JE Cleantech Holdings Limited, (JCSE): Price and Financial Metrics

JCSE Price/Volume Stats

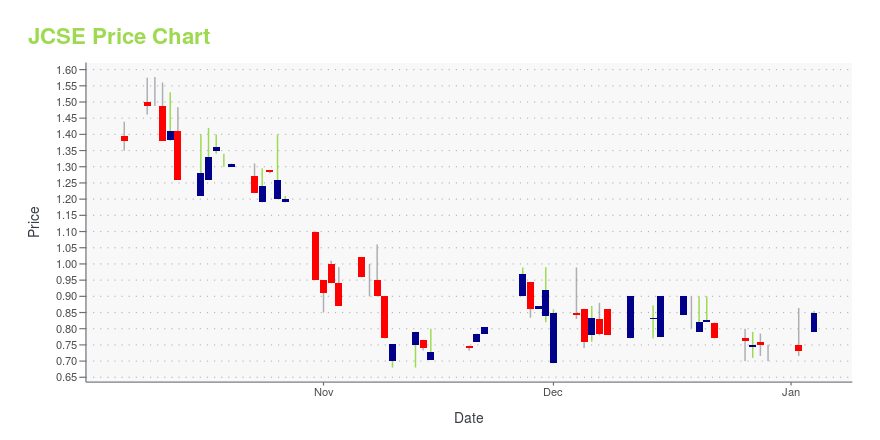

| Current price | $1.26 | 52-week high | $1.80 |

| Prev. close | $1.18 | 52-week low | $0.60 |

| Day low | $1.09 | Volume | 44,469 |

| Day high | $1.26 | Avg. volume | 382,870 |

| 50-day MA | $0.92 | Dividend yield | N/A |

| 200-day MA | $0.88 | Market Cap | 6.31M |

JCSE Stock Price Chart Interactive Chart >

JE Cleantech Holdings Limited, (JCSE) Company Bio

JE Cleantech Holdings Limited, an investment holding company, designs, develops, manufactures, and sells cleaning systems for various industrial end-use applications in Singapore, Malaysia, and internationally. The company operates through two segments, Sale of Cleaning Systems and Other Equipment Business, and Provision of Centralized Dishware Washing and Ancillary Services. It provides various cleaning systems and other equipment, including aqueous washing systems, plating and cleaning systems, train cleaning systems, and filtration units. The company also offers centralized dishwashing services for food and beverage establishments, such as food courts, hawker centers, restaurants, cookhouses, eldercare homes, and inflight catering service providers; and general cleaning services for food courts. In addition, it leases dishware washing equipment. The company was founded in 1999 and is headquartered in Singapore. JE Cleantech Holdings Limited operates as a subsidiary of JE Cleantech Global Limited.

Latest JCSE News From Around the Web

Below are the latest news stories about JE CLEANTECH HOLDINGS LTD that investors may wish to consider to help them evaluate JCSE as an investment opportunity.

JE Cleantech Holdings Limited Announces Receipt of NASDAQ Notification Regarding Minimum Bid Price DeficiencySINGAPORE, Dec. 19, 2023 (GLOBE NEWSWIRE) -- JE Cleantech Holdings Limited (Nasdaq: JCSE), a manufacturer of a broad range of cleaning systems, announced that on December 14, 2023, it received a written notification from the Listing Qualifications Department of The Nasdaq Stock Market LLC (the “Nasdaq Notification”). The Notification stated that the Company’s ordinary shares failed to maintain a minimum bid price of $1.00 over the last 30 consecutive business days as required by Nasdaq Listing R |

JE Cleantech (JCSE) Announces Annual General Meeting ResultsSINGAPORE, Dec. 06, 2023 (GLOBE NEWSWIRE) -- JE Cleantech Holdings Limited (Nasdaq: JCSE), (“the Company”) a Singapore-based cleantech company, today announced the results of the Company’s Annual General Meeting of Members (the “AGM”) held on December 5, 2023, at the Company’s offices located at 3 Woodlands Sector 1, Singapore 738361. Appointment of Board of Directors At the AGM, the members of the Company approved and ratified the appointment of Hong Bee Yin, Long Jia Kwang, Singh Karmjit, Tay |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayPre-market stock movers are a hot topic on Wednesday and we're starting the morning with a breakdown of the biggest ones. |

JE Cleantech Holdings Limited Regains Compliance with Nasdaq Minimum Bid Price RequirementSINGAPORE - (NewMediaWire) - November 1, 2023 - (ACN Newswire) - JE Cleantech Holdings Limited (NASDAQ: JCSE) ("JE Cleantech" or the "Company"), a Singapore-headquartered cleantech company, announced today that it has received formal notice from The ... |

JE Cleantech Holdings Limited Announces Share Consolidation/Reverse Stock Split to Regain NASDAQ ComplianceSINGAPORE, Oct. 13, 2023 (GLOBE NEWSWIRE) -- JE Cleantech Holdings Limited (NASDAQ: JCSE) announced today that it will effect a share consolidation (“Reverse Stock Split”) of its Ordinary Shares at a ratio of 1-for-3, effective as of 11:59 pm on October 13, 2023 (the “Effective Time”), in order to regain compliance with the minimum $1.00 bid price per share requirement of Nasdaq’s Marketplace Rule 5450(a)(1). The Company’s Ordinary Shares are expected to begin trading on a Reverse Stock Split ad |

JCSE Price Returns

| 1-mo | 43.98% |

| 3-mo | 75.00% |

| 6-mo | 77.46% |

| 1-year | -20.60% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 68.00% |

| 2023 | -66.02% |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...