JD.com, Inc. (JD): Price and Financial Metrics

JD Price/Volume Stats

| Current price | $26.56 | 52-week high | $41.95 |

| Prev. close | $26.33 | 52-week low | $20.82 |

| Day low | $26.08 | Volume | 3,608,500 |

| Day high | $26.67 | Avg. volume | 13,277,971 |

| 50-day MA | $28.78 | Dividend yield | 2.83% |

| 200-day MA | $26.91 | Market Cap | 41.89B |

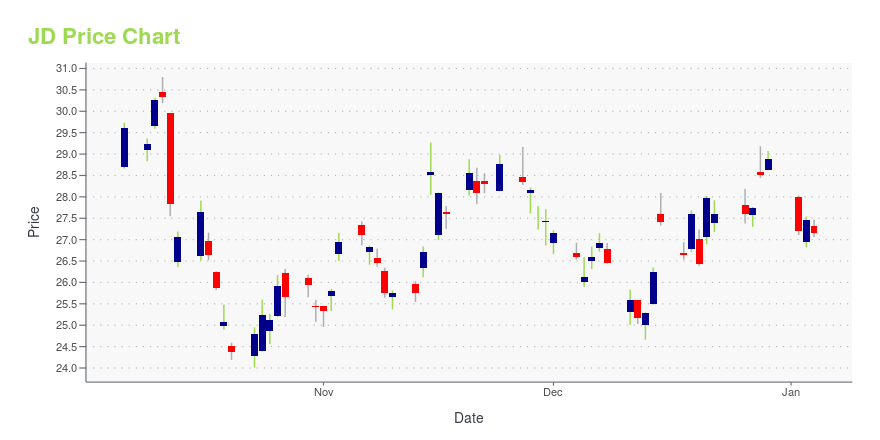

JD Stock Price Chart Interactive Chart >

JD.com, Inc. (JD) Company Bio

JD.com operates as an online direct sales company in China. It primarily offers electronics and home appliances products; and general merchandise products, including audio and video products, and books. The company sells its products directly to customers through its Website JD.com and mobile applications. The company was founded in 2007 and is based in Beijing, China.

Latest JD News From Around the Web

Below are the latest news stories about JDCOM INC that investors may wish to consider to help them evaluate JD as an investment opportunity.

JD Stock Alert: What to Know as JD.com Plans Big Salary BumpsNew salary raises at JD.com will test whether money buys hard work and imagination in China or office politics and jealousy. |

Why JD.com Stock Jumped TodayThe Chinese e-commerce leader is planning huge pay increases for front-line staff next year. |

JD.com stock rises on 2024 pay hike plans: RPTJD.com (JD) stock is rising Thursday morning following plans to hike employee salaries in 2024, according to Bloomberg. Yahoo Finance Live highlights China's economic conditions and how it is weighing on various Chinese e-commerce companies. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live. |

JD.com Preps Big Pay Hikes Even As Chinese Consumption Gyrates(Bloomberg) -- JD.com Inc. plans sweeping salary increases for its workforce next year, a major move for an e-commerce company struggling with intense competition and uncertain Chinese consumption in 2024.Most Read from BloombergThe Late-Night Email to Tim Cook That Set the Apple Watch Saga in MotionChinese Carmaker Overtakes Tesla as World’s Most Popular EV MakerBridgewater CEO’s Past Office Romance Led to Favoritism ClaimsL’Oreal Heir Francoise Bettencourt Meyers Becomes First Woman With $100 |

The Next Bull Run: 3 Stocks Poised for Unprecedented Growth in 2024Are you looking for the next bull run in the stock market? |

JD Price Returns

| 1-mo | -3.45% |

| 3-mo | -12.46% |

| 6-mo | 14.42% |

| 1-year | -28.12% |

| 3-year | -57.24% |

| 5-year | -12.21% |

| YTD | -5.50% |

| 2023 | -47.78% |

| 2022 | -19.89% |

| 2021 | -20.28% |

| 2020 | 149.50% |

| 2019 | 68.32% |

JD Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching JD

Want to do more research on JDcom Inc's stock and its price? Try the links below:JDcom Inc (JD) Stock Price | Nasdaq

JDcom Inc (JD) Stock Quote, History and News - Yahoo Finance

JDcom Inc (JD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...