Inpixon (INPX): Price and Financial Metrics

INPX Price/Volume Stats

| Current price | $5.27 | 52-week high | $6.75 |

| Prev. close | $0.06 | 52-week low | $0.04 |

| Day low | $5.20 | Volume | 423,640 |

| Day high | $6.75 | Avg. volume | 15,942,010 |

| 50-day MA | $0.05 | Dividend yield | N/A |

| 200-day MA | $0.12 | Market Cap | 379.67M |

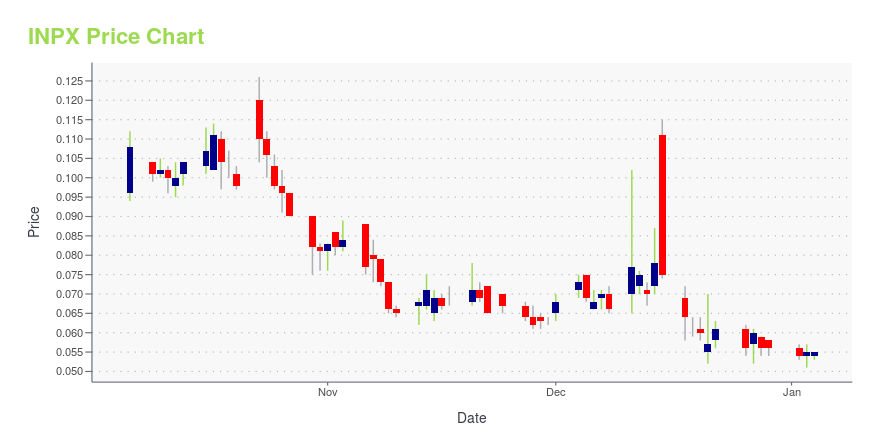

INPX Stock Price Chart Interactive Chart >

Inpixon (INPX) Company Bio

Inpixon, together with its subsidiaries, provides big data analytics and location based products and related services worldwide. It offers Inpixon Sensor 4000, a passive RF sensor to detect signals ranging from pings to a cell tower to active wireless transmissions; Inpixon IPA Pod offers entry-level barriers to radio detection based indoor positioning; Inpixon Smart School Safety Network solution, a combination of wristbands, ID badges, gateways, and proprietary backend software for school; UWB Sensor Module helps in detection with location; Inpixon GPS 900, a personnel, vehicle, and asset tracking solution; IPA Security, a mobile security and detection product that locates devices operating within a monitored area; Inpixon MDM Connector enables two-way communication between our IPA Security platform and a 3rd-party mobile device management system; Inpixon On-Premises Analytics security customers running systems; and Inpixon GPS Viewer, a browser-based portal used to monitor location and movements of GPS-enabled tracking devices. The company also offers data analytics solutions, such as IPA Wi-Fi, a cloud-based data analytics engine that provides visitor metrics and insights by ingesting diverse data from IoT, third-party, and proprietary sensors; IPA Video analytics to help security personnel combat crime and secure indoor locations; Inpixon Captive Portal, a splash page for their customers to accept terms and conditions before using Wi-Fi; and Shoom Products cloud based applications and analytics for the media and publishing industry. It serves shopping malls, corporate offices, healthcare facilities, government agencies, local publications, and others. The company was formerly known as Sysorex Global and changed its name to Inpixon in March 2017. Inpixon is headquartered in Palo Alto, California.

Latest INPX News From Around the Web

Below are the latest news stories about INPIXON that investors may wish to consider to help them evaluate INPX as an investment opportunity.

Inpixon Announces That Damon Motors Will Feature Its HyperFighter Superbike at CES 2024Inpixon® (Nasdaq: INPX) today announced that Damon Motors, maker of the award-winning HyperSport EV Motorcycle, will be featuring its HyperFighter Superbike at CES 2024 within the NXP® Semiconductors booth CP-19 at the Las Vegas Convention Center Central Plaza, January 9-12, 2024. CES, owned and produced by the Consumer Technology Association (CTA)®, is widely recognized as the one of the most influential tech events in the world. CES provides a platform to showcase groundbreaking technologies a |

Inpixon Announces Record Date and Details for Subsidiary Spin-off and its Planned Business Combination with Damon MotorsInpixon® (Nasdaq: INPX) today announced that its board of directors has set December 27th, 2023 as the record date ("Record Date") for determining the holders of Inpixon's outstanding capital stock and certain other securities (the "Record Date Securityholders") entitled to the distribution of all the outstanding shares of Grafiti Holding Inc. ("Grafiti") owned by Inpixon (the "Spin-off Shares") in connection with its previously announced spinoff ("Spin-off"). |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayPre-market stock movers are a hot topic on Wednesday and we're starting the day with a breakdown of the biggest ones worth watching! |

Inpixon Announces Shareholder Approval of Proposals Related to Merger Agreement with XTI Aircraft Company, Developer of a Vertical Lift Crossover Airplane (VLCA)Inpixon® (NASDAQ: INPX) today announced that it has received shareholder approval of the proposals related to the previously announced merger agreement with XTI Aircraft Company ("XTI"), an aviation company developing the TriFan 600, a fixed-wing, vertical takeoff and landing (VTOL) aircraft. The merger is expected to be completed at or around year end and remains subject to certain closing conditions including Nasdaq approval of an initial listing application of the combined company. The combin |

Hundreds of Stocks Have Fallen Below $1. They’re Still Listed on Nasdaq.Investor-protection advocates say many belong to risky small companies that should be on the OTC market. |

INPX Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -0.94% |

| 1-year | -78.16% |

| 3-year | -99.93% |

| 5-year | -100.00% |

| YTD | -6.23% |

| 2023 | -96.69% |

| 2022 | -96.22% |

| 2021 | -41.18% |

| 2020 | -79.20% |

| 2019 | -96.58% |

Continue Researching INPX

Want to see what other sources are saying about Inpixon's financials and stock price? Try the links below:Inpixon (INPX) Stock Price | Nasdaq

Inpixon (INPX) Stock Quote, History and News - Yahoo Finance

Inpixon (INPX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...