Investar Holding Corporation (ISTR): Price and Financial Metrics

ISTR Price/Volume Stats

| Current price | $18.78 | 52-week high | $18.99 |

| Prev. close | $18.71 | 52-week low | $9.07 |

| Day low | $18.62 | Volume | 54,900 |

| Day high | $18.99 | Avg. volume | 43,613 |

| 50-day MA | $15.99 | Dividend yield | 2.22% |

| 200-day MA | $14.87 | Market Cap | 184.59M |

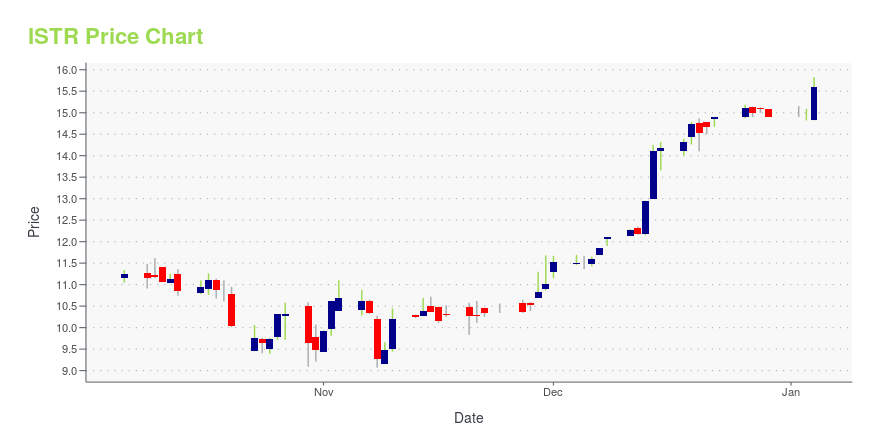

ISTR Stock Price Chart Interactive Chart >

Investar Holding Corporation (ISTR) Company Bio

Investar Holding Corporation provides various commercial banking products and services for individuals and small to medium-sized businesses in South Louisiana. The company was founded in 2006 and is based in Baton Rouge, Louisiana.

Latest ISTR News From Around the Web

Below are the latest news stories about INVESTAR HOLDING CORP that investors may wish to consider to help them evaluate ISTR as an investment opportunity.

Investar Holding (NASDAQ:ISTR) Is Paying Out A Dividend Of $0.10The board of Investar Holding Corporation ( NASDAQ:ISTR ) has announced that it will pay a dividend on the 31st of... |

Investar Holding Corporation Declares Quarterly Cash DividendBATON ROUGE, LA / ACCESSWIRE / December 20, 2023 / Investar Holding Corporation (the "Company") (NASDAQ:ISTR), the holding company of Investar Bank, National Association (the "Bank"), declared a quarterly cash dividend of $0.10 per share to holders ... |

Positive Signs As Multiple Insiders Buy Investar Holding StockWhen a single insider purchases stock, it is typically not a major deal. However, when multiple insiders purchase... |

With 40% stake, Investar Holding Corporation (NASDAQ:ISTR) seems to have captured institutional investors' interestKey Insights Given the large stake in the stock by institutions, Investar Holding's stock price might be vulnerable to... |

Is Investar Holding Corp. (ISTR) Stock Undervalued Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

ISTR Price Returns

| 1-mo | 23.95% |

| 3-mo | 16.04% |

| 6-mo | 7.88% |

| 1-year | 37.15% |

| 3-year | -6.31% |

| 5-year | -14.54% |

| YTD | 27.56% |

| 2023 | -28.59% |

| 2022 | 19.04% |

| 2021 | 12.98% |

| 2020 | -29.84% |

| 2019 | -2.29% |

ISTR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ISTR

Want to do more research on Investar Holding Corp's stock and its price? Try the links below:Investar Holding Corp (ISTR) Stock Price | Nasdaq

Investar Holding Corp (ISTR) Stock Quote, History and News - Yahoo Finance

Investar Holding Corp (ISTR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...