iPower Inc. (IPW): Price and Financial Metrics

IPW Price/Volume Stats

| Current price | $1.66 | 52-week high | $3.65 |

| Prev. close | $1.62 | 52-week low | $0.40 |

| Day low | $1.62 | Volume | 108,788 |

| Day high | $1.75 | Avg. volume | 346,017 |

| 50-day MA | $2.01 | Dividend yield | N/A |

| 200-day MA | $0.92 | Market Cap | 52.13M |

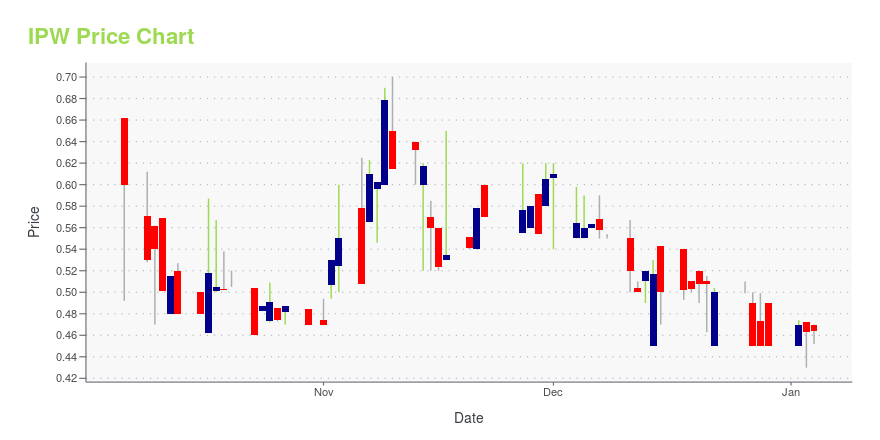

IPW Stock Price Chart Interactive Chart >

iPower Inc. (IPW) Company Bio

iPower Inc. supplies hydroponics equipment online in the United States. It offers various products, including advanced indoor and greenhouse grow-light systems, ventilation systems, activated carbon filters, nutrients, growing media, hydroponic water-resistant grow tents, trimming machines, pumps, and accessories for hydroponic gardening, as well as other indoor and outdoor growing products under the iPower and Simple Deluxe brands through its Zenhydro.com website and various third-party e-commerce channels. The company was formerly known as BZRTH Inc. and changed its name to iPower Inc. in September 2020. iPower Inc. was founded in 2018 and is based in Duarte, California.

Latest IPW News From Around the Web

Below are the latest news stories about IPOWER INC that investors may wish to consider to help them evaluate IPW as an investment opportunity.

Earnings Release: Here's Why Analysts Cut Their iPower Inc. (NASDAQ:IPW) Price Target To US$1.50A week ago, iPower Inc. ( NASDAQ:IPW ) came out with a strong set of quarterly numbers that could potentially lead to a... |

iPower Inc. (NASDAQ:IPW) Q1 2024 Earnings Call TranscriptiPower Inc. (NASDAQ:IPW) Q1 2024 Earnings Call Transcript November 14, 2023 iPower Inc. beats earnings expectations. Reported EPS is $-0.04, expectations were $-0.06. Operator: Good afternoon, everyone, and thank you for participating in today’s conference call to discuss iPower’s Financial Results for its Fiscal Year First Quarter 2024 ending September 30, 2023. Joining us today […] |

IPower Inc. (IPW) Reports Q1 Loss, Tops Revenue EstimatesiPower Inc. (IPW) delivered earnings and revenue surprises of 33.33% and 9.09%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

iPower Reports Fiscal First Quarter 2024 Results- Record Quarterly Revenue, Driven In-Part by Ramp of New SuperSuite Supply Chain Business - - iPower Management to Host Conference Call Today at 4:30 p.m. Eastern Time - DUARTE, Calif., Nov. 14, 2023 (GLOBE NEWSWIRE) -- iPower Inc. (Nasdaq: IPW) (“iPower” or the “Company”), a tech and data-driven online retailer and supplier of consumer home and garden products, as well as a provider of value-added ecommerce services, today announced financial results for its fiscal first quarter ended Septembe |

iPower Schedules Fiscal First Quarter 2024 Conference Call for November 14, 2023 at 4:30 p.m. ETDUARTE, Calif., Nov. 01, 2023 (GLOBE NEWSWIRE) -- iPower Inc. (Nasdaq: IPW) (“iPower” or the “Company”), a tech and data-driven online retailer and supplier of consumer home and garden products, as well as a provider of value-added ecommerce services, will host a conference call on Tuesday, November 14, 2023 at 4:30 p.m. Eastern time to discuss the financial results for its fiscal first quarter ended September 30, 2023. The Company’s results will be reported in a press release prior to the call. |

IPW Price Returns

| 1-mo | -2.92% |

| 3-mo | 262.84% |

| 6-mo | 216.43% |

| 1-year | 93.47% |

| 3-year | -65.63% |

| 5-year | N/A |

| YTD | 268.89% |

| 2023 | 12.50% |

| 2022 | -83.19% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...