Independence Realty Trust, Inc. (IRT): Price and Financial Metrics

IRT Price/Volume Stats

| Current price | $18.88 | 52-week high | $19.51 |

| Prev. close | $18.49 | 52-week low | $11.61 |

| Day low | $18.51 | Volume | 1,759,300 |

| Day high | $18.96 | Avg. volume | 2,386,190 |

| 50-day MA | $17.94 | Dividend yield | 3.37% |

| 200-day MA | $15.66 | Market Cap | 4.25B |

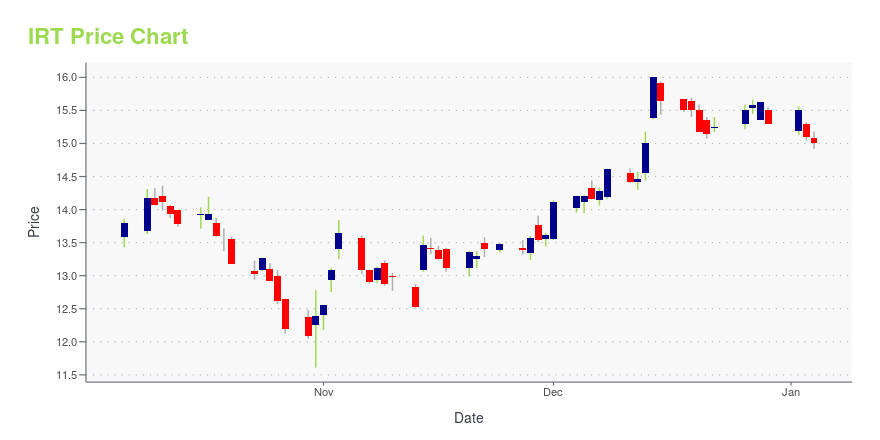

IRT Stock Price Chart Interactive Chart >

Independence Realty Trust, Inc. (IRT) Company Bio

Independence Realty Trust, Inc is an equity real estate investment trust launched by RAIT Financial Trust. It makes investments in apartment properties to create its portfolio. The company was founded in 2009 and is based in Philadelphia, Pennsylvania.

Latest IRT News From Around the Web

Below are the latest news stories about INDEPENDENCE REALTY TRUST INC that investors may wish to consider to help them evaluate IRT as an investment opportunity.

Independence Realty Trust Announces Fourth Quarter 2023 DividendPHILADELPHIA, December 11, 2023--Independence Realty Trust, Inc. (NYSE: IRT) ("IRT") announced that today IRT’s board of directors declared a quarterly dividend of $0.16 per share of IRT common stock, payable on January 19, 2024 to stockholders of record at the close of business on December 29, 2023. |

Investor Favorites: 7 Dividend Stocks with Strong Buy RatingsIf you’re looking for the most confidence-inspiring ideas ahead of market ambiguities, don't overlook strong-buy dividend stocks. |

Independence Realty Trust Scheduled to Participate in Nareit’s REITworld Annual ConferencePHILADELPHIA, November 13, 2023--Independence Realty Trust, Inc. (NYSE: IRT) ("IRT") today announced that Scott Schaeffer, IRT’s Chairman and Chief Executive Officer, and Jim Sebra, IRT’s Chief Financial Officer are scheduled to host meetings with investors and analysts at Nareit’s REITworld 2023 Annual Conference in Los Angeles on November 14 and 15. |

Independence Realty Trust, Inc. (NYSE:IRT) Q3 2023 Earnings Call TranscriptIndependence Realty Trust, Inc. (NYSE:IRT) Q3 2023 Earnings Call Transcript October 31, 2023 Operator: Good morning. My name is Audra, and I will be your conference operator today. At this time, I would like to welcome everyone to the Independence Realty Trust Q3 2023 Conference Call. Today’s conference is being recorded. All lines have been […] |

Q3 2023 Independence Realty Trust Inc Earnings CallQ3 2023 Independence Realty Trust Inc Earnings Call |

IRT Price Returns

| 1-mo | 4.07% |

| 3-mo | 20.08% |

| 6-mo | 27.16% |

| 1-year | 16.83% |

| 3-year | 13.48% |

| 5-year | 88.00% |

| YTD | 25.75% |

| 2023 | -5.58% |

| 2022 | -32.88% |

| 2021 | 96.41% |

| 2020 | 0.28% |

| 2019 | 62.55% |

IRT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IRT

Here are a few links from around the web to help you further your research on Independence Realty Trust Inc's stock as an investment opportunity:Independence Realty Trust Inc (IRT) Stock Price | Nasdaq

Independence Realty Trust Inc (IRT) Stock Quote, History and News - Yahoo Finance

Independence Realty Trust Inc (IRT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...