Jupiter Wellness Inc. (JUPW): Price and Financial Metrics

JUPW Price/Volume Stats

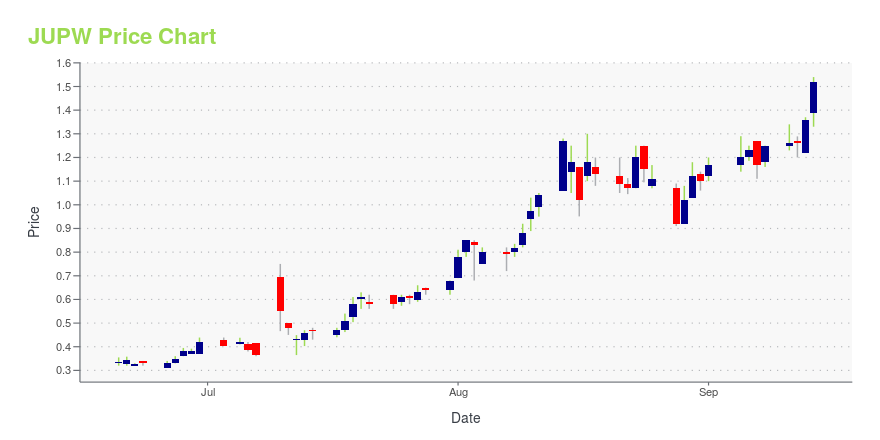

| Current price | $1.52 | 52-week high | $1.64 |

| Prev. close | $1.36 | 52-week low | $0.31 |

| Day low | $1.33 | Volume | 2,010,000 |

| Day high | $1.54 | Avg. volume | 911,297 |

| 50-day MA | $0.89 | Dividend yield | N/A |

| 200-day MA | $0.64 | Market Cap | 41.73M |

JUPW Stock Price Chart Interactive Chart >

Jupiter Wellness Inc. (JUPW) Company Bio

Jupiter Wellness, Inc. is a wellness brand dedicated to exploring the multiple therapeutic and medical uses of cannabidiol via a collection of convenient consumer products. Its brands include CaniSun, CaniSkin, CaniDermRx and CaniSweet. The company was founded by Brian S. John on October 24, 2018 and is headquartered in Jupiter, FL.

Latest JUPW News From Around the Web

Below are the latest news stories about JUPITER WELLNESS INC that investors may wish to consider to help them evaluate JUPW as an investment opportunity.

Safety Shot to Develop Detox Product for Alcohol Poising, Plans to File IND with U.S. FDAConcentrated form of Safety Shot may be effective as a rapid treatment for alcohol poising which causes 2,200 deaths each year from an estimated 20,000 cases annually in the U.S.Acute alcohol consumption leads to 52 million hospital emergency department visits annually JUPITER, FL, Sept. 18, 2023 (GLOBE NEWSWIRE) -- Safety Shot, Inc. (Nasdaq: SHOT) today announced it intends to develop its Safety Shot functional beverage platform in a unique concentrated form to treat alcohol poisoning in hospit |

Jupiter Wellness Changes its Name to Safety Shot and Ticker to “SHOT” in Alignment with New Business FocusSafety Shot is the first patented beverage on Earth that helps a person feel better faster by reducing blood alcohol content and boosting clarity JUPITER, FL, Sept. 14, 2023 (GLOBE NEWSWIRE) -- Jupiter Wellness, Inc. (Nasdaq: JUPW) (Nasdaq: SHOT) today announced that effective September 15, 2023, the Company has changed its name to Safety Shot, Inc. and at the open of market has changed its ticker symbol and will be trading as “SHOT”. The Company recently acquired Safety Shot which is going into |

Jupiter Wellness Responds to Frivolous Claims Made by FSD Pharma and Unauthorized Tagging of its Stock.JUPITER, FL, Aug. 30, 2023 (GLOBE NEWSWIRE) -- Jupiter Wellness, Inc. (Nasdaq: JUPW), a diversified company that supports health and wellness, announced it has retained Gusrae, Kaplan, Nusbaum PLLC as its securities litigation firm to investigate frivolous claims, allegations and the unauthorized tagging of its stock by FSD Pharma on August 25, 2023. Jupiter Wellness acquired the asset Safety Shot, from GBB Drink Lab who in May 2023 filed a $53 million dollar lawsuit against FSD Pharma. Jupiter |

Jupiter Wellness Appoints Jarrett Boon, as COOBoon was one of the original thought leaders and investors in LifeLock, which was subsequently acquired for $2.3 billion.He will lead the launch and growth of the Safety Shot business, a $1.56 billion market opportunity.David Sadler will move to the position of CMO. JUPITER, FL, Aug. 29, 2023 (GLOBE NEWSWIRE) -- Jupiter Wellness, Inc. (Nasdaq: JUPW), a diversified company that supports health and wellness, today announced the appointment of Jarrett Boon as the Company’s COO. Boon was the Co-Foun |

Jupiter Wellness Announces Darren Heitner, Esq. Sports Attorney and Influencer Signs on as Brand Ambassador for Safety ShotJupiter Wellness, Inc Darren Heitner Heitner has been referred to as one of the foremost experts on name, image, and likeness (NIL) by The Wall Street Journal, USA TODAY and worked on behalf of numerous athletes and brands, including Gatorade, INFLCR, Marketpryce, and Icon Source, in the NIL space JUPITER, FL, Aug. 22, 2023 (GLOBE NEWSWIRE) -- Jupiter Wellness, Inc. (Nasdaq: JUPW), a diversified company that supports health and wellness, today announced that Darren Heitner, Esq. has signed on as |

JUPW Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 141.16% |

| 3-year | -21.24% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -13.54% |

| 2021 | -82.51% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...