ImmunoGen, Inc. (IMGN): Price and Financial Metrics

IMGN Price/Volume Stats

| Current price | $31.23 | 52-week high | $31.25 |

| Prev. close | $31.23 | 52-week low | $3.61 |

| Day low | $31.22 | Volume | 48,606,800 |

| Day high | $31.25 | Avg. volume | 8,778,325 |

| 50-day MA | $29.35 | Dividend yield | N/A |

| 200-day MA | $19.00 | Market Cap | 8.32B |

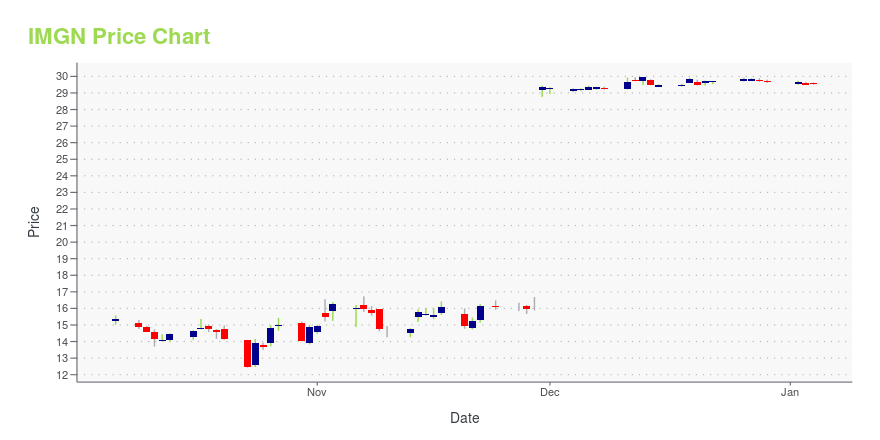

IMGN Stock Price Chart Interactive Chart >

ImmunoGen, Inc. (IMGN) Company Bio

Immunogen develops targeted anticancer therapeutics. The Company's ADC technology uses tumor-targeting antibodies to deliver an ImmunoGen cell-killing agent specifically to cancer cells. The company was founded in 1981 and is based in Waltham, Massachusetts.

Latest IMGN News From Around the Web

Below are the latest news stories about IMMUNOGEN INC that investors may wish to consider to help them evaluate IMGN as an investment opportunity.

3 Stocks at the Forefront of Medical InnovationBoring businesses and industries typically show new faces when technology comes around; today, these biotech stocks are leading the way. |

AbbVie's Recent ImmunoGen Acquisition Looks Brilliant: Here's WhyThe acquisition fills an immediate need with some extras to boot. |

Are Investors Undervaluing ImmunoGen, Inc. (NASDAQ:IMGN) By 38%?Key Insights The projected fair value for ImmunoGen is US$47.87 based on 2 Stage Free Cash Flow to Equity Current share... |

The 7 Most Undervalued Growth Stocks to Buy in DecemberStocks of a lot of well-known and historically great companies are on sale right now. |

AbbVie Just Followed Pfizer's Big Move. Here's What It Means For InvestorsIt's making a major acquisition to beef up a key area of its pipeline. |

IMGN Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 5.61% |

| 1-year | 69.18% |

| 3-year | 464.74% |

| 5-year | 1,228.94% |

| YTD | 5.33% |

| 2023 | 497.78% |

| 2022 | -33.15% |

| 2021 | 15.04% |

| 2020 | 26.35% |

| 2019 | 6.35% |

Continue Researching IMGN

Want to see what other sources are saying about ImmunoGen Inc's financials and stock price? Try the links below:ImmunoGen Inc (IMGN) Stock Price | Nasdaq

ImmunoGen Inc (IMGN) Stock Quote, History and News - Yahoo Finance

ImmunoGen Inc (IMGN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...