Immatics N.V. (IMTX): Price and Financial Metrics

IMTX Price/Volume Stats

| Current price | $4.61 | 52-week high | $13.77 |

| Prev. close | $4.51 | 52-week low | $3.30 |

| Day low | $4.40 | Volume | 156,859 |

| Day high | $4.63 | Avg. volume | 921,580 |

| 50-day MA | $4.49 | Dividend yield | N/A |

| 200-day MA | $8.15 | Market Cap | 560.35M |

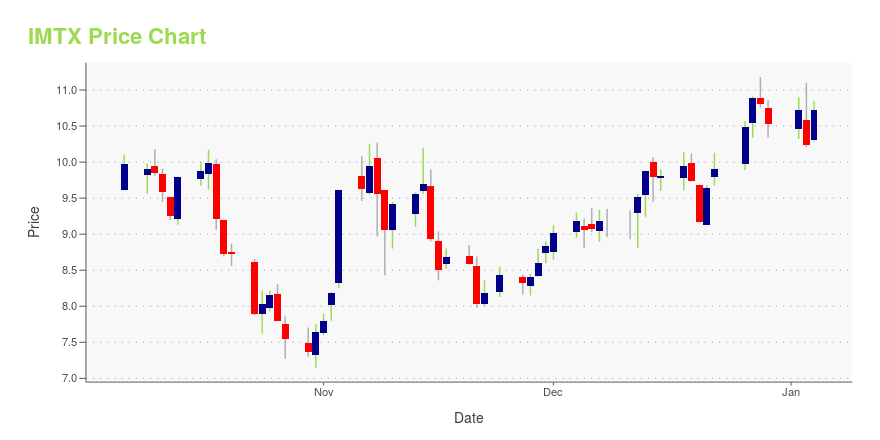

IMTX Stock Price Chart Interactive Chart >

Immatics N.V. (IMTX) Company Bio

Immatics N.V., a clinical-stage biopharmaceutical company, focuses on the discovery and development of T cell receptor (TCR) based immunotherapies for the treatment of cancer in the United States. The company is developing targeted immunotherapies with a focus on treating solid tumors through two distinct therapeutic modalities, such as adoptive cell therapies (ACT) and antibody-like TCR Bispecifics. Its ACTengine product candidates include IMA201 that targets melanoma-associated antigen 4 or 8 in patients with solid tumors; IMA202 that targets melanoma-associated antigen 1 in patients with various solid tumors, including squamous non-small cell lung carcinoma and hepatocellular carcinoma; IMA203 that targets preferentially expressed antigen in melanoma in adult patients with relapsed and/or refractory solid tumors; and IMA204, an anti-tumor therapy that targets the malignant tumor cell. Its TCR Bispecifics product candidates include IMA401, a cancer testis antigen for the treatment of solid tumor; and IMA402 for the treatment of solid and hematological malignancies. The company also develops IMA101, a multi-target precision immunotherapy; and IMA301, an off-the-shelf ACT. It has a strategic collaboration agreement with GlaxoSmithKline plc to develop novel adoptive cell therapies targeting multiple cancer indications; MD Anderson Cancer Center to develop multiple T cell and TCR-based adoptive cellular therapies; Celgene Switzerland LLC to develop novel adoptive cell therapies targeting multiple cancers; Genmab A/S to develop T cell engaging bispecific immunotherapies targeting multiple cancer indications; Amgen Inc.; and MorphoSys to develop novel antibody-based therapies against various cancer antigens that are recognized by T cells. Immatics N.V. is headquartered in Tübingen, Germany.

IMTX Price Returns

| 1-mo | -1.50% |

| 3-mo | -17.68% |

| 6-mo | -50.22% |

| 1-year | -54.58% |

| 3-year | -43.57% |

| 5-year | N/A |

| YTD | -35.16% |

| 2024 | -32.48% |

| 2023 | 20.90% |

| 2022 | -35.19% |

| 2021 | 24.56% |

| 2020 | N/A |

Loading social stream, please wait...