Interpace Biosciences, Inc. (IDXG): Price and Financial Metrics

IDXG Price/Volume Stats

| Current price | $1.15 | 52-week high | $2.60 |

| Prev. close | $1.12 | 52-week low | $0.77 |

| Day low | $1.01 | Volume | 2,100 |

| Day high | $1.16 | Avg. volume | 4,836 |

| 50-day MA | $1.30 | Dividend yield | N/A |

| 200-day MA | $1.20 | Market Cap | 5.03M |

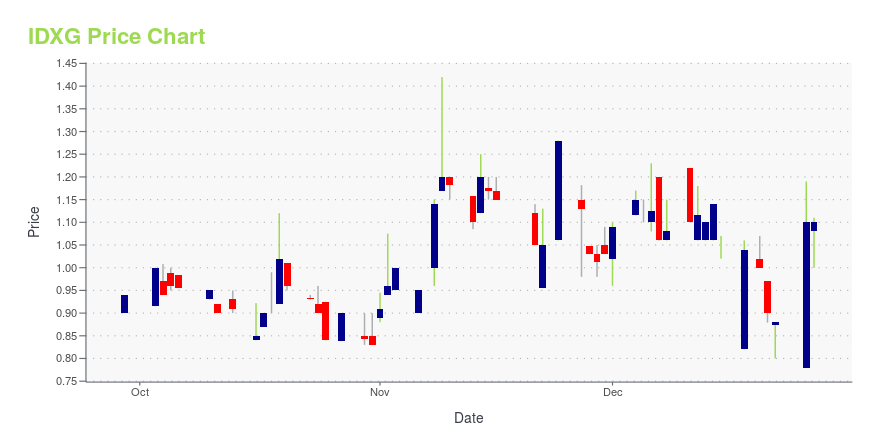

IDXG Stock Price Chart Interactive Chart >

Interpace Biosciences, Inc. (IDXG) Company Bio

Interpace Biosciences, Inc. provides molecular diagnostic tests, bioinformatics, and pathology services for evaluating cancer risk in the United States. The company offers PancraGEN, a pancreatic cyst and pancreaticobiliary solid lesion genomic test that helps physicians better assess risk of pancreaticobiliary cancers using its PathFinderTG platform; and ThyGeNEXT, an oncogenic mutation panel to identify malignant thyroid nodules. It also provides ThyraMIR assesses thyroid nodules for risk of malignancy utilizing a proprietary microRNA gene-expression assay; and RespriDx, a genomic test that helps physicians to differentiate metastatic or recurrent lung cancer. The company also provides pharmacogenomics testing, genotyping, biorepository, and other customized services to the pharmaceutical and biotech industries. It primarily serves physicians, hospitals, and clinics. The company was formerly known as Interpace Diagnostics Group, Inc. and changed its name to Interpace Biosciences, Inc. in November 2019. Interpace Biosciences, Inc. was incorporated in 1986 and is headquartered in Parsippany, New Jersey.

Latest IDXG News From Around the Web

Below are the latest news stories about INTERPACE BIOSCIENCES INC that investors may wish to consider to help them evaluate IDXG as an investment opportunity.

Interpace Biosciences Announces Record Third Quarter 2023 Financial and Business Results●Q3 Revenue of $9.1 million; an 11% increase year-over-year ●Q3 Test volume up 11% year-over-year ●Q3 Reimbursement improvement up 11% year-over-year, driven by additional commercial contracts and collection initiatives PARSIPPANY, NJ, Nov. 08, 2023 (GLOBE NEWSWIRE) -- Interpace Biosciences, Inc. (“Interpace” or the “Company”) (OTCQX: IDXG) today announced financial results for the third quarter ended September 30, 2023 and provided a business and financial update. Third quarter Net Revenue was |

Interpace Biosciences Announces Record Second Quarter 2023 Financial and Business Results●Q2 Revenue of $11.0 million; a 49% increase year-over-year; highest quarter in history ●Q2 Test volume up 15% year over year to record levels ●Q2 Reimbursement improvement up 34% year-over-year driven by additional commercial contracts and collection initiatives PARSIPPANY, NJ, Aug. 09, 2023 (GLOBE NEWSWIRE) -- Interpace Biosciences, Inc. (“Interpace” or the “Company”) (OTCQX: IDXG) today announced financial results for the second quarter ended June 30, 2023 and provided a business and financia |

Interpace Biosciences Releases Preliminary Record Second Quarter 2023 Business Results; Updates Status of PancraGEN® ReimbursementQ2 Revenue of $11 million; a 49.1% increase year-over-year and 12.2% better than Q1; highest quarter in history1st Half Revenue $20.9 million; 36.1% improvement over 1st Half 2022Q2 Test volume up 15.2% year-over-year to record levels; 1st Half volume up 16.5% year-over-yearNovitas announces that LCD L39365 has been rescinded and will NOT go into effect July 17, 2023 PARSIPPANY, NJ, July 10, 2023 (GLOBE NEWSWIRE) -- Interpace Biosciences, Inc. (“Interpace” or the “Company”) (OTCQX: IDXG) today a |

Interpace Expects to Stop Offering PancraGEN® Test Due to CMS Decision to End Reimbursement as of July 17, 2023PARSIPPANY, NJ, June 05, 2023 (GLOBE NEWSWIRE) -- Interpace Biosciences, Inc. (“Interpace” or the “Company”) (OTCQX: IDXG) today announced that the Centers for Medicare & Medicaid Services (CMS) issued the final Local Coverage Determination (LCD) of Genetic Testing for Oncology (L39365) which establishes non-coverage for the Company’s widely used PancraGEN® test effective July 17, 2023. Commercially available in its current form since 2013, PancraGEN is a DNA-based molecular diagnostic test that |

Interpace Biosciences Announces Record First Quarter 2023 Financial and Business Results●Q1 Revenue of $9.8 million; a 24% increase year-over-year; highest quarter in history ●Q1 Test volume up nearly 20% year over year to record levels ●Q1 41.9 million covered lives added, resulting from 8 new or updated commercial contracts PARSIPPANY, NJ, May 12, 2023 (GLOBE NEWSWIRE) -- Interpace Biosciences, Inc. (“Interpace” or the “Company”) (OTCQX: IDXG) today announced financial results for the first quarter ended March 31, 2023 and provided a business and financial update. First quarter N |

IDXG Price Returns

| 1-mo | 4.55% |

| 3-mo | -23.33% |

| 6-mo | 9.52% |

| 1-year | -41.03% |

| 3-year | -86.67% |

| 5-year | -87.02% |

| YTD | 6.48% |

| 2023 | 3.85% |

| 2022 | -86.08% |

| 2021 | 137.90% |

| 2020 | -37.20% |

| 2019 | -37.50% |

Continue Researching IDXG

Want to see what other sources are saying about Interpace Biosciences Inc's financials and stock price? Try the links below:Interpace Biosciences Inc (IDXG) Stock Price | Nasdaq

Interpace Biosciences Inc (IDXG) Stock Quote, History and News - Yahoo Finance

Interpace Biosciences Inc (IDXG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...