Integrated Media Technology Limited (IMTE): Price and Financial Metrics

IMTE Price/Volume Stats

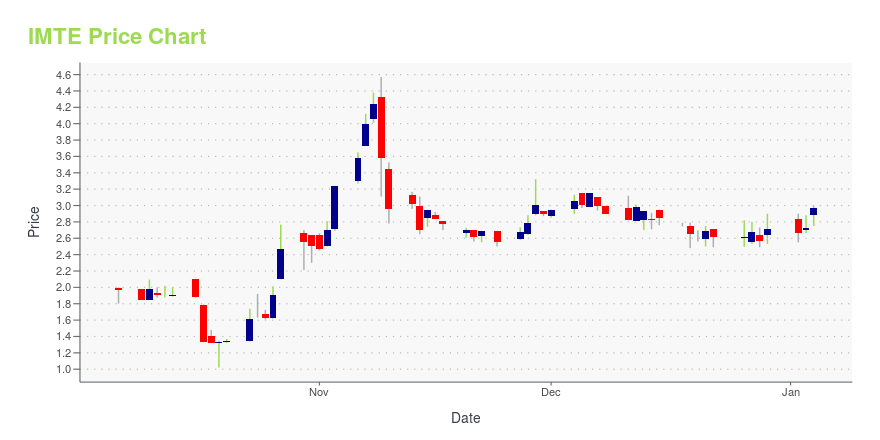

| Current price | $1.79 | 52-week high | $4.57 |

| Prev. close | $1.63 | 52-week low | $1.02 |

| Day low | $1.72 | Volume | 2,100 |

| Day high | $1.79 | Avg. volume | 17,307 |

| 50-day MA | $1.84 | Dividend yield | N/A |

| 200-day MA | $2.37 | Market Cap | 1.66M |

IMTE Stock Price Chart Interactive Chart >

Integrated Media Technology Limited (IMTE) Company Bio

Integrated Media Technology Limited develops, sells, and distributes 3D autostereoscopic display (ASD) technology products and services in Australia, Hong Kong, and China. It offers 3D conversion equipment and software; ASD video walls, ASD digital signage displays, ASD PC monitors, and ASD mobile phones and tablets; and 2D/3D content management and distribution systems. The company also provides 3D super workstations for content conversion of 2D videos to 3D mode for the TV and movie industry; and VisuMotion, a set of software designed for 2D to 3D conversion, as well as 3D content creation. In addition, it sells and distributes switchable glasses; and offers 3D consultancy, management, and trading services. The company was formerly known as China Integrated Media Corporation Limited and changed its name to Integrated Media Technology Limited in October 2016. The company was incorporated in 2008 and is headquartered in Wan Chai, Hong Kong. Integrated Media Technology Limited is a subsidiary of Marvel Finance Limited.

Latest IMTE News From Around the Web

Below are the latest news stories about INTEGRATED MEDIA TECHNOLOGY LTD that investors may wish to consider to help them evaluate IMTE as an investment opportunity.

Integrated Media Technology Limited Announcement - Share ConsolidationIntegrated Media Technology Limited (NASDAQ: IMTE) ("IMTE" or the "Company"), an Australia company that is engaged in the businesses of the manufacturing and sale of electronic glass for the USA markets, trading in Halal products, the manufacture and sale of nano coated plates for filters, and the trading of luxury products on its digital assets trading platform, today announced it is going to effectuated a 1-for-10 share consolidation (the "Share Consolidation") of its ordinary shares (the "Ord |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayWe're starting off Friday with a breakdown of the biggest pre-market stock movers traders will want to keep an eye on this morning! |

IMTE Announces 180-Day Extension to Regain Compliance with Nasdaq Minimum Bid Price RequirementAs previously disclosed on a Form 6-K filed on November 3, 2022, on November 2, 2022, Integrated Media Technology Limited (NASDAQ: IMTE) ("IMTE" or the "Company") received a notification letter (the "Notification Letter") from the Listings Qualifications Department of The Nasdaq Stock Market LLC ("Nasdaq") regarding a failure to meet Nasdaq's minimum bid price requirements. The Notification Letter informed the Company that the minimum closing bid price per share for its common stock was below $1 |

Integrated Media Technology Full Year 2022 Earnings: AU$0.77 loss per share (vs AU$0.70 loss in FY 2021)Integrated Media Technology ( NASDAQ:IMTE ) Full Year 2022 Results Key Financial Results Net loss: AU$12.6m (loss... |

IMTE Price Returns

| 1-mo | -7.25% |

| 3-mo | -25.10% |

| 6-mo | -32.71% |

| 1-year | -34.91% |

| 3-year | -95.41% |

| 5-year | -97.50% |

| YTD | -33.95% |

| 2023 | -60.59% |

| 2022 | -84.62% |

| 2021 | 14.62% |

| 2020 | -57.52% |

| 2019 | 42.11% |

Continue Researching IMTE

Here are a few links from around the web to help you further your research on Integrated Media Technology Ltd's stock as an investment opportunity:Integrated Media Technology Ltd (IMTE) Stock Price | Nasdaq

Integrated Media Technology Ltd (IMTE) Stock Quote, History and News - Yahoo Finance

Integrated Media Technology Ltd (IMTE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...