InnovAge Holding Corp. (INNV): Price and Financial Metrics

INNV Price/Volume Stats

| Current price | $6.35 | 52-week high | $7.73 |

| Prev. close | $6.15 | 52-week low | $3.52 |

| Day low | $6.14 | Volume | 66,000 |

| Day high | $6.38 | Avg. volume | 35,427 |

| 50-day MA | $4.99 | Dividend yield | N/A |

| 200-day MA | $5.13 | Market Cap | 863.52M |

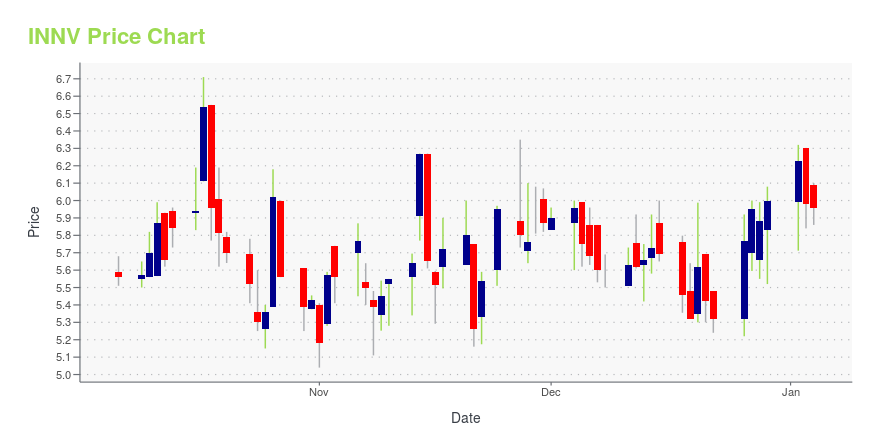

INNV Stock Price Chart Interactive Chart >

InnovAge Holding Corp. (INNV) Company Bio

InnovAge Holding Corp. engages in the provision of a healthcare delivery platform. It offers interdisciplinary care teams and community-based care delivery models. It operates through the PACE and All Other segments. The PACE segment consists of the West, Central, and East operations. The All Other segment consists of homecare and senior housing. The company was founded in 2007 and is headquartered in Denver, CO.

Latest INNV News From Around the Web

Below are the latest news stories about INNOVAGE HOLDING CORP that investors may wish to consider to help them evaluate INNV as an investment opportunity.

InnovAge Announces Acquisition of ConcertoCare’s PACE ProgramsLeading provider of PACE services expands West Coast footprintDENVER, Dec. 01, 2023 (GLOBE NEWSWIRE) -- InnovAge Holding Corp. (“InnovAge”) (Nasdaq: INNV), an industry leader in providing comprehensive healthcare programs to frail, predominantly dual-eligible seniors through the Program of All-inclusive Care for the Elderly (PACE), completed its acquisition of two PACE programs in California from ConcertoCare today. ConcertoCare, a tech-enabled, value-based provider of at-home, comprehensive car |

InnovAge Holding Corp. (NASDAQ:INNV) Q1 2024 Earnings Call TranscriptInnovAge Holding Corp. (NASDAQ:INNV) Q1 2024 Earnings Call Transcript November 11, 2023 Operator: Thank you for standing by. Welcome to InnovAge First Quarter 2024 Earnings Conference Call. [Operator Instructions] Please be advised that today’s conference is being recorded. I would now like to hand the conference over to your speaker today, Ryan Kubota, Director of […] |

Q1 2024 InnovAge Holding Corp Earnings CallQ1 2024 InnovAge Holding Corp Earnings Call |

InnovAge Holding Corp. (INNV) Reports Q1 Loss, Tops Revenue EstimatesInnovAge Holding Corp. (INNV) delivered earnings and revenue surprises of -100% and 3.21%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

InnovAge Announces Financial Results For The Fiscal First Quarter Ended September 30, 2023DENVER, Nov. 07, 2023 (GLOBE NEWSWIRE) -- InnovAge Holding Corp. (“InnovAge” or the “Company”) (Nasdaq: INNV), an industry leader in providing comprehensive healthcare programs to frail, predominantly dual-eligible seniors through the Program of All-inclusive Care for the Elderly (PACE), today announced financial results for its fiscal first quarter ended September 30, 2023. “The Company’s first quarter results were in line with our expectations and reflect continued improvement,” said Patrick B |

INNV Price Returns

| 1-mo | 32.57% |

| 3-mo | 62.40% |

| 6-mo | 8.36% |

| 1-year | -11.56% |

| 3-year | -61.77% |

| 5-year | N/A |

| YTD | 5.83% |

| 2023 | -16.43% |

| 2022 | 43.60% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...