Jamf Holding Corp. (JAMF): Price and Financial Metrics

JAMF Price/Volume Stats

| Current price | $18.91 | 52-week high | $21.98 |

| Prev. close | $18.64 | 52-week low | $14.68 |

| Day low | $18.53 | Volume | 403,900 |

| Day high | $18.99 | Avg. volume | 539,245 |

| 50-day MA | $16.73 | Dividend yield | N/A |

| 200-day MA | $17.73 | Market Cap | 2.43B |

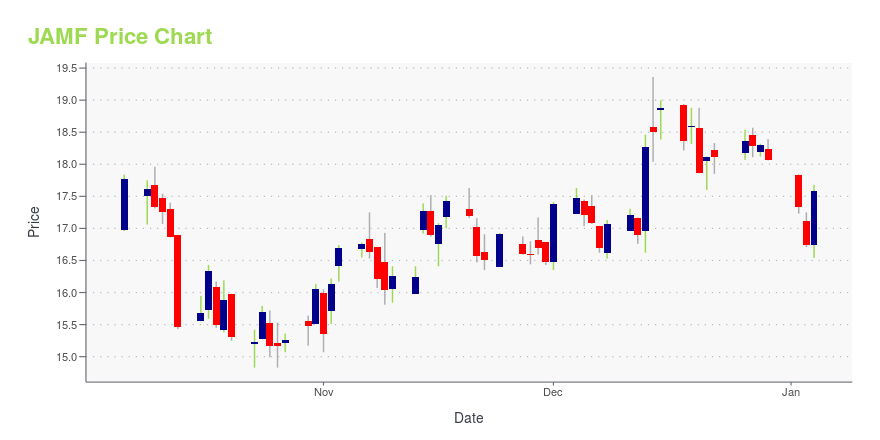

JAMF Stock Price Chart Interactive Chart >

Jamf Holding Corp. (JAMF) Company Bio

Jamf Holding Corp. engages in the provision of Apple-focused device management solution. It help organizations including businesses, hospitals, schools and government agencies to connect, manage, and protect Apple products, applications, and corporate resources in the cloud even without touching the device. The company was founded in 2002 and is headquartered in Minneapolis, MN.

Latest JAMF News From Around the Web

Below are the latest news stories about JAMF HOLDING CORP that investors may wish to consider to help them evaluate JAMF as an investment opportunity.

3 Beaten-Down IT Services Stocks to Buy for a Turnaround in 20242023 turned out to be a good year for technology services participants due to artificial intelligence. In 2024, digitization, driven by emerging trends, is likely to take center stage. |

Insider Sell: Chief Strategist Jason Wudi Sells 15,000 Shares of Jamf Holding Corp (JAMF)In a notable insider transaction, Chief Strategist Jason Wudi sold 15,000 shares of Jamf Holding Corp (NASDAQ:JAMF) on December 14, 2023. |

SMGZY or JAMF: Which Is the Better Value Stock Right Now?SMGZY vs. JAMF: Which Stock Is the Better Value Option? |

Wall Street Analysts See a 40.72% Upside in Jamf Holding (JAMF): Can the Stock Really Move This High?The average of price targets set by Wall Street analysts indicates a potential upside of 40.7% in Jamf Holding (JAMF). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock. |

Jamf Announces Upcoming Conference ParticipationMINNEAPOLIS, Dec. 04, 2023 (GLOBE NEWSWIRE) -- Jamf (NASDAQ: JAMF), the standard in managing and securing Apple at work, announced today that members of its management team will present at the following investor conference: 2023 Barclays Global Technology Conference on Wednesday, December 6, 2023 at 8:40am Pacific Time Webcast of this event will be available on the investor relations section of the Company's website at https://ir.jamf.com/. About JamfJamf’s purpose is to simplify work by helping |

JAMF Price Returns

| 1-mo | 25.73% |

| 3-mo | -3.27% |

| 6-mo | -3.47% |

| 1-year | -11.01% |

| 3-year | -39.60% |

| 5-year | N/A |

| YTD | 4.71% |

| 2023 | -15.21% |

| 2022 | -43.96% |

| 2021 | 27.04% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...