KB Financial Group Inc. ADR (KB): Price and Financial Metrics

KB Price/Volume Stats

| Current price | $64.56 | 52-week high | $64.61 |

| Prev. close | $60.79 | 52-week low | $36.57 |

| Day low | $62.55 | Volume | 569,808 |

| Day high | $64.61 | Avg. volume | 215,086 |

| 50-day MA | $58.58 | Dividend yield | 2.93% |

| 200-day MA | $48.83 | Market Cap | 26.05B |

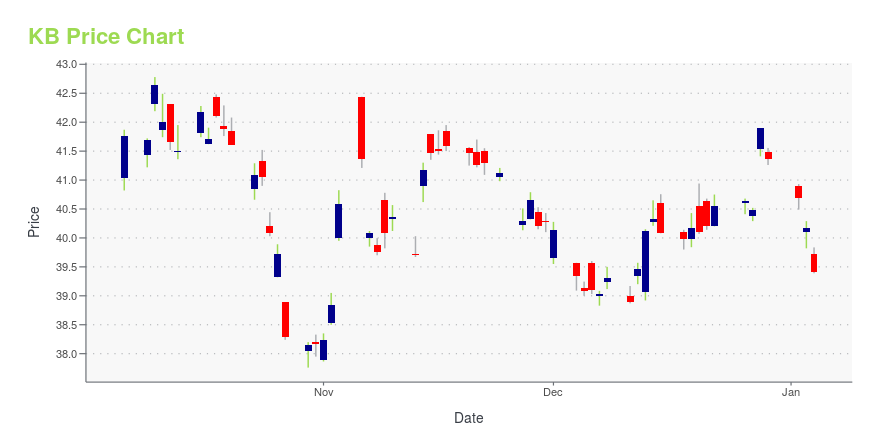

KB Stock Price Chart Interactive Chart >

KB Financial Group Inc. ADR (KB) Company Bio

KB Financial Group Inc. (Korean: 주식회사 케이비금융지주; RR: Jusik-hoesa Keibi Geumyung Jiju) is a financial holding company headquartered in Seoul, South Korea. The Group and its subsidiaries provide a broad range of banking and financial services. It is one of the domestic systemically important banks (D-SIBs) identified by the Financial Services Commission. (Source:Wikipedia)

Latest KB News From Around the Web

Below are the latest news stories about KB FINANCIAL GROUP INC that investors may wish to consider to help them evaluate KB as an investment opportunity.

7 Value Stocks That Could Double Your Net WorthIn an era of dynamic market fluctuations and ever-evolving industries, identifying investment opportunities that promise significant growth potential is paramount. |

KB Financial Group Inc. (NYSE:KB) Q3 2023 Earnings Call TranscriptKB Financial Group Inc. (NYSE:KB) Q3 2023 Earnings Call Transcript October 28, 2023 Peter Kweon: Greetings. I am Peter Kweon, the Head of IR at KBFG. We will now begin the 2023 Q3 Business Results Presentation. I would like to express my deepest gratitude to everyone for participating today. We have here with us our […] |

Yoon Jong-kyoo steps down as KB Financial Group chair, expresses hopes for global top 20 rankingKB Financial Group's outgoing chairman, Yoon Jong-kyoo, expressed his hopes for the future of the group during a press conference on Monday at the group's headquarters in Seoul. Yoon, who has served as chairman since November 2014, will step down on November 20, passing the reins to Yang Jong-hee, the group's vice chairman. |

Are You Looking for a Top Momentum Pick? Why KB Financial (KB) is a Great ChoiceDoes KB Financial (KB) have what it takes to be a top stock pick for momentum investors? Let's find out. |

KB vs. SMFG: Which Stock Is the Better Value Option?KB vs. SMFG: Which Stock Is the Better Value Option? |

KB Price Returns

| 1-mo | 15.12% |

| 3-mo | 18.11% |

| 6-mo | 64.72% |

| 1-year | 67.63% |

| 3-year | 55.00% |

| 5-year | 90.53% |

| YTD | 60.58% |

| 2023 | 9.60% |

| 2022 | -14.27% |

| 2021 | 17.80% |

| 2020 | -4.28% |

| 2019 | -1.45% |

KB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KB

Want to do more research on KB Financial Group Inc's stock and its price? Try the links below:KB Financial Group Inc (KB) Stock Price | Nasdaq

KB Financial Group Inc (KB) Stock Quote, History and News - Yahoo Finance

KB Financial Group Inc (KB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...