IDEXX Laboratories Inc. (IDXX): Price and Financial Metrics

IDXX Price/Volume Stats

| Current price | $469.71 | 52-week high | $583.39 |

| Prev. close | $470.68 | 52-week low | $372.50 |

| Day low | $467.80 | Volume | 588,400 |

| Day high | $476.23 | Avg. volume | 477,107 |

| 50-day MA | $496.31 | Dividend yield | N/A |

| 200-day MA | $505.25 | Market Cap | 38.79B |

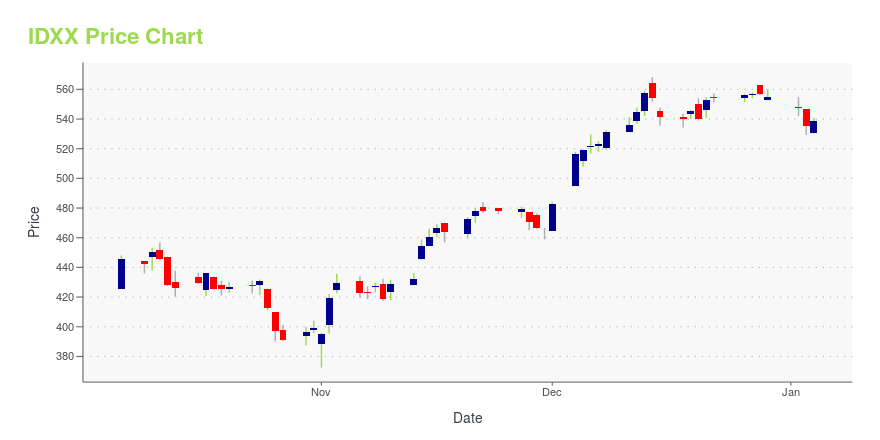

IDXX Stock Price Chart Interactive Chart >

IDEXX Laboratories Inc. (IDXX) Company Bio

IDEXX Laboratories, Inc. is an American multinational corporation engaged in the development, manufacture, and distribution of products and services for the companion animal veterinary, livestock and poultry, water testing, and dairy markets. Incorporated in 1983 and headquartered in Westbrook, Maine, and EMEA in Hoofddorp, Netherlands, IDEXX offers products to customers in over 175 countries around the world and employs approximately 9,200 people in full-and part-time positions (as of 7 February 2020). There are three main segments of the company: Companion Animal Group, Water, and Livestock, Poultry and Dairy (LPD). In addition, the company also manufactures and sells pet-side SNAP tests for a variety of animal health diagnostic uses. (Source:Wikipedia)

Latest IDXX News From Around the Web

Below are the latest news stories about IDEXX LABORATORIES INC that investors may wish to consider to help them evaluate IDXX as an investment opportunity.

Here's Why You Should Invest in IDEXX (IDXX) Stock Right NowInvestors continue to be optimistic about IDEXX (IDXX), backed by the strength of the CAG Diagnostics business. |

Should You Add IDEXX Laboratories (IDXX) to Your Portfolio?TimesSquare Capital Management, an equity investment management company, released its “U.S. Mid Cap Growth Strategy” third-quarter investor letter. A copy of the same can be downloaded here. In the third quarter, the strategy outperformed the Russell Midcap Growth Index and returned -4.11% (net) while the index return was -5.22%. The third quarter saw a decline in […] |

Insider Sell: Executive Vice President James Polewaczyk Sells Shares of IDEXX Laboratories IncIn a notable insider transaction, Executive Vice President James Polewaczyk has parted with 11,636 shares of IDEXX Laboratories Inc (NASDAQ:IDXX), a leader in veterinary diagnostics, software, and water microbiology testing. |

Insider Sell: President and CEO Jonathan Mazelsky Sells Shares of IDEXX Laboratories Inc (IDXX)In a notable insider transaction, President and CEO Jonathan Mazelsky has parted with 7,128 shares of IDEXX Laboratories Inc (NASDAQ:IDXX), a leader in veterinary diagnostics, veterinary practice software, and water microbiology testing. |

IDEXX Laboratories Schedules Two Institutional Investor EventsWESTBROOK, Maine, December 07, 2023--IDEXX Laboratories, Inc. (NASDAQ: IDXX), a global leader in pet healthcare innovation, will participate in two upcoming institutional investor events: |

IDXX Price Returns

| 1-mo | -3.87% |

| 3-mo | -5.93% |

| 6-mo | -10.53% |

| 1-year | -13.97% |

| 3-year | -31.62% |

| 5-year | 65.43% |

| YTD | -15.38% |

| 2023 | 36.06% |

| 2022 | -38.04% |

| 2021 | 31.73% |

| 2020 | 91.43% |

| 2019 | 40.38% |

Continue Researching IDXX

Here are a few links from around the web to help you further your research on Idexx Laboratories Inc's stock as an investment opportunity:Idexx Laboratories Inc (IDXX) Stock Price | Nasdaq

Idexx Laboratories Inc (IDXX) Stock Quote, History and News - Yahoo Finance

Idexx Laboratories Inc (IDXX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...