ChipMOS Technologies Inc. ADR (IMOS): Price and Financial Metrics

IMOS Price/Volume Stats

| Current price | $17.85 | 52-week high | $26.56 |

| Prev. close | $18.31 | 52-week low | $12.78 |

| Day low | $17.71 | Volume | 10,822 |

| Day high | $17.96 | Avg. volume | 26,005 |

| 50-day MA | $18.69 | Dividend yield | 3.37% |

| 200-day MA | $19.25 | Market Cap | 640.14M |

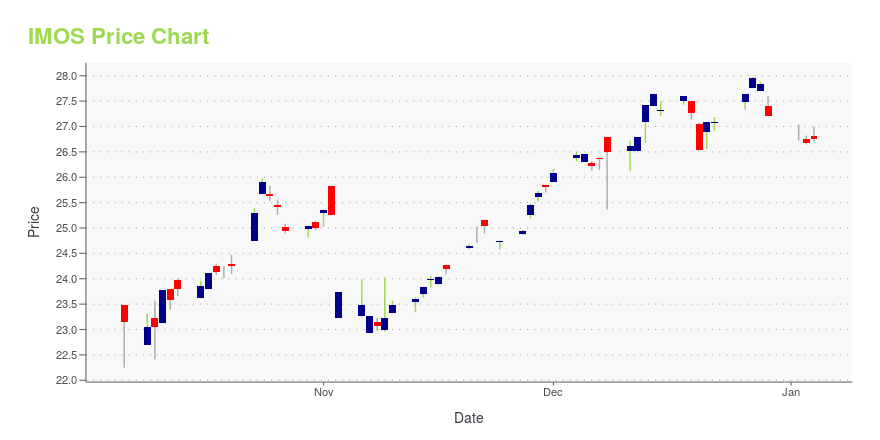

IMOS Stock Price Chart Interactive Chart >

ChipMOS Technologies Inc. ADR (IMOS) Company Bio

ChipMOS Technologies provides assembly and test services to a broad range of customers, including leading fabless semiconductor companies, integrated device manufacturers and independent semiconductor foundries. The company was founded in 1986 and is based in Hsinchu, Taiwan.

IMOS Price Returns

| 1-mo | -4.18% |

| 3-mo | 14.78% |

| 6-mo | 0.41% |

| 1-year | -31.25% |

| 3-year | -12.64% |

| 5-year | 2.55% |

| YTD | -2.04% |

| 2024 | -28.58% |

| 2023 | 32.84% |

| 2022 | -34.19% |

| 2021 | 48.59% |

| 2020 | 12.40% |

IMOS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IMOS

Want to do more research on Chipmos Technologies Inc's stock and its price? Try the links below:Chipmos Technologies Inc (IMOS) Stock Price | Nasdaq

Chipmos Technologies Inc (IMOS) Stock Quote, History and News - Yahoo Finance

Chipmos Technologies Inc (IMOS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...