Jaguar Health, Inc. (JAGX): Price and Financial Metrics

JAGX Price/Volume Stats

| Current price | $2.39 | 52-week high | $110.75 |

| Prev. close | $2.70 | 52-week low | $2.28 |

| Day low | $2.28 | Volume | 331,500 |

| Day high | $2.75 | Avg. volume | 87,781 |

| 50-day MA | $4.82 | Dividend yield | N/A |

| 200-day MA | $16.54 | Market Cap | 2.43M |

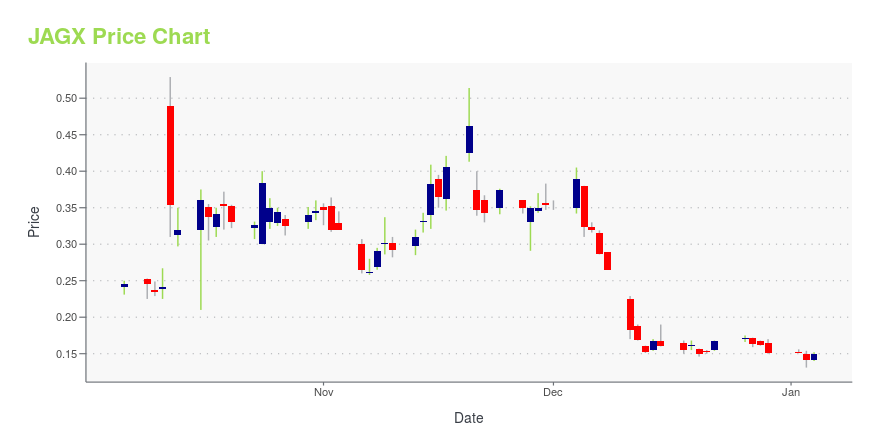

JAGX Stock Price Chart Interactive Chart >

Jaguar Health, Inc. (JAGX) Company Bio

Jaguar Health, Inc., a commercial-stage pharmaceuticals company, focuses on developing gastrointestinal products for human prescription use and animals worldwide. It operates through two reportable segments, Human Health and Animal Health. The company, through its wholly-owned subsidiary, Napo Pharmaceuticals, Inc., focuses on developing and commercializing proprietary human gastrointestinal pharmaceuticals. Its human health product pipelines include crofelemer, which is in Phase III clinical trial for the treatment of cancer therapy-related diarrhea, as well as for the supportive care for inflammatory bowel disease; formulation of crofelemer that is Phase II clinical trial for the treatment of short bowel syndrome, congenital diarrheal disorders, idiopathic/functional diarrhea, and irritable bowel; and SB-300, a second-generation anti-secretory agent for various indications, including cholera. The company's animal health product candidates comprise Canalevia, an animal prescription drug product candidate intended for treatment of chemotherapy-induced diarrhea in dogs; and Equilevia, a non-prescription product for total gut health in equine athletes. In addition, its products include Neonorm Calf and Neonorm Foal. Jaguar Health, Inc. was founded in 2013 and is headquartered in San Francisco, California.

JAGX Price Returns

| 1-mo | -31.52% |

| 3-mo | -57.41% |

| 6-mo | -88.88% |

| 1-year | -97.64% |

| 3-year | -99.99% |

| 5-year | -100.00% |

| YTD | -90.53% |

| 2024 | -88.88% |

| 2023 | -97.68% |

| 2022 | -91.64% |

| 2021 | -57.46% |

| 2020 | 1.75% |

Continue Researching JAGX

Here are a few links from around the web to help you further your research on Jaguar Health Inc's stock as an investment opportunity:Jaguar Health Inc (JAGX) Stock Price | Nasdaq

Jaguar Health Inc (JAGX) Stock Quote, History and News - Yahoo Finance

Jaguar Health Inc (JAGX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...