Intrusion Inc. (INTZ): Price and Financial Metrics

INTZ Price/Volume Stats

| Current price | $1.18 | 52-week high | $21.60 |

| Prev. close | $1.18 | 52-week low | $1.04 |

| Day low | $1.15 | Volume | 50,900 |

| Day high | $1.19 | Avg. volume | 131,153 |

| 50-day MA | $1.34 | Dividend yield | N/A |

| 200-day MA | $3.88 | Market Cap | 5.79M |

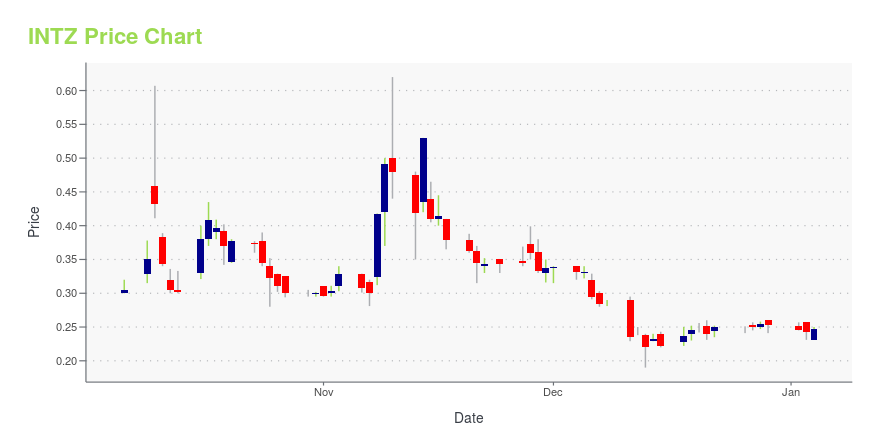

INTZ Stock Price Chart Interactive Chart >

Intrusion Inc. (INTZ) Company Bio

Intrusion Inc. develops, markets, and supports entity identification, high speed data mining, cybercrime and advanced persistent threat detection, regulated information compliance, and data privacy protection products in the United States. Its product portfolio comprises TraceCop, which includes a database of worldwide IP addresses that aid in the identification and location of individuals involved in cybercrime, and analysis software and a GUI interface to assist analysts in locating cybercriminals and other bad guys; and Savant, a high-speed network data mining product that organizes the data into networks of relationships and associations. The company also offers Compliance Commander for regulated information and data privacy protection. In addition, it resells third-party products, such as computers and servers for the implementation of its software into customer networks, as well as provides installation and threat data interpretation services. The company's customers primarily include the United States federal government and local government entities, banks, credit unions, other financial institutions, hospitals and other healthcare providers, and other customers. Intrusion Inc. markets and distributes its products through a direct sales force to end-users, distributors, system integrators, managed service providers, and value-added resellers. The company was formerly known as Intrusion.com, Inc. and changed its name to Intrusion Inc. in November 2001. Intrusion Inc. was founded in 1983 and is headquartered in Richardson, Texas.

Latest INTZ News From Around the Web

Below are the latest news stories about INTRUSION INC that investors may wish to consider to help them evaluate INTZ as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayIt's time to dive into the biggest pre-market stock movers as we check out all of the hottest news worth reading about on Wednesday! |

Intrusion Inc. (NASDAQ:INTZ) Q3 2023 Earnings Call TranscriptIntrusion Inc. (NASDAQ:INTZ) Q3 2023 Earnings Call Transcript November 14, 2023 Intrusion Inc. misses on earnings expectations. Reported EPS is $-0.13924 EPS, expectations were $-0.12. Operator: Welcome to Intrusion’s Inc Third Quarter 2023 Earnings Confrence Call and Webcast. [Operator Instructions]. Please note, this confrence is being recorded. An audio replay of the conference will be […] |

Q3 2023 Intrusion Inc Earnings CallQ3 2023 Intrusion Inc Earnings Call |

Intrusion, Inc. Reports Third Quarter 2023 ResultsIntrusion Shield gaining tractionPLANO, TX / ACCESSWIRE / November 14, 2023 / Intrusion Inc. (NASDAQ:INTZ), a leader in cyberattack prevention solutions, announced today financial results for the third quarter ended September 30, 2023.Recent Financial ... |

James Gero Bought 73% More Shares In IntrusionInvestors who take an interest in Intrusion Inc. ( NASDAQ:INTZ ) should definitely note that the Independent Director... |

INTZ Price Returns

| 1-mo | 1.29% |

| 3-mo | -40.40% |

| 6-mo | -76.16% |

| 1-year | -94.43% |

| 3-year | -98.85% |

| 5-year | -98.75% |

| YTD | -76.68% |

| 2023 | -91.99% |

| 2022 | -8.14% |

| 2021 | -80.48% |

| 2020 | 220.36% |

| 2019 | 44.36% |

Continue Researching INTZ

Want to do more research on Intrusion Inc's stock and its price? Try the links below:Intrusion Inc (INTZ) Stock Price | Nasdaq

Intrusion Inc (INTZ) Stock Quote, History and News - Yahoo Finance

Intrusion Inc (INTZ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...