9F INC. (JFU): Price and Financial Metrics

JFU Price/Volume Stats

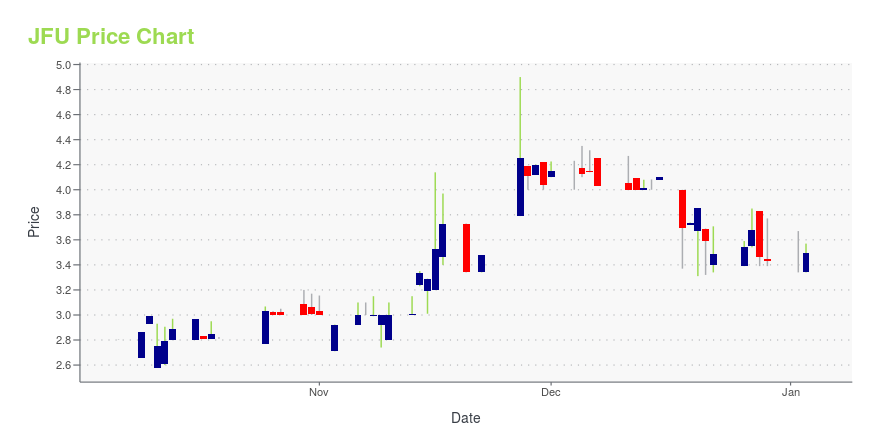

| Current price | $1.88 | 52-week high | $4.90 |

| Prev. close | $1.81 | 52-week low | $1.79 |

| Day low | $1.85 | Volume | 2,504 |

| Day high | $1.88 | Avg. volume | 6,614 |

| 50-day MA | $2.31 | Dividend yield | N/A |

| 200-day MA | $2.97 | Market Cap | 22.13M |

JFU Stock Price Chart Interactive Chart >

9F INC. (JFU) Company Bio

9F, Inc. operates as a digital financial account platform integrating and personalizing financial services. It provides a financial products and services across loan products, online wealth management products, and payment facilitation, all integrated under a single digital financial account. The firm delivers products and services through an open ecosystem(One Card) bringing together borrowers (consumers), investors, financial institution partners and merchant partners. The company was founded by Lei Liu and Luxing Chen in August 2016 and is headquartered in Beijing, China.

Latest JFU News From Around the Web

Below are the latest news stories about 9F INC that investors may wish to consider to help them evaluate JFU as an investment opportunity.

Even after rising 25% this past week, 9F (NASDAQ:JFU) shareholders are still down 89% over the past three years9F Inc. ( NASDAQ:JFU ) shareholders will doubtless be very grateful to see the share price up 52% in the last month... |

9F Inc. Announces Plan to Implement ADS Ratio Change9F Inc. (NASDAQ: JFU) ("9F" or the "Company") today announced that it will change the ratio of its American depositary shares ("ADSs") to its Class A ordinary shares (the "ADS Ratio"), par value US$0.00001 per share, from the current ratio of one (1) ADS to one (1) Class A ordinary share to a new ratio of one (1) ADS to twenty (20) Class A ordinary shares. |

JFU Price Returns

| 1-mo | 3.87% |

| 3-mo | -39.74% |

| 6-mo | -21.67% |

| 1-year | -51.80% |

| 3-year | -94.81% |

| 5-year | N/A |

| YTD | -45.19% |

| 2023 | -2.00% |

| 2022 | -84.09% |

| 2021 | 5.77% |

| 2020 | -89.17% |

| 2019 | N/A |

Loading social stream, please wait...