Coffee Holding Co., Inc. (JVA): Price and Financial Metrics

JVA Price/Volume Stats

| Current price | $2.46 | 52-week high | $3.25 |

| Prev. close | $2.33 | 52-week low | $0.67 |

| Day low | $2.32 | Volume | 32,200 |

| Day high | $2.48 | Avg. volume | 52,159 |

| 50-day MA | $1.81 | Dividend yield | N/A |

| 200-day MA | $1.30 | Market Cap | 14.05M |

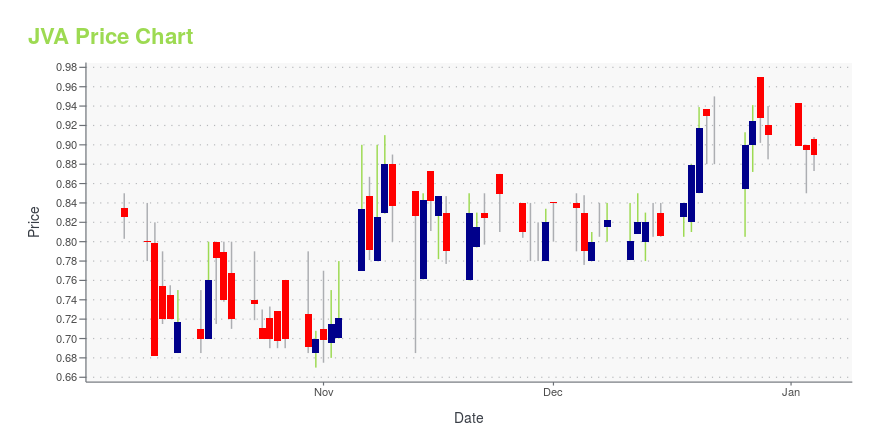

JVA Stock Price Chart Interactive Chart >

Coffee Holding Co., Inc. (JVA) Company Bio

Coffee Holding Co., Inc. manufactures, roasts, packages, markets, and distributes roasted and blended coffees in the United States, Australia, Canada, England, and China. The company offers wholesale green coffee products, which include unroasted raw beans of approximately 90 varieties that are sold to large, medium, and small roasters, as well as coffee shop operators. It also roasts, blends, packages, and sells coffee under private labels. As of October 31, 2019, the company supplied private label coffee under approximately 19 labels to wholesalers and retailers in cans, brick packages, and instants of various sizes. In addition, it roasts, blends, and packages company label branded coffee to supermarkets, wholesalers, and individually owned and multi-unit retail customers. Further, the company offers tabletop coffee roasting equipment, instant coffees, and tea products for its customers. Its coffee brands include Cafe Caribe, Don Manuel, S&W, Cafe Supremo, Via Roma, Premier Roasters, and Harmony Bay. The company was formerly known as Transpacific International Group Corp and changed its name to Coffee Holding Co., Inc. in April 1998. Coffee Holding Co., Inc. was founded in 1971 and is headquartered in Staten Island, New York.

Latest JVA News From Around the Web

Below are the latest news stories about COFFEE HOLDING CO INC that investors may wish to consider to help them evaluate JVA as an investment opportunity.

11 Best Coffee Stocks to Invest InIn this article, we will take a look at the 11 best coffee stocks to invest in. To see more such companies, go directly to 5 Best Coffee Stocks to Invest In. Coffee is one of the most popular beverages in the world. A latest industry research report by Coffee Barometer quoted data from the […] |

Coffee Holdings Co., Inc. Issues Business Update Following 2023 Annual MeetingSTATEN ISLAND, New York, Nov. 03, 2023 (GLOBE NEWSWIRE) -- Coffee Holding Co., Inc. (Nasdaq: JVA) (the “Company”) today provided a business update following its 2023 Annual Meeting held on October 27, 2023. Andrew Gordon, Chief Executive Officer and Chairman of the Company provided the following update: “I would like to provide a business update and an update regarding the proposed transaction with Delta Corp Holdings Limited (“Delta”) to employees, shareholders and interested persons of Coffee |

Delta Corp Holdings Limited Advances Merger and Share Exchange with Coffee Holding Co., Inc. with Filing of Registration StatementNEW YORK and LONDON, Sept. 28, 2023 (GLOBE NEWSWIRE) -- Coffee Holding Co., Inc. (NASDAQ: JVA) (“Coffee Holding”), a publicly traded integrated wholesale coffee roaster and dealer located in the United States, and Delta Corp Holdings Limited (“Delta”), a privately held holding company engaged in logistics, fuel supply and asset management related services, primarily servicing the international supply chains of commodity, energy and capital goods producers, jointly announced the filing with the U |

Coffee Holding First Quarter 2023 Earnings: US$0.093 loss per share (vs US$0.049 profit in 1Q 2022)Coffee Holding ( NASDAQ:JVA ) First Quarter 2023 Results Key Financial Results Revenue: US$18.3m (up 9.7% from 1Q... |

Delta Corp Holdings Limited Advances Merger and Share Exchange with Coffee Holding Co., Inc. with Confidential Submission of Registration StatementStaten Island, NY and London, United Kingdom, April 17, 2023 (GLOBE NEWSWIRE) -- Coffee Holding Co., Inc. (NASDAQ: JVA) (“Coffee Holding”), a publicly traded integrated wholesale coffee roaster and dealer located in the United States, and Delta Corp Holdings Limited (“Delta”), a privately held holding company engaged in logistics, fuel supply and asset management related services, primarily servicing the international supply chains of commodity, energy and capital goods producers, announced the |

JVA Price Returns

| 1-mo | 26.15% |

| 3-mo | 48.19% |

| 6-mo | 115.79% |

| 1-year | 68.33% |

| 3-year | -56.46% |

| 5-year | -38.50% |

| YTD | 170.33% |

| 2023 | -55.39% |

| 2022 | -53.53% |

| 2021 | 14.32% |

| 2020 | -16.52% |

| 2019 | 30.31% |

Continue Researching JVA

Want to see what other sources are saying about Coffee Holding Co Inc's financials and stock price? Try the links below:Coffee Holding Co Inc (JVA) Stock Price | Nasdaq

Coffee Holding Co Inc (JVA) Stock Quote, History and News - Yahoo Finance

Coffee Holding Co Inc (JVA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...