Kensington Capital Acquisition Corp. (KCAC): Price and Financial Metrics

KCAC Price/Volume Stats

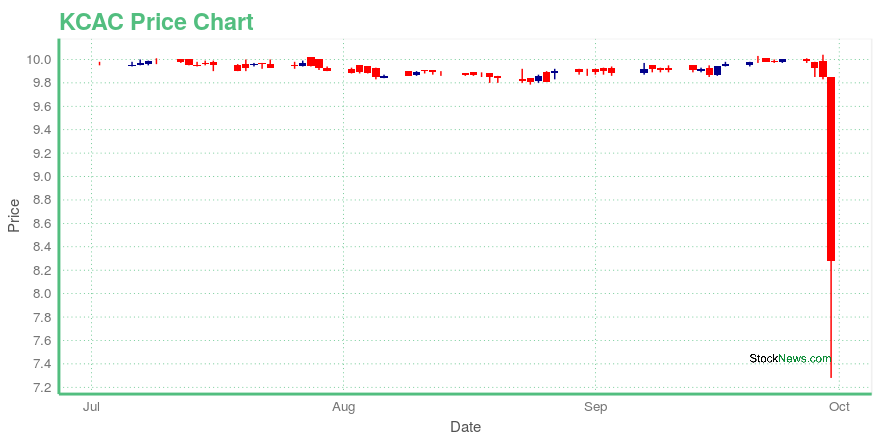

| Current price | $8.07 | 52-week high | $10.65 |

| Prev. close | $8.28 | 52-week low | $7.28 |

| Day low | $8.00 | Volume | 316,000 |

| Day high | $8.71 | Avg. volume | 185,002 |

| 50-day MA | $9.83 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 232.01M |

KCAC Stock Price Chart Interactive Chart >

Kensington Capital Acquisition Corp. (KCAC) Company Bio

Kensington Capital Acquisition Corp. is a blank check company that focuses on effecting merger, capital stock exchange, asset acquisition, stock purchase, and reorganization. The company was founded in 2020 and is based in Westbury, New York.

Latest KCAC News From Around the Web

Below are the latest news stories about Kensington Capital Acquisition Corp II that investors may wish to consider to help them evaluate KCAC as an investment opportunity.

EV charging company Wallbox goes public via SPACEnric Asunción, Wallbox CEO and Co-Founder, joins Yahoo Finance Live from the floor of the NYSE for Wallbox's trading debut. |

EV charging tech provider Wallbox goes public by merging with SPAC Kensington Capital AcquisitionWallbox, a provide of electric vehicle charging technology, said Monday it is going public by merging with special purpose acquisition corporation Kensington Capital Acquisition Corp. II . The deal was approved by Kensington shareholders and closed on Oct. 1. Wallbox shares will start trading later Monday on the New York Stock Exchange, under the new ticker "WBX." The company offers electric vehicle charging for residential, semi-public and public use. Its product line includes Quasar, which it |

Kensington Capital Acquisition Corp. II And Wallbox Announce Closing Of Business Combination; Wallbox To Trade On NYSE Under Ticker "WBX" Beginning On October 4Kensington Capital Acquisition Corp. II (NYSE: KCAC) ("Kensington") and Wall Box Chargers, S.L. ("Wallbox"), a leader in electric vehicle charging and energy management solutions, announced today the completion of its business combination. The business combination was approved by Kensington stockholders on September 30, 2021, by a quorum of 76.5% of the outstanding shareholders and received approval from 94.9% of those votes cast. Beginning on October 4, 2021, the Class A ordinary shares of Wall |

Wallbox Appoints Beatriz González to Board of DirectorsWallbox, a leading provider of electric vehicle (EV) charging and energy management solutions worldwide, today announced the appointment of Beatriz González to the Company's Board of Directors upon completion of Wallbox's business combination with Kensington Capital Acquisition Corp. II ("Kensington") (NYSE: KCAC). |

Kensington Capital Acquisition Corp. II and Wallbox Announce Final Exchange Ratio for Proposed Business CombinationKensington Capital Acquisition Corp. II (NYSE: KCAC) ("Kensington") and Wall Box Chargers, S.L. ("Wallbox") today announced that they have determined the exchange ratio to be 240.990816528527 as of the anticipated date for Closing (as defined below) in accordance with the terms of the Business Combination Agreement, dated as of June 9, 2021 (the "Business Combination Agreement"), among Kensington, Wallbox B.V. ("Holdco"), Orion Merger Sub Corp. and Wallbox, pursuant to which, among other things, |

KCAC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -19.06% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...