Inventiva S.A. ADR (IVA): Price and Financial Metrics

IVA Price/Volume Stats

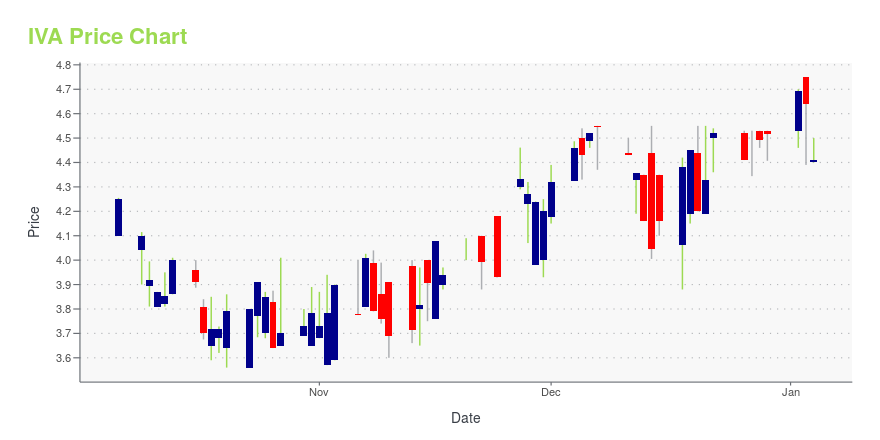

| Current price | $2.28 | 52-week high | $4.75 |

| Prev. close | $2.28 | 52-week low | $2.15 |

| Day low | $2.20 | Volume | 28,000 |

| Day high | $2.48 | Avg. volume | 25,465 |

| 50-day MA | $3.07 | Dividend yield | N/A |

| 200-day MA | $3.66 | Market Cap | 119.65M |

IVA Stock Price Chart Interactive Chart >

Inventiva S.A. ADR (IVA) Company Bio

Inventiva SA engages in the development of oral small molecule therapies for the treatment of non-alcoholic steatohepatitis and related diseases. It owns an in-house drug-discovery platform that develops internal oncology and fibrosis discovery pipeline with approaches centred on transcription factors, epigenetics targets, and nuclear receptors. The company was founded by Pierre Broqua and Frédéric Cren on October 27, 2011 and is headquartered in Daix, France.

Latest IVA News From Around the Web

Below are the latest news stories about INVENTIVA SA that investors may wish to consider to help them evaluate IVA as an investment opportunity.

Inventiva announces the randomization of the first patient in China in the NATiV3 clinical trial and provides an update on its clinical development programThe first patient was randomized in China in the NATiV3 Phase III clinical trial, triggering a milestone payment of $3 million from CTTQ to Inventiva. With this milestone payment Inventiva expects to have met the operational and financial conditions precedent to draw the second €25 million tranche of the EIB loan.1 China’s National Medical Products Administration has granted “Breakthrough Therapy Designation” to lanifibranor for the treatment of NASH. Lanifibranor is believed to be the first dru |

Inventiva announces the positive recommendation of the third DMC of the Phase III clinical trial with lanifibranor in patients with NASHThe DMC recommended to continue the clinical trial without modification of the protocol, based on the pre-planned review of safety dataThe safety assessment was based on the review of safety data from more than 500 patients, including patients that have been treated with lanifibranor for more than 72 weeksThe DMC review remains consistent, confirming the good safety profile of lanifibranor Daix (France), Long Island City (New York, United States), December 4, 2023 – Inventiva (Euronext Paris and |

Inventiva reports 2023 Third Quarter Financial Information¹Cash and cash equivalents at €43.8 million, short-term deposits at €0.03 million2, and long-term deposit at €5.0 million3 as of September 30, 2023, compared to €86.7 million, €1.0 million and €0.7 million as of December 31, 2022, respectivelyRevenues of €1.9 million for the first nine months of 2023, compared to €0.1 million for the same period in 2022Estimated cash runway expected to be extended to beginning of Q3 2024 subject to meeting the conditions precedent to the disbursement of the secon |

Inventiva announces a late breaker abstract and two additional abstracts on its lead compound, lanifibranor, at the AASLD The Liver Meeting® 2023The phase II study led by Dr. Kenneth Cusi evaluating lanifibranor in patients with T2D and MASLD was selected as late breaker.Two additional scientific abstracts from the NATIVE Phase IIb clinical trial evaluating lanifibranor for the treatment of patients with NASH have been selected for presentation. The two abstracts show: the correlation between the increase of adiponectin under lanifibranor and the improvement of histological and serum markers of NASH severity both in terms of activity and |

Roblox upgraded, Bristol Myers downgraded: Wall Street's top analyst callsRoblox upgraded, Bristol Myers downgraded: Wall Street's top analyst calls |

IVA Price Returns

| 1-mo | N/A |

| 3-mo | -29.85% |

| 6-mo | -40.16% |

| 1-year | -40.93% |

| 3-year | -83.50% |

| 5-year | N/A |

| YTD | -49.51% |

| 2023 | 1.26% |

| 2022 | -67.35% |

| 2021 | -5.79% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...