Janus Henderson Group PLC (JHG): Price and Financial Metrics

JHG Price/Volume Stats

| Current price | $36.55 | 52-week high | $36.67 |

| Prev. close | $36.26 | 52-week low | $22.17 |

| Day low | $36.15 | Volume | 1,042,871 |

| Day high | $36.67 | Avg. volume | 1,048,071 |

| 50-day MA | $34.19 | Dividend yield | 4.32% |

| 200-day MA | $30.40 | Market Cap | 5.86B |

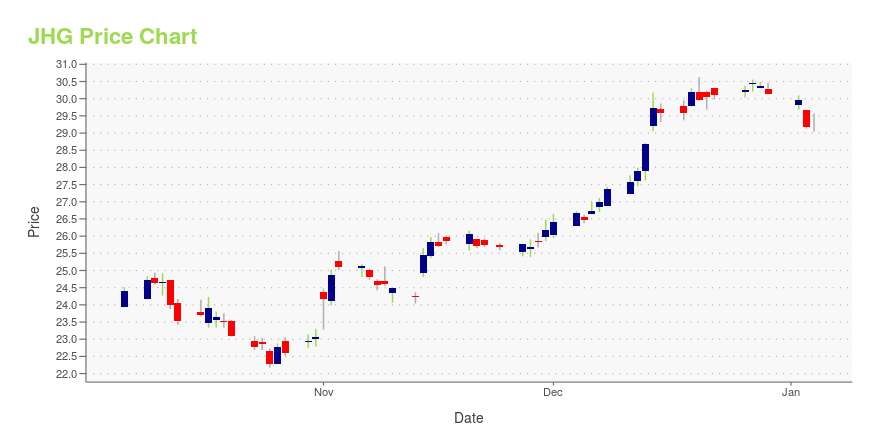

JHG Stock Price Chart Interactive Chart >

Janus Henderson Group PLC (JHG) Company Bio

Janus Henderson Group plc provides retirement planning, investment planning, tax planning, investment for college, and tax planning services to its clients. The company was founded in 1969 and is based in Denver Colorado.

Latest JHG News From Around the Web

Below are the latest news stories about JANUS HENDERSON GROUP PLC that investors may wish to consider to help them evaluate JHG as an investment opportunity.

Is Janus Henderson Global Life Science A (JFNAX) a Strong Mutual Fund Pick Right Now?Mutual Fund Report for JFNAX |

Is Janus Henderson Research D (JNRFX) a Strong Mutual Fund Pick Right Now?Mutual Fund Report for JNRFX |

Is Janus Henderson Enterprise A (JDMAX) a Strong Mutual Fund Pick Right Now?Mutual Fund Report for JDMAX |

Is Janus Henderson Triton T (JATTX) a Strong Mutual Fund Pick Right Now?Mutual Fund Report for JATTX |

Best High-Dividend Stocks 2024: 3 Names to Add to Your Must-Buy ListInvestors who prize dividends and rely on the payments for income should consider these top dividend stocks. |

JHG Price Returns

| 1-mo | 8.55% |

| 3-mo | 16.71% |

| 6-mo | 27.82% |

| 1-year | 33.89% |

| 3-year | 8.70% |

| 5-year | 110.77% |

| YTD | 24.26% |

| 2023 | 36.00% |

| 2022 | -40.46% |

| 2021 | 34.18% |

| 2020 | 41.87% |

| 2019 | 25.86% |

JHG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching JHG

Want to do more research on Janus Henderson Group Plc's stock and its price? Try the links below:Janus Henderson Group Plc (JHG) Stock Price | Nasdaq

Janus Henderson Group Plc (JHG) Stock Quote, History and News - Yahoo Finance

Janus Henderson Group Plc (JHG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...