Issuer Direct Corporation (ISDR): Price and Financial Metrics

ISDR Price/Volume Stats

| Current price | $8.69 | 52-week high | $23.40 |

| Prev. close | $8.42 | 52-week low | $7.61 |

| Day low | $8.56 | Volume | 6,700 |

| Day high | $9.12 | Avg. volume | 11,569 |

| 50-day MA | $8.93 | Dividend yield | N/A |

| 200-day MA | $13.36 | Market Cap | 33.17M |

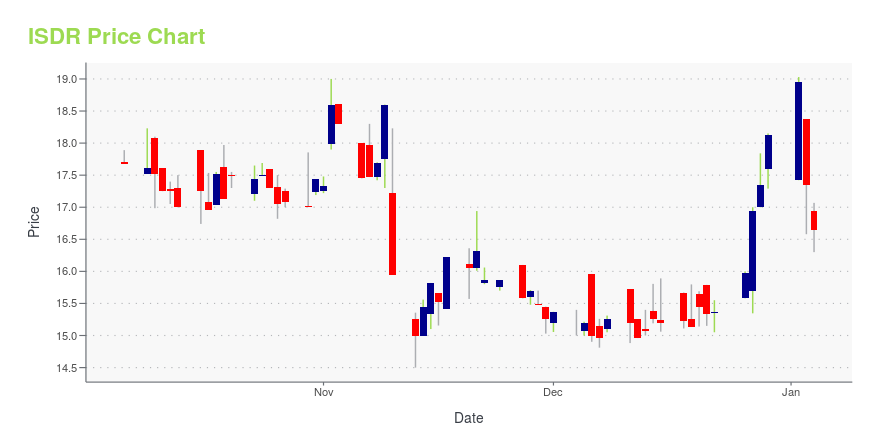

ISDR Stock Price Chart Interactive Chart >

Latest ISDR News From Around the Web

Below are the latest news stories about ISSUER DIRECT CORP that investors may wish to consider to help them evaluate ISDR as an investment opportunity.

Newswire Named Leader in Press Release Distribution in G2's Winter 2024 ReportRALEIGH, NC / ACCESSWIRE / December 20, 2023 /Newswire, an industry leader in press release distribution services, including content production, strategy, planning, and media technology, is proud to announce it earned 27 badges in G2's Winter 2024 ... |

ACCESSWIRE Scores Top Honors in G2’s Winter 2024 Report Including, Best UsabilityRALEIGH, NC / ACCESSWIRE / December 18, 2023 / ACCESSWIRE, a newswire service standout that provides regional, national, and global news to thousands of clients worldwide, is proud to announce it earned 17 badges in G2's Winter 2024 report.G2 , the ... |

CBOE Global Markets and Issuer Direct have been highlighted as Zacks Bull and Bear of the DayCBOE Global Markets and Issuer Direct have been highlighted as Zacks Bull and Bear of the Day. |

Bear of the Day: Issuer Direct (ISDR)The communications company is expected to post negative earnings growth in 2024. |

Build Better Journalist Relationships with These Three Tips from ACCESSWIRERALEIGH, NC / ACCESSWIRE / December 1, 2023 / It's reported that journalists receive anywhere between 20 to 30 cold pitches a day.With this constant rush of messages to their inbox, ACCESSWIRE a newswire service standout that provides regional, national ... |

ISDR Price Returns

| 1-mo | 10.42% |

| 3-mo | -27.28% |

| 6-mo | -42.64% |

| 1-year | -56.87% |

| 3-year | -67.68% |

| 5-year | -15.38% |

| YTD | -52.07% |

| 2023 | -27.60% |

| 2022 | -14.98% |

| 2021 | 68.20% |

| 2020 | 49.79% |

| 2019 | 3.00% |

Continue Researching ISDR

Want to do more research on Issuer Direct Corp's stock and its price? Try the links below:Issuer Direct Corp (ISDR) Stock Price | Nasdaq

Issuer Direct Corp (ISDR) Stock Quote, History and News - Yahoo Finance

Issuer Direct Corp (ISDR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...