IDRA): Q3 GAAP EPS of -$0.06.Revenue of $0.05M.The Company’s pro forma cash position as of September 30, 2022 was $26.8 million. |

Idera Pharmaceuticals Reports Third Quarter 2022 Financial Results and Provides Corporate UpdateEXTON, Pa. and DURHAM, N.C., Nov. 14, 2022 (GLOBE NEWSWIRE) -- Idera Pharmaceuticals, Inc. (“Idera,” the “Company,” “we,” “us,” or “our”) (Nasdaq: IDRA) today reported its consolidated financial and operational results for the third quarter ended September 30, 2022. “We are pleased to have completed the merger of Idera and Aceragen at the end of the third quarter, better |

Idera Pharma Acquires Rare Disease Player, Names New CEOIdera Pharmaceuticals Inc (NASDAQ: IDRA ) acquired Aceragen Inc , a privately-held biotechnology company focused on rare, orphan pulmonary, and rheumatic diseases. The combined cash of the two companies is expected to provide a runway into Q3 2023 , funding the advancement of Aceragen''s pipeline, including ACG-701 and ACG-801, through important 2023 clinical milestones. The company estimates an annual peak sales potential of $650 million from … Full story available on Benzinga.com |

Idera Pharmaceuticals Acquires AceragenAcquisition includes late-stage rare disease portfolio with anticipated 2023 clinical milestones and first potential product approval as early as late 2024 |

Idera Pharmaceuticals completes acquisition of AceragenIdera Pharmaceuticals (IDRA) has completed the acquisition of privately-held biotechnology company Aceragen in a stock-for-stock transaction. |

IDRA Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -58.30% |

| 5-year | -83.26% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -38.60% |

| 2021 | -84.47% |

| 2020 | 101.65% |

| 2019 | -34.30% |

Continue Researching IDRA

Want to see what other sources are saying about Idera Pharmaceuticals Inc's financials and stock price? Try the links below:Idera Pharmaceuticals Inc (IDRA) Stock Price | Nasdaq

Idera Pharmaceuticals Inc (IDRA) Stock Quote, History and News - Yahoo Finance

Idera Pharmaceuticals Inc (IDRA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...