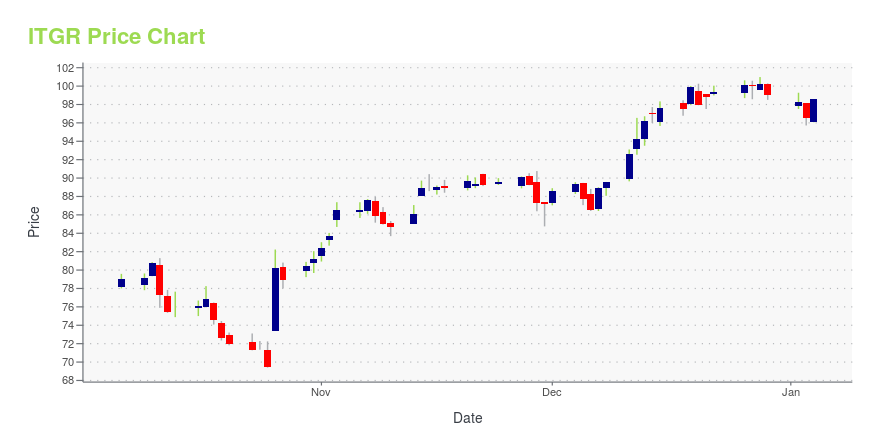

Integer Holdings Corporation (ITGR): Price and Financial Metrics

ITGR Price/Volume Stats

| Current price | $116.81 | 52-week high | $130.15 |

| Prev. close | $115.68 | 52-week low | $69.40 |

| Day low | $114.56 | Volume | 460,076 |

| Day high | $119.89 | Avg. volume | 330,641 |

| 50-day MA | $119.12 | Dividend yield | N/A |

| 200-day MA | $105.33 | Market Cap | 3.91B |

ITGR Stock Price Chart Interactive Chart >

Integer Holdings Corporation (ITGR) Company Bio

Integer Holdings Corporation is a medical device outsource manufacturer serving the cardiac, neuromodulation, orthopedics, vascular, advanced surgical and power solutions markets.

Latest ITGR News From Around the Web

Below are the latest news stories about INTEGER HOLDINGS CORP that investors may wish to consider to help them evaluate ITGR as an investment opportunity.

3 Reasons to Hold Zimmer Biomet (ZBH) Stock in Your PortfolioZimmer Biomet's (ZBH) focus on emerging markets raises optimism about the stock. |

Three Reasons to Add Ecolab (ECL) Stock to Your PortfolioEcolab's (ECL) focus on R&D raises optimism about the stock. |

5 MedTech Stocks Poised to Continue Their Winning Streaks in 2024Stocks like DexCom Inc. (DXCM), Integer Holdings (ITGR), Penumbra (PEN), Haemonetics (HAE), Health Equity (HAE) and are likely to continue their strong performance in 2024. |

McKesson (MCK) Announces Availability of PNH's FDA-Approved DrugThe availability of the FDA-approved drug via McKesson's (MCK) independent specialty pharmacy is expected to give patients more treatment options for PNH. |

Three Reasons to Add DaVita (DVA) Stock to Your PortfolioDaVita's (DVA) strength in its DaVita Kidney Care raises optimism about the stock. |

ITGR Price Returns

| 1-mo | 1.79% |

| 3-mo | 6.60% |

| 6-mo | 15.47% |

| 1-year | 25.28% |

| 3-year | 22.06% |

| 5-year | 36.17% |

| YTD | 17.89% |

| 2023 | 44.73% |

| 2022 | -20.01% |

| 2021 | 5.42% |

| 2020 | 0.94% |

| 2019 | 5.47% |

Continue Researching ITGR

Want to see what other sources are saying about Integer Holdings Corp's financials and stock price? Try the links below:Integer Holdings Corp (ITGR) Stock Price | Nasdaq

Integer Holdings Corp (ITGR) Stock Quote, History and News - Yahoo Finance

Integer Holdings Corp (ITGR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...