i3 Verticals, Inc. (IIIV): Price and Financial Metrics

IIIV Price/Volume Stats

| Current price | $24.99 | 52-week high | $25.48 |

| Prev. close | $24.28 | 52-week low | $17.54 |

| Day low | $24.43 | Volume | 158,384 |

| Day high | $25.01 | Avg. volume | 233,985 |

| 50-day MA | $20.96 | Dividend yield | N/A |

| 200-day MA | $20.89 | Market Cap | 836.47M |

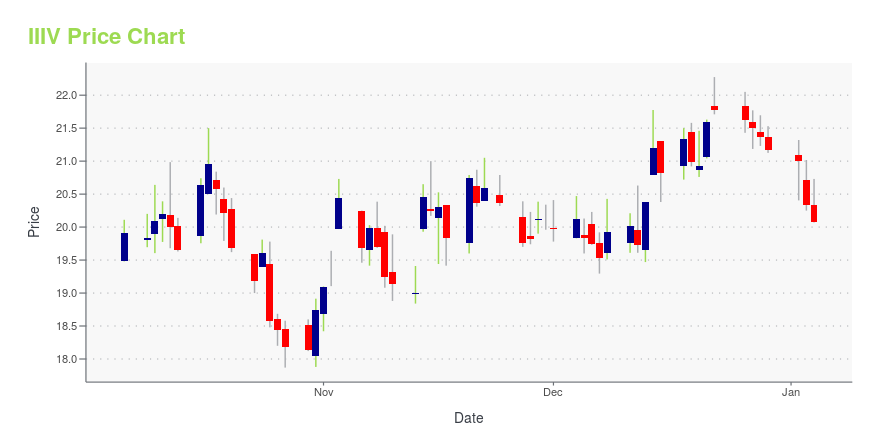

IIIV Stock Price Chart Interactive Chart >

i3 Verticals, Inc. (IIIV) Company Bio

i3 Verticals, Inc. provides electronic-based payment processing solutions for small- and medium-sized businesses and organizations in the United States. Its payment processing services enable clients to accept electronic payments, facilitate the exchange of funds, and transact data between clients, financial institutions, and payment networks. The company’s payment processing services include merchant onboarding, risk and underwriting, authorization, settlement, chargeback processing, and other merchant support services. It also provides software licensing subscriptions, ongoing support, and other POS-related solutions. The company distributes its payment technology and proprietary software solutions to its clients through direct sales force, as well as through a network of distribution partners, including independent software vendors, value-added resellers, independent sales organizations, and other referral partners, including financial institutions. Its primary vertical markets include education, non-profit, public sector, property management, and healthcare. The company was founded in 2012 and is based in Nashville, Tennessee.

Latest IIIV News From Around the Web

Below are the latest news stories about I3 VERTICALS INC that investors may wish to consider to help them evaluate IIIV as an investment opportunity.

i3 Verticals, Inc. (NASDAQ:IIIV) Is About To Turn The Corneri3 Verticals, Inc. ( NASDAQ:IIIV ) is possibly approaching a major achievement in its business, so we would like to... |

i3 Verticals, Inc. (NASDAQ:IIIV) Q4 2023 Earnings Call Transcripti3 Verticals, Inc. (NASDAQ:IIIV) Q4 2023 Earnings Call Transcript November 16, 2023 Operator: Good day, everyone, and welcome to the i3 Verticals Fourth Quarter 2023 Earnings Conference Call. Today’s call is being recorded and a replay will be available starting today through November 27th. The number for the replay is 877-344-7529 and the code is […] |

Q4 2023 I3 Verticals Inc Earnings CallQ4 2023 I3 Verticals Inc Earnings Call |

i3 Verticals (IIIV) Reports Q4 Earnings: What Key Metrics Have to SayAlthough the revenue and EPS for i3 Verticals (IIIV) give a sense of how its business performed in the quarter ended September 2023, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers. |

i3 Verticals Inc (IIIV) Reports Strong Revenue and Adjusted EBITDA Growth in Q4 and Full Fiscal ...Company Sees Significant Turnaround in Net Income and Provides Positive Outlook for 2024 |

IIIV Price Returns

| 1-mo | 26.53% |

| 3-mo | 8.18% |

| 6-mo | 27.63% |

| 1-year | 2.92% |

| 3-year | -19.88% |

| 5-year | -12.35% |

| YTD | 18.04% |

| 2023 | -13.02% |

| 2022 | 6.80% |

| 2021 | -31.36% |

| 2020 | 17.52% |

| 2019 | 17.22% |

Continue Researching IIIV

Here are a few links from around the web to help you further your research on i3 Verticals Inc's stock as an investment opportunity:i3 Verticals Inc (IIIV) Stock Price | Nasdaq

i3 Verticals Inc (IIIV) Stock Quote, History and News - Yahoo Finance

i3 Verticals Inc (IIIV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...