Ideal Power Inc. (IPWR): Price and Financial Metrics

IPWR Price/Volume Stats

| Current price | $7.35 | 52-week high | $13.98 |

| Prev. close | $7.13 | 52-week low | $6.52 |

| Day low | $7.05 | Volume | 6,600 |

| Day high | $7.35 | Avg. volume | 29,006 |

| 50-day MA | $7.29 | Dividend yield | N/A |

| 200-day MA | $8.23 | Market Cap | 56.48M |

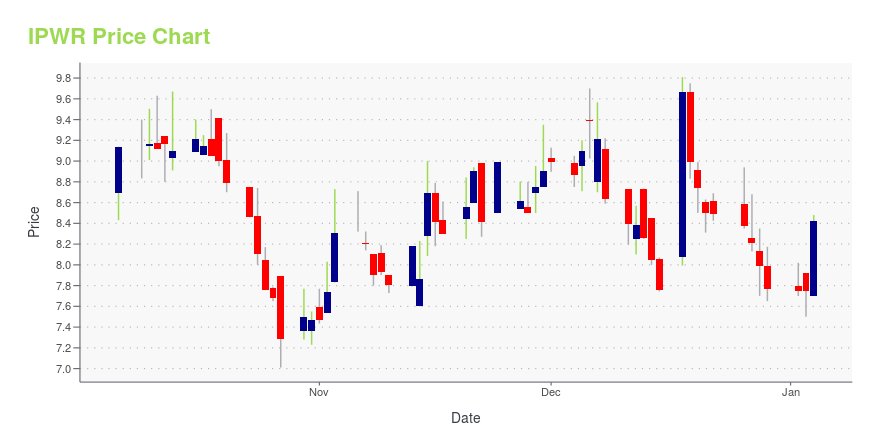

IPWR Stock Price Chart Interactive Chart >

Latest IPWR News From Around the Web

Below are the latest news stories about IDEAL POWER INC that investors may wish to consider to help them evaluate IPWR as an investment opportunity.

Stellantis Named Ideal Power Finalist in 2023 Stellantis Venture AwardsAUSTIN, TX / ACCESSWIRE / December 18, 2023 / Ideal Power Inc. ("Ideal Power," the "Company," "we," "us" or "our") (Nasdaq:IPWR), pioneering the development and commercialization of the highly efficient and broadly patented B-TRAN™ bidirectional semiconductor ... |

Ideal Power Inc. (NASDAQ:IPWR) Q3 2023 Earnings Call TranscriptIdeal Power Inc. (NASDAQ:IPWR) Q3 2023 Earnings Call Transcript November 14, 2023 Operator: Good morning, ladies and gentlemen. And welcome to the Ideal Power Third Quarter 2023 Results Call. At this time, all participants are in a listen-only mode. At the end of management’s remarks, there will be a question-and-answer session [Operator Instructions]. As a […] |

Ideal Power Reports Third Quarter 2023 Financial ResultsAUSTIN, TX / ACCESSWIRE / November 14, 2023 / Ideal Power Inc. ("Ideal Power," the "Company," "we," "us" or "our") (NASDAQ:IPWR), pioneering the development and commercialization of the highly efficient and broadly patented B-TRAN™ bidirectional semiconductor ... |

Ideal Power to Host Third Quarter 2023 Results Conference Call on November 14, 2023 at 10:00 AM Eastern TimeAUSTIN, TX / ACCESSWIRE / October 31, 2023 / Ideal Power Inc. ("Ideal Power," the "Company," "we," "us" or "our") (NASDAQ:IPWR), pioneering the development and commercialization of the highly efficient and broadly patented B-TRAN™ bidirectional semiconductor ... |

Presenting on the Emerging Growth Conference 64 Day 1 on November 1 Register NowMIAMI, Oct. 31, 2023 (GLOBE NEWSWIRE) -- EmergingGrowth.com a leading independent small cap media portal announces the schedule of the 64th Emerging Growth Conference on November 1st and 2nd, 2023. The Emerging Growth Conference identifies companies in a wide range of growth sectors, with strong management teams, innovative products & services, focused strategy, execution, and the overall potential for long-term growth. Register for the conference here. Submit Questions for any of the presenting |

IPWR Price Returns

| 1-mo | 7.46% |

| 3-mo | -3.67% |

| 6-mo | 4.85% |

| 1-year | -36.75% |

| 3-year | -50.00% |

| 5-year | 104.39% |

| YTD | -5.41% |

| 2023 | -27.38% |

| 2022 | -11.28% |

| 2021 | 47.61% |

| 2020 | 255.22% |

| 2019 | -8.00% |

Continue Researching IPWR

Want to see what other sources are saying about Ideal Power Inc's financials and stock price? Try the links below:Ideal Power Inc (IPWR) Stock Price | Nasdaq

Ideal Power Inc (IPWR) Stock Quote, History and News - Yahoo Finance

Ideal Power Inc (IPWR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...