Orix Corp. ADR (IX): Price and Financial Metrics

IX Price/Volume Stats

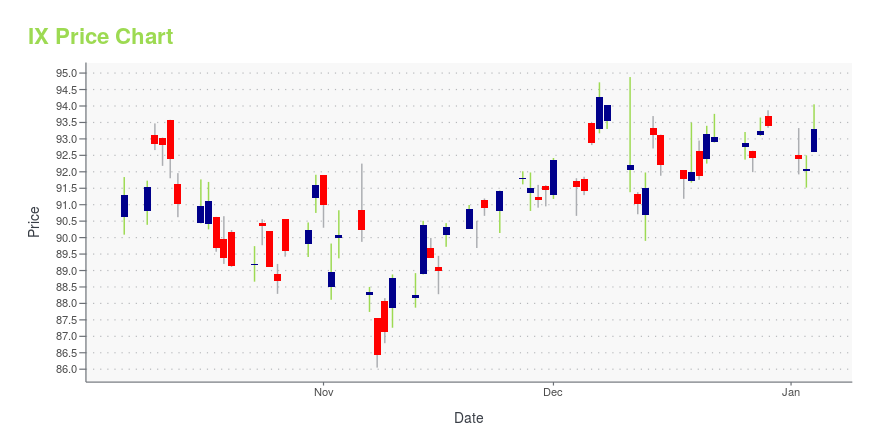

| Current price | $115.93 | 52-week high | $119.69 |

| Prev. close | $114.72 | 52-week low | $86.05 |

| Day low | $115.31 | Volume | 7,700 |

| Day high | $116.19 | Avg. volume | 15,622 |

| 50-day MA | $111.44 | Dividend yield | 2.4% |

| 200-day MA | $101.56 | Market Cap | 26.92B |

IX Stock Price Chart Interactive Chart >

Orix Corp. ADR (IX) Company Bio

ORIX Corporation (オリックス株式会社, Orikkusu Kabushiki-gaisha), styled as ORIX, is a Japanese diversified financial services group headquartered in Minato, Tokyo, and Osaka, Japan. (Source:Wikipedia)

Latest IX News From Around the Web

Below are the latest news stories about ORIX CORP that investors may wish to consider to help them evaluate IX as an investment opportunity.

ORIX Corporation (NYSE:IX) Q2 2024 Earnings Call TranscriptORIX Corporation (NYSE:IX) Q2 2024 Earnings Call Transcript November 2, 2023 Nakane: Now it’s time to start the ORIX Corporation’s Financial Results Briefing for the Six-Month Period Ended September 30, 2023. Thank you very much for joining us today. I’d like to act as a moderator. I am Nakane from IR Sustainability Promotion Division. Today, […] |

Energy sector shines as Australian market dips amid rate concernsThe Australian Securities Exchange (ASX) experienced a broad decline on Tuesday, with the energy sector being the only one to close higher. Local shares fell by almost half a percent as gains in energy were offset by losses across other sectors. The Reserve Bank of Australia's (RBA) September minutes, released on the same day, revealed that board members decided to hold rates steady at the September meeting due to significant increases in interest rates over a short period. |

ORIX Corporation (NYSE:IX) Q1 2024 Earnings Call TranscriptORIX Corporation (NYSE:IX) Q1 2024 Earnings Call Transcript August 6, 2023 Operator: So it is now time to get started. Thank you for joining us for the First Quarter Consolidated Financial Results for the three-month period ended June 30, 2023. This is the ORIX Corporation meeting. And today, we have the attendee Hitomaro Yano, Executive […] |

ORIX Submits Form 20-F for Filing for the Fiscal Year Ended March 31, 2023TOKYO, June 27, 2023--ORIX Corporation (TOKYO: 8591; NYSE: IX; ISIN:JP3200450009) has submitted its annual Form 20-F for the fiscal year ended March 31, 2023 to the U.S. Securities and Exchange Commission on June 26, 2023. Please find online versions of the file available for download, as well as a link to the SEC EDGAR format, on ORIX’s website at: https://www.orix.co.jp/grp/en/ir/library/20f/index.html |

Boeing, Avolon Announce Order for 40 737 MAX JetsBoeing [NYSE: BA] and Avolon, the international aircraft leasing company, today announced an order for 40 737 MAX airplanes at the Paris Air Show. |

IX Price Returns

| 1-mo | 5.59% |

| 3-mo | 13.04% |

| 6-mo | 21.33% |

| 1-year | 23.15% |

| 3-year | 43.79% |

| 5-year | 82.35% |

| YTD | 25.77% |

| 2023 | 19.24% |

| 2022 | -18.22% |

| 2021 | 36.12% |

| 2020 | -4.92% |

| 2019 | 21.26% |

IX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IX

Want to do more research on Orix Corp's stock and its price? Try the links below:Orix Corp (IX) Stock Price | Nasdaq

Orix Corp (IX) Stock Quote, History and News - Yahoo Finance

Orix Corp (IX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...